Need help navigating Virginia health insurance options? Whether it’s for yourself, family, or your small business, looking at premiums, deductibles and plan benefits can be overwhelming.

The good news? A licensed Virginia health insurance broker can help for free if you know where to look.

In this guide, we’ll show you how to find a health insurance broker who is certified and vetted to assist with individual, family and small business plans in Virginia.

This guide is intended to give Virginia residents the resources to find the best health insurance with the peace of mind you deserve.

Thank you,

Theodore “Ted” McNeil

Owner, Broker

HealthBenefits, LLC

BenZen Insurance

804-807-7637 (Mon-Fri, 9am-6pm)

Licensed and ACA Certified in Virginia and these states with national & regional carriers.

Individual & Family Plans

Start your search by visiting Virginia’s Insurance Marketplace. This is the official state health insurance exchange and where you can find a licensed health insurance broker.

Open Enrollment occurs each year from November-January and is an opportunity to sign up for ACA health insurance without much restriction.

Outside of those dates, you might be eligible for a Special Enrollment if you experience a Qualifying Life Event.

To get started, visit Virginia’s Marketplace and browse for plans in your area. If you have questions, you can find and connect with a health insurance broker for free assistance.

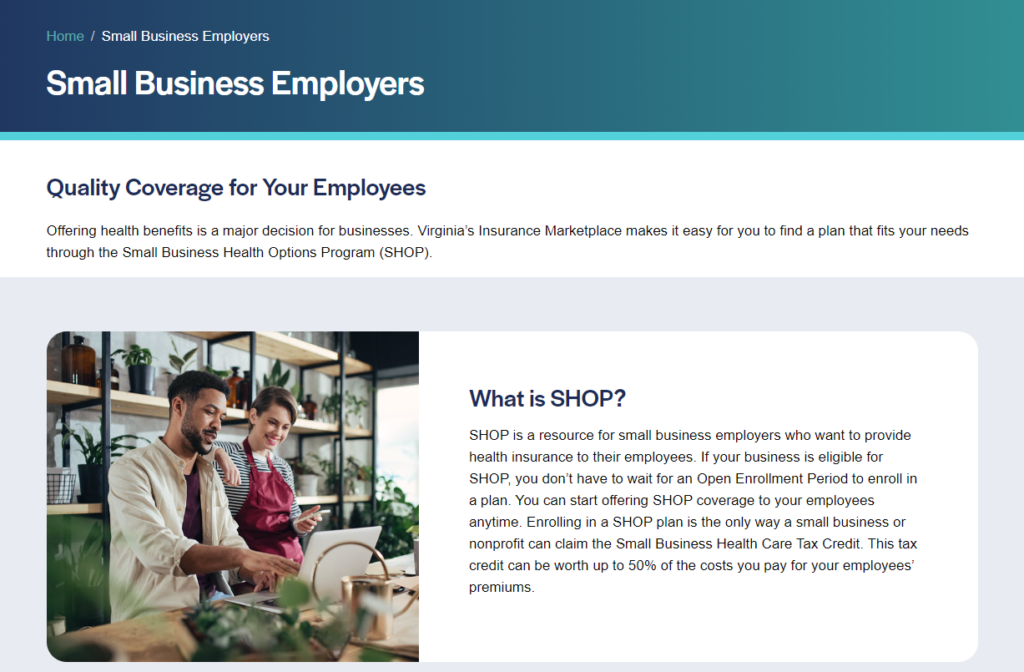

Small Group Health Plans

If you have less than 50 full-time employees you are not required to offer health insurance.

But you can start a small group plan and potentially be eligible for a Small Business Health Care Tax Credit with just 1 full-time employee.

The only catch is that one employee can’t be you or a spouse.

Navigating the complexities of group plans can be time-consuming, but a Virginia health insurance broker certified for small group plans like SHOP can be invaluable.

Here’s what a health insurance broker can do for your small business:

- Shop multiple carriers to find the most competitive rates and coverage options for your group size and needs.

- Explain plan features like deductibles, copays, and network options in clear, easy-to-understand language.

- Help you navigate enrollment and ensure all your employees get the coverage they need.

- Provide ongoing support as your business and healthcare needs evolve.

Providing affordable benefits is one of the best ways to attract and retain top talent, promote a happy & healthy workplace. and build your business. We’d like to help.

As a Certified Virginia Health Insurance Broker, we’re licensed with all qualified health plans in the state and can guide you through the process.

