| We may receive compensation from partners & advertiser links at no cost to you. Read our disclosure for details. |

How can you find affordable dental & vision insurance when you’re self-employed? Can you get dental & vision insurance in the Marketplace? Can you purchase a plan outside of Open Enrollment?

While many self-employed professionals and small business owners prioritize affordable health coverage, oral and vision health are often overlooked.

Dental insurance when you’re self-employed goes beyond exams and teeth cleanings. A simple toothache can easily turn into a root canal and without a dental plan or insurance, you could miss work — and you’ll also feel it in your bank account too.

And don’t forget about your eyes! An affordable vision plan will help you get regular exams to protect your vision and detect problems early. A vision plan will also help you save money on eyeglasses, frames and lenses.

If you need to find affordable dental & vision plans when you’re self-employed check with major carriers that bundle the coverage like Ameritas, Cigna and UnitedHealthcare.

In this article, we’ll discuss two types of dental & vision plans when you’re self-employed, a freelancer, or an independent contractor:

- Dental Insurance Plans

- Dental Savings Plans

Either can be a great investment (and potential write-off) so keep reading to find out how to protect your teeth & eyes and keep your business moving.

Dental & Vision Insurance When You’re Self-Employed Is Crucial

Being your own boss comes with its perks, but it also means additional responsibilities that an employer might have covered in the past.

One of those essential responsibilities is taking care of your oral & vision health.

Shopping for dental & vision insurance when you’re self-employed may not be at the top of your list, but it’s one of the best investments you can make.

Dental & vision plans are a proactive move to help reduce the risk of issues coming out of nowhere to affect your wellness. And your ability to earn.

How Does Dental Insurance Work?

Dental insurance pays a percentage of your costs. Depending on the insurance carrier you choose, the plan might cover 50%-80% of the cost for a root canal or cavity filling while you’d be responsible for the difference.

Some dental insurance plans cover major services like dentures and orthodontics (braces, aligners), and the insurance company might split the bill with you 50/50.

Your employment status is not an issue with private dental insurance — self-employed, freelancers, independent contractors, or almost anyone can purchase a private plan any time of year.

Routine checkups, exams, and cleanings are typically covered 100% by most dental insurance plans and while you can see any dentist, using a dentist within the network can maximize your benefits.

While you don’t need insurance to see a dentist, it can save you money in-network, especially for more expensive procedures like implants, dentures, or crowns.

What About Waiting Periods?

Most dental insurance plans have waiting periods. These can be frustrating, but they have a purpose and ultimately keep prices low for the rest of us.

Dental insurance encourages preventative care. By taking advantage of free checkups, your dentist will be able to spot issues before they arise so they don’t become expensive problems down the road.

And if you need an expensive procedure like implants or braces, you’ll want to plan to get the most out of your coverage.

How Does Vision Insurance Work?

Vision insurance is a specialized plan that covers expenses related to eye care and vision correction.

Eye exams are usually included along with allowances (discounts) for frames, lenses and contacts. This coverage focuses on preventive care and helps with the costs of corrective measures like LASIK.

Regular vision check-ups are crucial. Here are key points highlighting their importance:

- Early Detection of Eye Conditions: Regular eye exams allow for the early detection of potential eye conditions such as glaucoma, cataracts, and macular degeneration. Early identification facilitates timely intervention and treatment, often preventing or minimizing vision loss.

- Prescription Updates: Vision can change over time, and regular eye exams ensure that your prescription for glasses or contact lenses is up to date. Wearing the correct prescription helps in maintaining clear vision and prevents eye strain.

- Detection of Systemic Health Issues: The eyes can serve as indicators of overall health. During an eye exam, an optometrist may detect signs of systemic conditions like diabetes, high blood pressure, or cholesterol issues, allowing for early diagnosis and management.

- Children’s Visual Development: For children, regular eye exams are crucial for monitoring visual development. Early identification of issues like amblyopia (lazy eye) or strabismus (crossed eyes) is vital for effective treatment and preventing long-term vision problems.

