| We may receive compensation from partners & advertiser links at no cost to you. Read our disclosure for details. |

A Health Savings Account (HSA) is a financial tool that can help you save for your medical needs while offering tax benefits. In this blog post, we’ll quickly compare Fidelity, Lively & HSA Bank to determine which is better to set up an HSA online.

We’ll discuss the basics of HSAs, account fees, the convenience of opening an account online, and how to get started.

Note: An HSA is not for everyone. Be sure to consult with a financial planner or tax professional as needed to fully understand your options.

In This Article:

What Are The HSA Limits for 2024?

Before we go any further let’s start with the basics: The IRS sets the rules!

A Health Savings Account is a tax-advantaged account designed to help you save for qualified medical expenses. It comes with unique tax benefits: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are also tax-free.

You must be enrolled in a high-deductible health plan to be eligible.

A high-deductible health plan (HDHP) must have a deductible of at least $1,600 for self-only coverage, (up from $1,500 in 2023), or $3,200 for family coverage, up from $3,000, the IRS noted.

According to the IRS the amount you can set aside in an HSA for a high deductible health plan (HDHP) in 2024:

- $4,150 (self-only)

- $8,300 (family)

Age 55 and older can contribute an additional $1,000 as a catch-up.

The maximum out-of-pocket amounts for high deductible health plans in 2024 (deductibles, co-payments and other amounts, but not premiums):

- $8,050 (self-only)

- $16,100 (family)

Benefits Of A Health Savings Account

One of the primary benefits of opening an HSA account is that you can take advantage of certain tax benefits. The contributions made to the account are usually tax-deductible and they generate tax-free earnings.

If you use the funds in your HSA for qualified medical expenses, then you will not be subject to additional taxes. Make sure to check with your tax advisor to ensure that you are getting the most out of your HSA contributions.

The most important thing when maximizing your HSA savings is to track all of your contributions and payments. This will ensure that you are taking full advantage of the tax breaks available with the HSA.

It’s also a good idea to keep a log of when you make payments and how much they are for in order to stay organized. You may need this information at tax time.

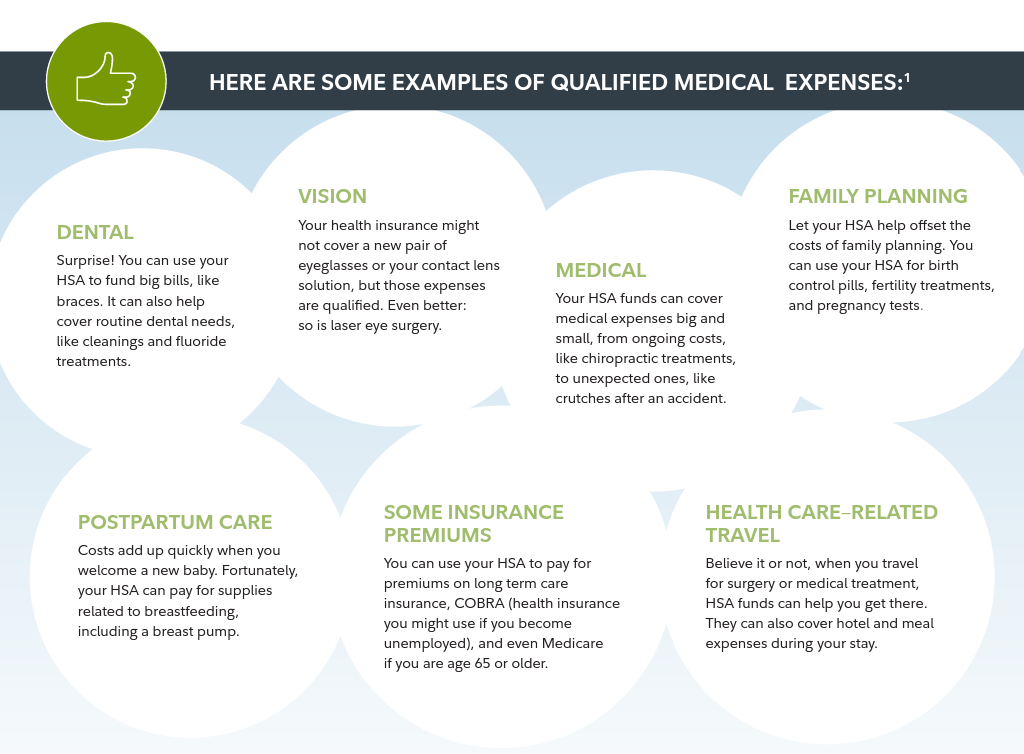

Other Examples Of HSA-Qualified Medical Expenses

- Dental Care

- Health Insurance Premiums (limited)