Visit us at BenZen for more information and a sample quote for your business!

What’s Inside:

What Is Virginia Marketplace Health Insurance?

Prior to November 1, 2023, Virginia residents had to visit Healthcare.gov for Affordable Care Act (ACA) Marketplace Health Insurance.

Now, Virginia’s Insurance Marketplace is the new platform to find, shop and compare health insurance plans with potential financial assistance or subsidies.

It’s a fact that healthcare in America is not a perfect system, but one positive outcome of the Affordable Care Act is prohibiting insurance companies from denying coverage or charging higher premiums based on pre-existing conditions.

Before ACA, a health insurance company could charge almost whatever they wanted if you had a health condition or deny coverage altogether.

Like most state-based health exchanges, the Virginia Marketplace helps to facilitate your application and ensures only Qualified Health Plans are made available to you.

It provides access to free assistance and maintains your account to facilitate initial enrollment, changes and renewals. It’s your gateway to affordable health insurance in Virginia!

The Virginia Marketplace, assisters and health insurance brokers do not provide coverage, collect premiums or pay claims. Their role is to provide the tools you need to get affordable ACA health insurance conveniently online.

Virginia’s Insurance Marketplace empowers residents to take control of their healthcare decisions and secure the coverage they need to protect their health and financial well-being.

It offers a large selection of private health insurance options from various carriers, the Virginia Marketplace ensures residents have ample choices to fit most budgets.

Additionally, the marketplace has the resources to assist you in understanding what plans are available, estimating subsidies or tax credits, and navigating the enrollment process.

Shopping for major medical coverage can be done on your own or with assistance from a licensed health insurance broker.

Whether you’re an individual or family, self-employed or senior not yet on Medicare, Virginia’s Insurance Marketplace is the place to get covered.

Do I Have to Use a Virginia Health Insurance Broker?

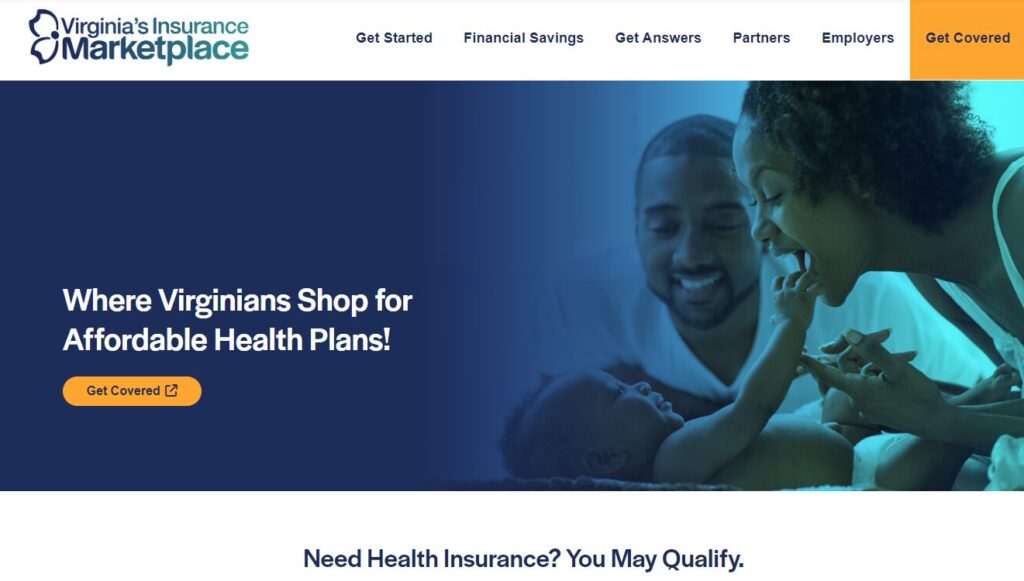

Nope! You are not obligated to use a Virginia health insurance broker to enroll in coverage. Virginia’s Insurance Marketplace is designed to be user-friendly, allowing you to navigate the enrollment process independently.

There are also customer service representatives employed by the Virginia Marketplace who can help with your enrollment if you’ve decided on a plan.

However, only a licensed health insurance broker can make recommendations and give advice. And regardless of whether you enroll on your own or with assistance, all Affordable Care Act health insurance applications go through Virginia’s Insurance Marketplace.