- Prevention of Digital Eye Strain: In today’s digital age, prolonged use of screens can lead to digital eye strain. Regular eye exams help in addressing issues related to extended screen time and provide recommendations for reducing eye strain, such as the use of computer glasses.

- Eye Health Education: Eye exams provide an opportunity for individuals to learn about proper eye care practices. Optometrists can offer guidance on eye-friendly habits, nutrition for eye health, and the use of protective eyewear in specific environments.

- Maintaining Quality of Life: Clear vision contributes significantly to one’s quality of life. Regular eye exams play a crucial role in ensuring that individuals can perform daily activities with ease, maintain independence, and enjoy a high quality of life throughout their lifespan.

How Much Does Dental & Vision Insurance Cost?

To find the best dental & vision insurance when you’re self-employed you’ll have to factor in where you live, your age, and level of coverage.

Age: As with most types of insurance, your age can impact cost. Generally, younger people will pay less for coverage than older people, as they are less likely to need more expensive procedures.

Overall Health: Your overall health can also impact the cost of your insurance. If you have a history of dental or vision problems or are more likely to need expensive procedures, you may pay more for a comprehensive plan.

Type of Plan: As mentioned, there are many different types of dental insurance plans, and the type of plan you choose can also impact the cost.

Dental & Vision Insurance Plans Cost

Ameritas | Cigna | |

|---|---|---|

| Dental Plan | $20-$50/mo | $20-$40/mo |

| Vision Plan | $10-$15/mo | $10-$20 |

| Enrollment | Apply Online | Apply Online |

For illustration only. Plan availability will vary by state. Check your ZIP Code.

Prioritizing Dental & Vision Insurance When You’re Self-Employed

The goal of your business might be to sell products or services, but the strength of your business often rests on your health.

Neglecting your dental & vision well-being can lead to discomfort, distractions, and even decreased productivity.

Issues with your teeth and eyes can impact your confidence and ability to interact with clients or partners.

Affordable dental & vision insurance when you’re self-employed is an investment in both your health and your business’s success.

Comprehensive Coverage

Comprehensive dental & vision insurance ensures that you’re covered for routine check-ups and preventive care along with basic and major services.

