| We may receive compensation from partners at no additional cost to you. Read our disclosure for details. |

Most critical illness insurance covers serious conditions such as heart attack, stroke, and cancer but how much does this pay in benefits?

Critical illness insurance can play a crucial role in enhancing healthcare coverage by providing additional financial support beyond standard medical plans.

In this guide, we’ll give you some insight to what critical illness insurance covers, how much it costs and if it’s worth it.

Most critical illness insurance plans provide lump sum payments to help with expenses associated with qualifying medical conditions, offering peace of mind during challenging times.

Whether it’s a heart attack, stroke or cancer diagnosis, by providing extra protection for large unexpected medical costs, supplemental critical illness covers what matters most and plays an important role in your financial security.

What Is Supplemental Critical Illness Insurance?

Supplemental health insurance serves as an additional layer of coverage to fill gaps left by primary health insurance plans, addressing out-of-pocket expenses like deductibles and copayments.

Critical Illness Insurance, a type of supplemental coverage, offers financial support upon diagnosis of severe medical conditions.

For instance, it provides a lump-sum payment for conditions such as heart attack, stroke, cancer, organ transplant, and major organ failure.

Explore how Critical Illness Insurance can provide peace of mind in various scenarios:

Heart Attack

Imagine experiencing a sudden heart attack, requiring immediate medical attention and ongoing treatment. Critical Illness Insurance offers a lump-sum payment to cover medical expenses, allowing you to focus on recovery without financial worry.

Cancer Diagnosis

Upon receiving a cancer diagnosis, the emotional and financial toll can be overwhelming. Critical Illness Insurance provides financial support to cover treatment costs, medication, and other associated expenses, ensuring you can access the best possible care.

Alzheimer’s Disease

Dealing with Alzheimer’s disease requires specialized care and support as the condition progresses. Critical Illness Insurance offers financial assistance to cover medical expenses, home care services, and other essential needs, easing the burden on you and your loved ones.

Organ Transplant

Undergoing an organ transplant is a life-changing experience that comes with significant medical costs. Critical Illness Insurance provides a lump-sum benefit to cover expenses related to the transplant surgery, post-operative care, and immunosuppressant medications, ensuring you can afford the necessary treatment for a successful outcome.

How Much Does Critical Illness Insurance Cost?

The cost of Critical Illness Insurance can vary based on factors such as age, health status, coverage amount, and geographical location.

Let’s look at a few examples in several states where we’re licensed. Not all plans will be available in all areas.

Female, 35 years old (nonsmoker) – $25,000 benefit

| State | Critical Illness | Cancer Insurance |

|---|---|---|

| Baltimore, Maryland | $30/month | $12/month |

| Atlanta, Georgia | $36/month | $15/month |

| Richmond, Virginia | — | $15/month |

| District of Columbia | — | $15/month |

Male, 40 years old (nonsmoker) – $50,000 benefit

| State | Heart Attack/Stroke | Critical Illness |

|---|---|---|

| Dallas, Texas | $22/month | $37/month |

| Philadelphia, Pennsylvania | $22/month | $37/month |

| Charlotte, North Carolina | $20/month | $33/month |

How To Get Supplemental Critical Illness Insurance

Various insurance providers offer critical illness insurance, providing individuals with several avenues to explore. Whether through insurance brokers, financial advisors, or directly from insurance companies, it’s essential to compare policies, coverage limits, and premium rates.

Various insurance providers offer Critical Illness Insurance. We work with Mutual of Omaha and UnitedHealthcare for example.

Individuals can explore options through insurance brokers, financial advisors, or directly from insurance companies. Be sure to compare policies, coverage limits, and premium rates to find the most suitable plan for specific needs.

Quote and enroll online 24/7 at your convenience or call us 888-488-3321 (Mon-Fri, 9am-6pm)

Licensed in: DC, FL, GA, MD, MS, NC, PA, TN, TX, VA

RELATED:

- Can You Be Denied Life Insurance for Medical Reasons?

- $0 Health Insurance Deductibles: The Good & Bad

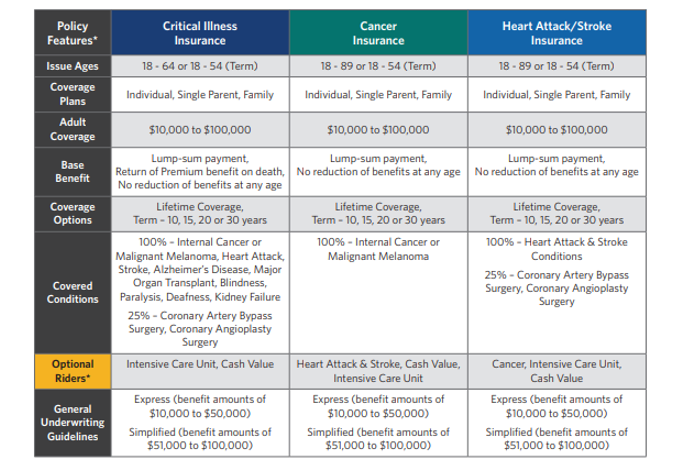

Mutual of Omaha

Mutual of Omaha offers the Critical Advantage Portfolio, providing comprehensive coverage for:

- Cancer

- Heart Attack

- Stroke

- Alzheimer’s Disease

- Coma

- Organ Transplant

- Paralysis

- Vision & Hearing Loss

With flexible benefit options, policyholders can tailor their coverage to align with their individual needs.

Mutual of Omaha Critical Illness requires agent assistance. Contact us

UnitedHealthcare

UnitedHealthcare supplemental insurance plans are underwritten by Golden Rule Insurance Company and offers additional financial protection in the event of critical illnesses.

With customizable coverage options, individuals can secure peace of mind knowing they have support during challenging times.

UnitedHealthcare has other supplemental plans like Accident Insurance & Hospital Insurance, but Critical Illness Insurance. Not available in all states.

Other Types of Supplemental Insurance

Beyond critical illness insurance, there are other forms of supplemental health insurance worth considering. These may include accident insurance, hospital indemnity insurance, or disability insurance, each providing additional financial support in specific medical situations.

Critical Illness Insurance vs Hospital Insurance vs Accident Insurance

Understanding the distinctions between critical illness, hospital indemnity, and accident insurance is crucial in making informed decisions about coverage.

While critical illness insurance focuses on providing a lump-sum benefit upon diagnosis of a covered condition, hospital indemnity insurance offers financial assistance for hospital stays, and accident insurance provides coverage for injuries resulting from accidents.

Is Supplemental Critical Illness Insurance Worth It?

Navigating the landscape of supplemental health insurance involves understanding its purpose, costs, eligibility, and operational aspects.

Whether considering critical illness, hospital, or cancer coverage and where to purchase this additional layer of protection, this guide aims to empower individuals to secure comprehensive healthcare coverage.

Quote and enroll online 24/7 at your convenience or call us 888-488-3321 (Mon-Fri, 9am-6pm)

Licensed in: DC, FL, GA, MD, MS, NC, PA, TN, TX, VA

Information is meant to be accurate and educational and not intended to be legal, medical or financial advice. Be sure to do your own research and contact a professional for help. Our site is free to use, but we may receive a commission from our partners & advertisers at no additional cost to you. Read our disclosure for more information.