Comparing premiums, deductibles, and out-of-pocket maximums (OOP) to select the best affordable plan that offers the most protection isn’t the easiest thing to do on your own. Working with a Virginia health insurance broker can be a huge benefit. Plus, it’s free!

Virginia Marketplace Health Insurance Plans (2024)

As the 12th largest state by population, Virginia boasts many options from top-rated carriers offering qualified Affordable Care Act (ACA) Health Insurance.

Whether you live in a busy urban area or a quiet rural community, being able to navigate the Virginia Marketplace for affordable health insurance is your first step in getting the peace of mind you deserve.

For 2024 Virginia Marketplace Health Insurance, you’ll see individual & family HMO, EPO & PPO plans from Aetna, Cigna, Kaiser Permanente, UnitedHealthcare and other major carriers.

Plan availability will vary based on your ZIP Code:

- Aetna

- Anthem

- CareFirst

- Cigna

- Innovation Health

- Kaiser Permanente

- Oscar

- Sentara

- UnitedHealthcare

Illustration only. Plans & prices will vary.

For example, residents of Northern Virginia will see more CareFirst (BlueCross BlueShield) and Innovation Health plans, and Anthem Healthkeepers (BlueCross BlueShield) in areas heading south like Charlottesville, Richmond or Norfolk.

We work with our clients wherever they live in Virginia and help them understand premiums, deductibles, metal levels and availability of these plans, to find the best solution.

Visit: Virginia’s Insurance Marketplace

It’s important to note that regardless of where you reside in Virginia, all Marketplace health insurance plans must meet specific criteria.

These plans, known as Qualified Health Plans (QHPs), provide the minimum essential coverage required under the ACA.

This ensures that regardless of the carrier or plan you choose, you’ll have access to essential health benefits that cover a wide range of services, including preventive care, hospitalization, prescription drugs, and more.

As you explore the health insurance options available in Virginia’s marketplace, consider your doctor’s network, premiums, deductibles, and out-of-pocket maximum to find the plan that best suits your needs and budget.

With a diverse range of carriers and plans to choose from, you can rest assured that you’ll find comprehensive coverage that meets your requirements, no matter where you call home in the Commonwealth of Virginia.

RELATED:

- Ameritas Dental vs Delta Dental (No Waiting Period?)

- $0 Deductible Health Insurance: Good Or Bad?

- The Best Dental & Vision When You’re Self-Employed

10 Essential Health Benefits

Aligned with ACA mandates, Qualified Health Plans encompass a spectrum of 10 Essential Health Benefits, including but not limited to:

- Ambulatory Patient Services: Coverage for outpatient care, ensuring you’re covered for doctor visits, consultations, and treatments outside of hospitals.

- Emergency Services: Protection during unexpected medical crises, including emergency room visits and ambulance services.

- Hospitalization: Comprehensive coverage for inpatient care, surgeries, and hospital stays.

- Pregnancy, Maternity, and Newborn Care: Essential coverage for prenatal care, childbirth, and postnatal services.

- Mental Health and Substance Use Disorder Services: Support for mental health treatments, therapy sessions, and substance abuse rehabilitation.

- Prescription Drugs: Access to essential medications prescribed by healthcare providers.

- Rehabilitative Services and Devices: Coverage for therapies, rehabilitation programs, and assistive devices for recovery and mobility.

- Laboratory Services: Coverage for diagnostic tests and laboratory procedures essential for diagnosing and managing medical conditions.

- Preventive and Wellness Services: Access to preventive care services, vaccinations, and screenings to maintain overall health and detect potential health issues early.

- Pediatric Services, Including Oral and Vision Care for Children: Coverage for children’s healthcare needs, including dental and vision care, ensuring comprehensive wellness from infancy to adolescence.

Beyond these essentials, some insurers may offer additional coverage options, such as dental or vision insurance, catering to diverse healthcare needs and preferences.

When Should I Contact a Virginia Health Insurance Broker?

Understanding the distinction between Open Enrollment and Special Enrollment is crucial. Open Enrollment allows individuals to enroll in health insurance plans during a specific period, typically towards the end of the year and with less restriction.

Special Enrollment, on the other hand, is an opportunity to enroll outside of the standard enrollment period due to qualifying life events such as marriage, birth, or loss of other coverage.

Open Enrollment

Open Enrollment for Affordable Care Act (ACA) health plans typically span from November 1st to January 15th each year in most states, providing an important “open” window for individuals and families to enroll, review and adjust their healthcare coverage.