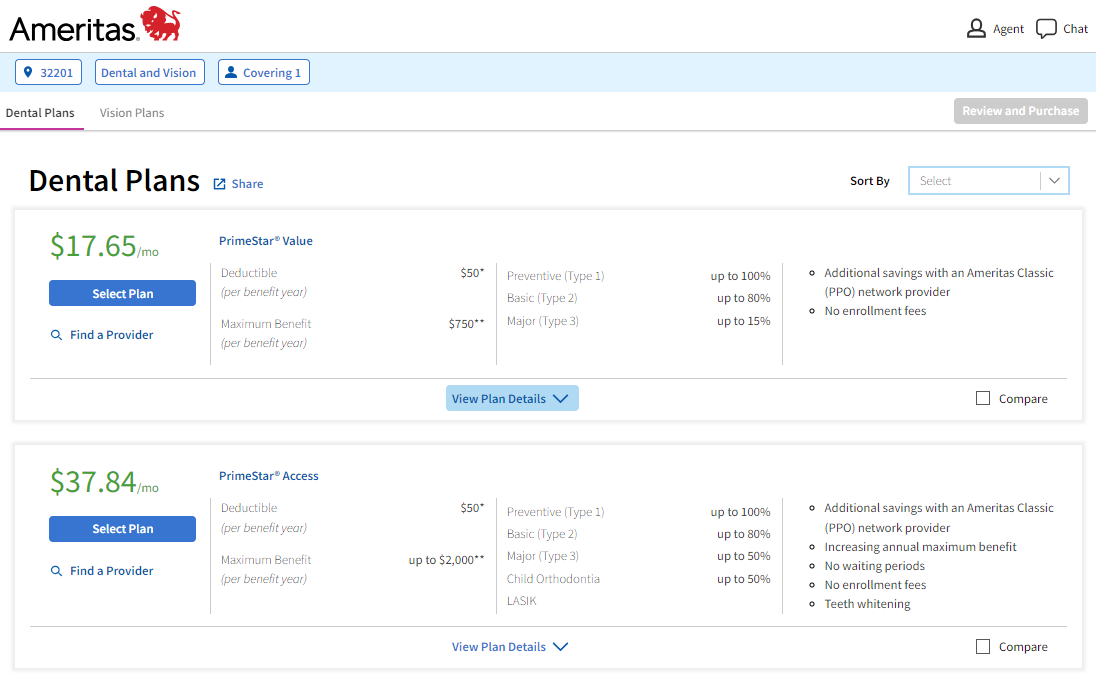

A plan like Ameritas PrimeStar can range anywhere from $30-$50 a month for individual coverage.

As the boss of your enterprise, make the smart choice for your health and business by securing reliable dental coverage today.

YOUTUBE CHANNEL

The Cost of a Dentist Visit

One of the main reasons why you should have a dental plan when you’re self-employed is the rising cost of dental care if you don’t have coverage.

If you don’t have insurance, the cost of dental procedures can quickly add up putting financial pressure on your bottom line. Remember, your cash flow is king.

Dental procedures can be expensive, and what you pay will vary depending on the procedure, your location, and your health.

For example, a dental cleaning might only cost around $100-$200 without coverage, while a root canal can easily cost $1,000-$2,500.

In addition to the cost of dental procedures, you may have to pay for other out-of-pocket expenses, like deductibles, copays, and coinsurance.

These costs can also sneak up on you, especially if you have a dental emergency or require multiple procedures to address a problem.

Dental Insurance Plans

Preventative Care: Dental insurance plans usually cover preventative care services such as routine cleanings and check-ups at little or no cost. These services help prevent more costly dental issues in the future, saving you money in the long run.

Cost Savings: Dental insurance plans negotiate discounted rates with dentists and dental specialists. By enrolling in a plan, you can take advantage of these reduced rates and save money on dental services.

Tax Deductions: Self-employed individuals may be eligible for tax deductions on their dental insurance premiums. This can help reduce your taxable income, which can ultimately save you money.

Access to Comprehensive Care: Dental insurance plans provide coverage for a wide range of services, from routine check-ups to more complex procedures like root canals and crowns. By enrolling in a plan, you can access comprehensive dental care that may otherwise be too expensive to pay for out of pocket.

Improved Health Outcomes: Regular dental care is essential for maintaining good oral health, which can impact your overall health and well-being. By enrolling in a dental insurance plan, you receive preventative care and early treatment for dental issues, leading to improved health outcomes and potentially reducing medical costs in the long run.

If you’re thinking about dental insurance and you’re self-employed, there are a few things to consider.

If you’re shopping for Marketplace health insurance, you should be able to add a dental plan during Open Enrollment.

You can’t just purchase dental insurance without a health plan in the Marketplace. Another option is to buy dental insurance direct to consumer any time of year.

It may cost a bit more, but there are no restrictions on when you can purchase it.

Second, when shopping for coverage don’t focus only on price. Be sure to compare waiting periods, annual benefit maximums, and covered procedures.

We made it easy to find affordable dental plans when you’re self-employed.

The dental plans we offer don’t require income, occupation, or health questions and you can start an instant quote on your own 24/7!

If you need assistance contact us for more information.

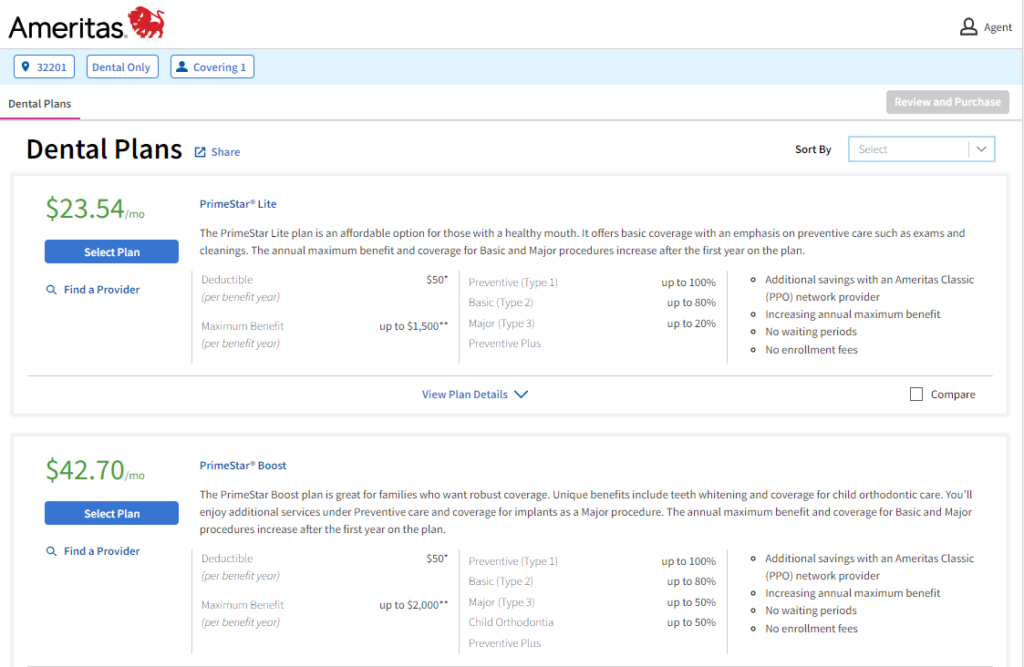

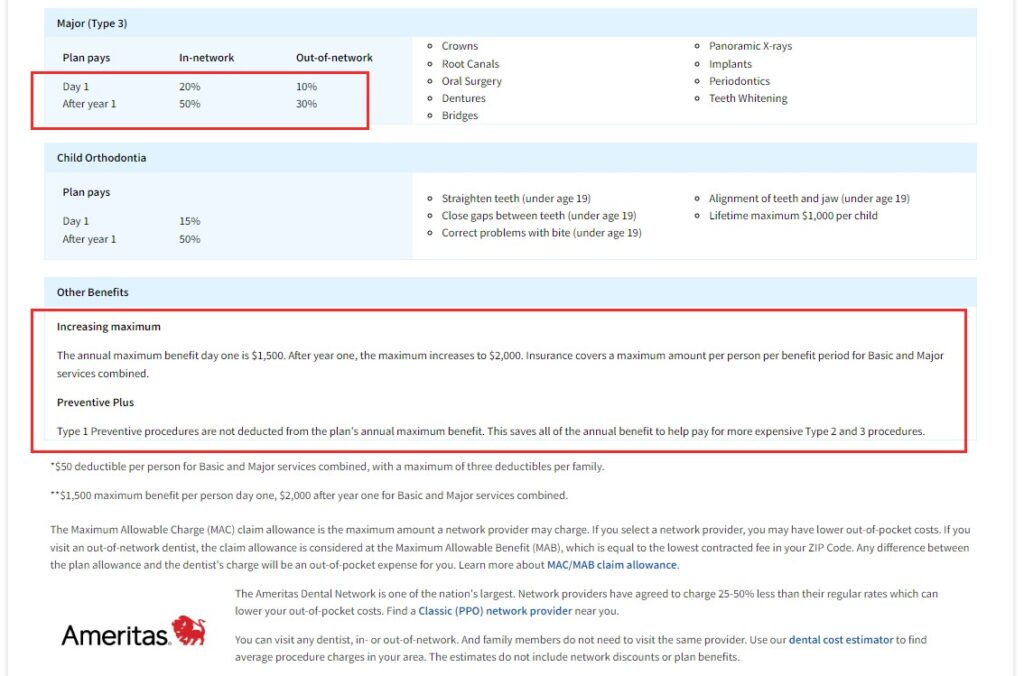

Ameritas Dental (no waiting period)

Ameritas dental insurance plans feature next-day coverage, no enrollment fees with increasing benefits.

You can add vision and hearing in many states.

There are no waiting periods for all dental services and no enrollment fees when you sign-up online.