This period offers a valuable opportunity to assess current health insurance needs, explore available plan options, and make informed decisions about enrollment or plan changes for the upcoming year with less restriction.

The primary benefit of Open Enrollment is that it enables nearly any eligible adult to enroll in a health insurance plan regardless of any pre-existing conditions.

It’s a time when individuals can consider changes in healthcare needs, anticipated life events, and financial circumstances to ensure they select the most suitable health insurance plan for themselves and their families.

With Open Enrollment, individuals have the flexibility and freedom to navigate the healthcare marketplace and secure comprehensive coverage that aligns with their unique healthcare needs and preferences.

Special Enrollment

Outside of the annual Open Enrollment Period, you might be eligible to purchase a health plan or make changes through a Special Enrollment Period.

You qualify for a Special Enrollment Period if you have experienced certain changes in your circumstances known as Qualifying Life Events.

Certain life events, like losing health coverage from a job or Medicaid, moving, getting married, having a baby, or adopting a child, may qualify you to enroll in or change Marketplace health plans outside of Open Enrollment

They include, but are not limited to:

- Getting married or divorced.

- Having a baby or adopting a child.

- Experiencing the death of the insurer in the family.

- Losing health insurance coverage due to job loss.

- Losing eligibility for Medicaid, or FAMIS

- Turning 26 and losing coverage from a parent’s health insurance plan.

- Moving to a different ZIP code or county or moving to the U.S. from a foreign country or U.S. territory.

After you experience a Qualifying Life Event, you usually have up to 60 days to enroll in a new plan through the Marketplace.

Have your personal information and any supporting documents on hand in case Marketplace customer service representatives need to verify how the life event affects your health insurance coverage.

How Much Does Virginia Health Insurance Cost?

Understanding the cost of Virginia health insurance involves various factors, including premiums, deductibles, subsidies, and plan metal levels.

According to Virginia’s Insurance Marketplace, nearly 90% of Marketplace consumers (9 out of 10) are eligible for financial aid.

In addition, certain Virginians may qualify for either free or low-cost coverage via Virginia Medicaid or FAMIS. During your application, the marketplace will point you in the right direction.

Note: The best or “cheapest” health insurance is not always the plan with the lowest monthly premium. There are other costs involved that you should compare.

Source: Virginia’s Insurance Marketplace

Premium Tax Credits

Federal subsidies, also known as premium tax credits, may be available to lower monthly premium costs for individuals and families who meet specific income criteria. These subsidies play a vital role in reducing the financial burden of health insurance, ensuring affordability for many enrollees.

When this tax credit is available, you have the option of using some or all of the credit upfront to lower your monthly payment versus waiting until tax time to claim the amount. .

This is why it’s also referred to as the advance premium tax credit (APTC).

Premiums

Premiums refer to the monthly payments required to maintain health insurance coverage. It’s important to understand premium costs and available payment options to effectively budget and choose the most suitable plan for your needs and financial situation.

Deductibles

Deductibles represent the amount individuals must pay out-of-pocket for covered medical expenses before their insurance plan begins to pay.

Choosing between low and high deductible plans involves striking a balance between upfront costs and long-term financial considerations, depending on your healthcare usage and budget preferences.

In general, premiums and deductibles work as opposites. For example:

- Bronze plans usually have low premiums, but higher deductibles.

- Gold plans have high premiums, but lower deductibles.

Out-Of-Pocket Maximum (OOP)

Out-of-pocket maximums limit the amount you’re required to pay for covered medical expenses in a given plan year.

After you spend this amount on deductibles, copayments, and coinsurance for in-network care and services, your health plan pays 100% of the costs of covered benefits for the rest of the year.

The out-of-pocket limit does not include:

- Your monthly premiums

- Anything you spend for services your plan doesn’t cover

- Out-of-network care and services

- Costs above the allowed amount for a service that a provider may charge

For the 2024 plan year, the out-of-pocket maximum for a Marketplace plan can’t be more than $9,450 for an individual and $18,900 for a family.

Understanding out-of-pocket maximums is crucial for assessing the total potential cost of healthcare within a plan, providing financial protection and peace of mind.

The Metal Levels

When it comes to selecting the right health insurance plan for your needs, understanding the ACA metal levels is crucial. Plans are categorized into four metal levels – Platinum, Gold, Silver, and Bronze – each offering varying levels of coverage and coinsurance. Think of coinsurance as your portion of the bill.

Platinum

Platinum plans offer the highest level of coverage, featuring higher premiums but lower out-of-pocket costs. These plans are ideal for individuals and families who prioritize comprehensive coverage and are willing to pay higher monthly premiums for reduced expenses when accessing healthcare services.

Coinsurance: You pay approx 10%, insurance pays 90%

Gold

Gold plans provide comprehensive coverage with moderate premiums and out-of-pocket costs. They strike a balance between affordability and coverage, making them suitable for individuals and families seeking robust healthcare benefits without excessively high monthly premiums.

Coinsurance: You pay approx 20%, insurance pays 80%

Silver

Silver plans offer a balanced approach to premiums and out-of-pocket costs, making them a popular choice for many enrollees. These plans provide moderate coverage levels at reasonable costs, appealing to individuals and families looking for a middle-ground option.

Another feature of Silver plans are Cost Sharing Reductions that lower your deductible.

Coinsurance: You pay approx 30%, insurance pays 70%

Bronze

Bronze plans feature lower premiums but higher out-of-pocket costs compared to other metal levels. They are suitable for individuals and families who prioritize affordability and are willing to accept higher out-of-pocket expenses in exchange for lower monthly payments. These plans are ideal for those who are generally healthy and do not anticipate frequent medical expenses.

Coinsurance: You pay approx 40%, insurance pays 60%

By understanding the differences between the metal levels, you can select a health insurance plan that aligns with your healthcare needs, budget, and preferences. Whether you prioritize comprehensive coverage or lower monthly premiums, there’s a metal level suited to your circumstances.

Find A Virginia Marketplace Health Insurance Broker Near You

Navigating through the enrollment process can be overwhelming, but you don’t have to do it alone!

As a Certified Virginia Marketplace Health Insurance Broker, we provide free assistance to help you find, shop & compare the best choices for your healthcare needs.

Our team is dedicated to guiding you through the process, answering your questions, and ensuring you understand all your options. Whether you’re new to the ACA marketplace or returning for enrollment, we’re here to ensure a smooth process and help you secure the coverage you deserve.