Preventive visits, such as dental exams and cleanings, are covered up to 100%.

Fillings and extractions are covered in Basic services. Crowns, implants, dentures and even teeth whitening are covered in select plans.

Online quoting and enrollment.

Additional benefits and options are available such as vision, LASIK, orthodontia, or hearing. Check your ZIP Code for availability.

- PrimeStar Lite

- PrimeStar Boost

- PrimeStar Complete

- Annual maximums from $1,500-$3,000

- Increasing benefits

- Child orthodontia

Cigna Dental

Cigna offers individual dental insurance plans along with options for vision and hearing.

Plus, Cigna Dental 1500 offers orthodontia

Get instant quotes on Cigna Dental plans, dental & vision, new high annual maximum plans or dental, vision & hearing bundles.

Online quoting and enrollment. Not all plans are available in all states. Check your ZIP Code >>

- Cigna Dental Preventative

- Cigna Dental 1000

- Cigna Dental 1500 (orthodontia)

- Cigna Dental Vision 1000

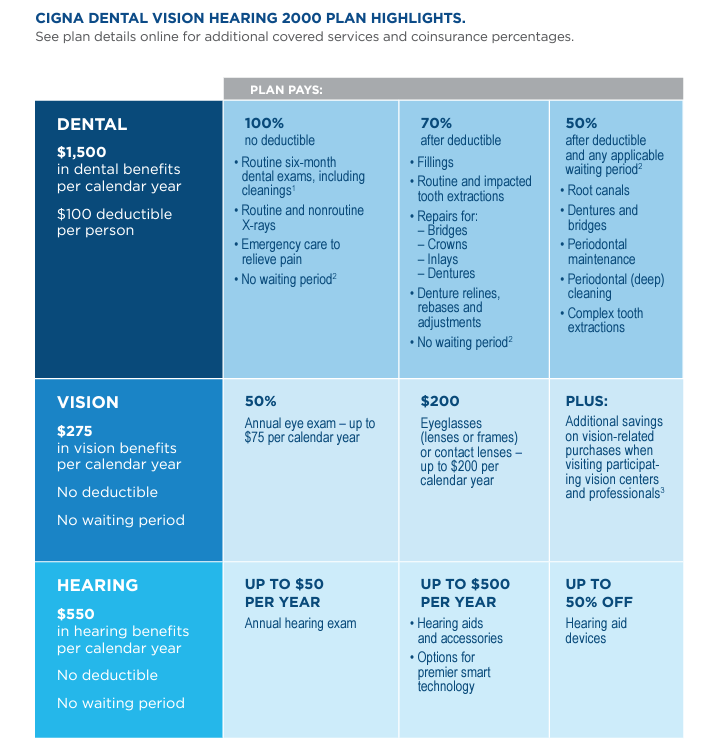

- Cigna Dental Vision Hearing 2000

- Cigna Dental 3500

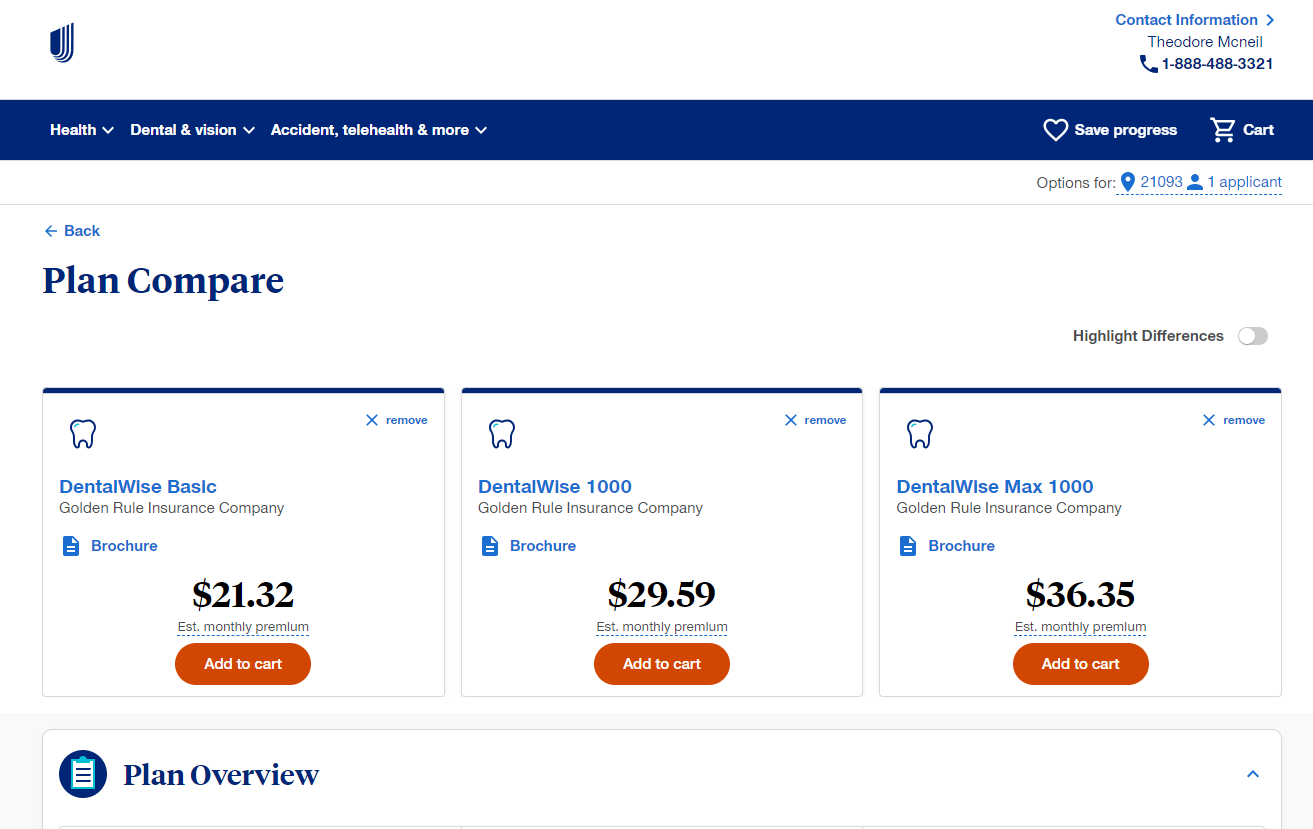

UnitedHealthcare (no waiting period)

From one of the best known names in healthcare, affordable solutions to protect your important assets. Their large network is widely accepted throughout the country.

UnitedHealthcare dental plans provide flexible options for basic and major dental services with no age limit, no waiting period, Day 1 coverage and increasing benefits.

Preventive, basic and major services covered. Annual maximums from $1,000-$3,000.

Popular plans: DentalWise 1000, DentalWise Max 1000 (covers vision) and DentalWise 2000 (covers implants) & DentalWise Max 3000.

DentalWise Max plans include vision. DentalWise 2000 covers implants with a separate $1,500 benefit (12-month waiting period applies to implants. No waiting period on all other services)

Online quoting and enrollment are available in licensed states. Contact us for assistance or if your state is not listed:

DC, FL, GA, MD, MS, NC, PA, TN, TX, VA.

- DentalWise 1000

- DentalWise Max 1000 (& vision)

- DentalWise 2000 (covers implants with additional $1,500 benefit)

- DentalWise Max 2000 (& vision)

- DentalWise Max 3000

RELATED PRODUCTS:

- Philips Sonicare 4100 Electric Power Toothbrush ($40-$50)

- DenTek Mouth Guard for Nighttime Teeth Grinding ($20)

- Oral-B iO Series 5 Rechargeable Electric Toothbrush ($100-$120)

Information is meant to be accurate and educational and not intended to be legal, medical or financial advice. Be sure to do your own research and contact a professional for help. Our site is free to use, but we may receive a commission from our partners & advertisers at no additional cost to you. Read our disclosure for more information.

Licensed insurance broker helping individuals, families and small business owners get affordable benefits.