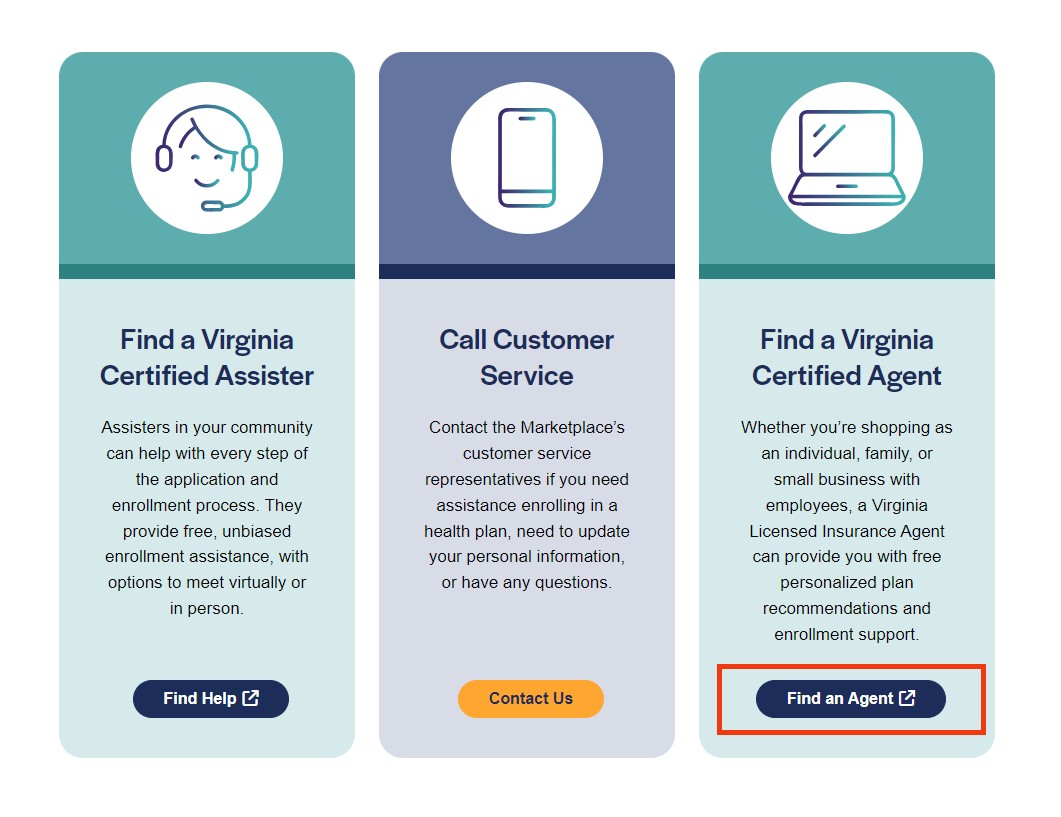

Ready to take the first step toward securing your health insurance? Here’s how to get free assistance:

Option 1:

Submit a request and one of our agents will contact you.

Option 2:

Call us toll free 804-807-7637 and speak with a Virginia licensed health insurance broker weekdays, 9am-6pm.

Option 3:

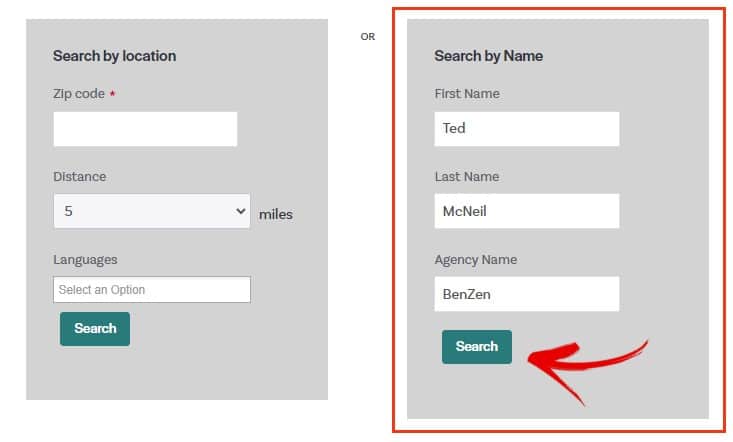

Visit Virginia’s Insurance Marketplace, click “Find an Agent” to start your search by name.

Most enrollments are done over the phone, but if you prefer to work with a health insurance broker near you in person, you can perform a search by location.

How To Enroll In Virginia ACA Health Insurance (3 Steps)

Enrolling in Virginia Affordable Care Act Health Insurance is a straightforward process designed to provide access to quality healthcare coverage.

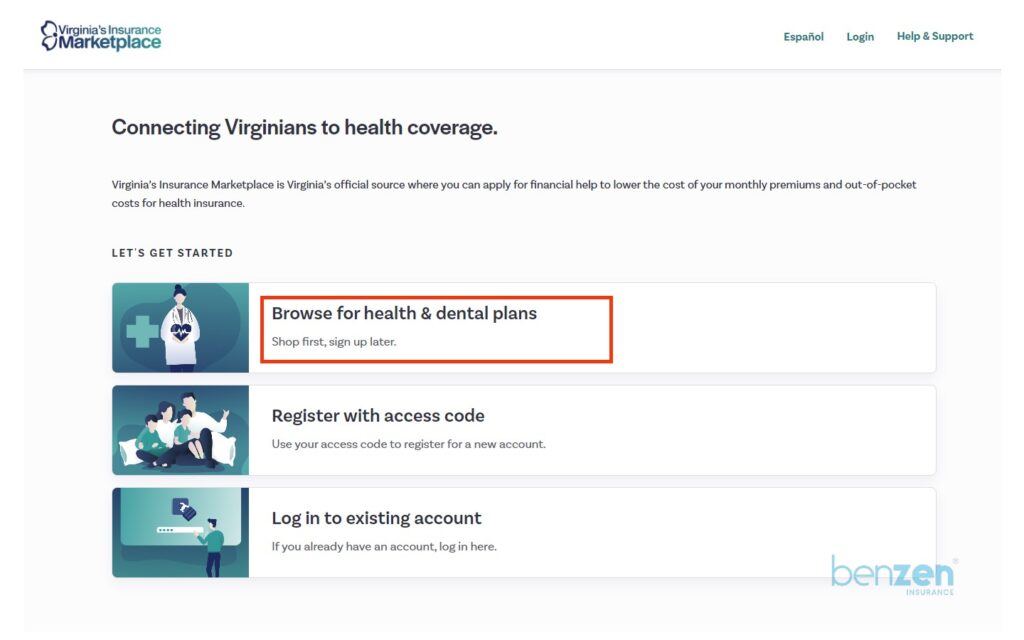

To get started, visit Virginia’s Insurance Marketplace at https://marketplace.virginia.gov/

Here, you’ll find a user-friendly platform that guides you through the enrollment process step by step. Whether you’re a first-time enrollee or returning to update your coverage, the Marketplace offers a range of plans to suit your needs.

As a guest, you can browse available health insurance options, compare plans, and assess their coverage and cost. Additionally, you’ll determine if you qualify for financial assistance, such as tax credits, to help make your coverage more affordable.

Whether you’re seeking coverage for yourself, your family, or your business, the Virginia Insurance Marketplace provides a comprehensive selection of health insurance options tailored to your needs.

Take the first step towards securing quality healthcare coverage by exploring the Marketplace today.

For Virginia Residents Only

To be eligible for Virginia’s Insurance Marketplace coverage, individuals / households must:

- Reside in Virginia.

- Be U.S. citizens, U.S. nationals, or lawfully present immigrants for the entire time they plan to have coverage.

- Not be incarcerated (unless pending disposition of charges).

- Be uninsured, generally not eligible for Medicaid or Medicare, and not have an offer of affordable employer-based coverage.

Based on your application the system will let you know if you’re eligible for assistance through Medicaid or FAMIS.

If you are eligible for Medicaid or FAMIS you should contact Virginia’s Department of Medical Assistance Services at CoverVA to get started.

Step 1: Check Eligibility

In Virginia’s Insurance Marketplace, you can browse health plans without registering.

Start by browsing your ZIP Code for health and dental plans near you. Compare different options, filter your results based on your preferences, and see details about the plan that best suits your needs.

Before you begin the enrollment process, gather all the necessary information for each adult who will be covered under the plan. This includes:

- Photo identification

- Social Security numbers

- The most recent tax return

- Pay stubs from the last four weeks

- Immigration documents, if applicable

Having this information ready will streamline the application process and help you avoid delays.

Step 2: Application

With all your required documents in hand, you’re ready to begin the application process. Whether you’re applying during Open Enrollment or Special Enrollment, the process is straightforward for Virginia residents.

- Open Enrollment: During the designated Open Enrollment period, which typically begins every year in November, you can apply for health insurance without providing additional documentation. This period allows for easy access to enroll or renew health coverage.

- Special Enrollment: If you’re applying outside of the Open Enrollment period, you may need to provide documentation of a Qualified Life Event to qualify for Special Enrollment. These events include life changes such as marriage, birth or adoption of a child, loss of other coverage, or a change in household income.

Keep in mind, that you may be eligible for tax credits or cost reductions to help make your health insurance more affordable.

These subsidies are based on your income and household size. Understanding your eligibility for these financial assistance options can significantly impact your decision-making process when selecting a health plan.

Submit your application.

Upon approval, you’ll be able to shop for the best health insurance that meets your needs.

Remember, you can explore the Marketplace plans on your own, seek guidance from a customer service representative or connect with a Certified Broker, who can provide personalized recommendations based on your situation and preferences.

Step 3: Shop & Enroll

Once you’ve made your selection, proceed to enroll in your chosen health plan through the Marketplace. Whether you’re enrolling online or with the assistance of a broker, ensure that you carefully review the plan details, including coverage, premiums, deductibles, and copayments, before finalizing your enrollment.

By following these steps, you can complete your application for Marketplace health insurance in Virginia and secure comprehensive coverage tailored to your healthcare needs.

Whether you’re navigating the process independently or seeking free assistance from a Certified Broker, you’re on your way to accessing quality healthcare coverage.

Virginia’s Insurance Marketplace >>

Licensed Virginia Health Insurance Broker

Licensed and ACA Certified in: MD, PA, VA

We can also assist through our national carriers in: FL, GA, MI, MS, NC, SC, TN, TX

Ted McNeil

Owner, Broker

804-807-7637 (Mon-Fri, 9am-6pm)

888-488-3321

HealthBenefits, LLC

BenZen Insurance

NPN #16365557

Information is meant to be accurate and educational and not intended to be legal, medical or financial advice. Be sure to do your own research and contact a professional for help. Our site is free to use, but we may receive a commission from our partners & advertisers at no additional cost to you. Read our disclosure for more information.

Licensed insurance broker helping individuals, families and small business owners get affordable benefits.