- Diabetes Management

- Doctor Visits

- First-Aid Supplies

- Hearing Aids

- Over-The-Counter (OTC) Medicine

- Smoking Cessation

- Telemedicine

- Healthcare Transportation

- Vasectomy

- Vision Care

- Women’s Health

Health Savings Account Annual Fees

When choosing an HSA provider, the fees associated with the account play a pivotal role in your decision-making process.

While many providers offer free setup, it’s important to remember that financial institutions generate much of their revenue by managing money.

To make an accurate comparison, you should look at the annual management fee. Keep reading for the small print.

What is Fidelity?

Can I Set Up An HSA Online On My Own?

Convenience is king, especially when managing your finances. The good news is that you can set up an HSA online, making the process quick and straightforward. We’ll guide you through the steps to get you started on the right foot.

You don’t need to be enrolled in an employer-sponsored health plan to open an individual HSA, but you do need to be enrolled in a high-deductible health plan.

With tax-free distributions and the potential to invest funds, HSAs are an excellent way to maintain control of your healthcare costs and still reach other financial objectives.

When selecting an HSA provider, account fees are a significant consideration.

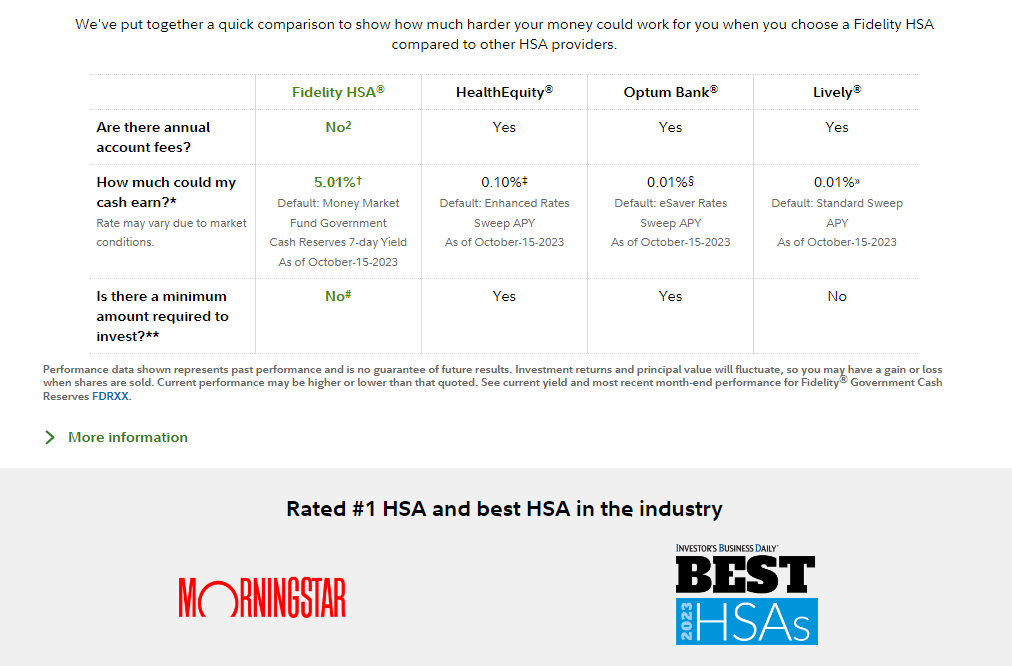

Fidelity is the most well known and offers competitive pricing, but how does it stack against the competition, like Lively or HSA Bank? Remember to read the small print.

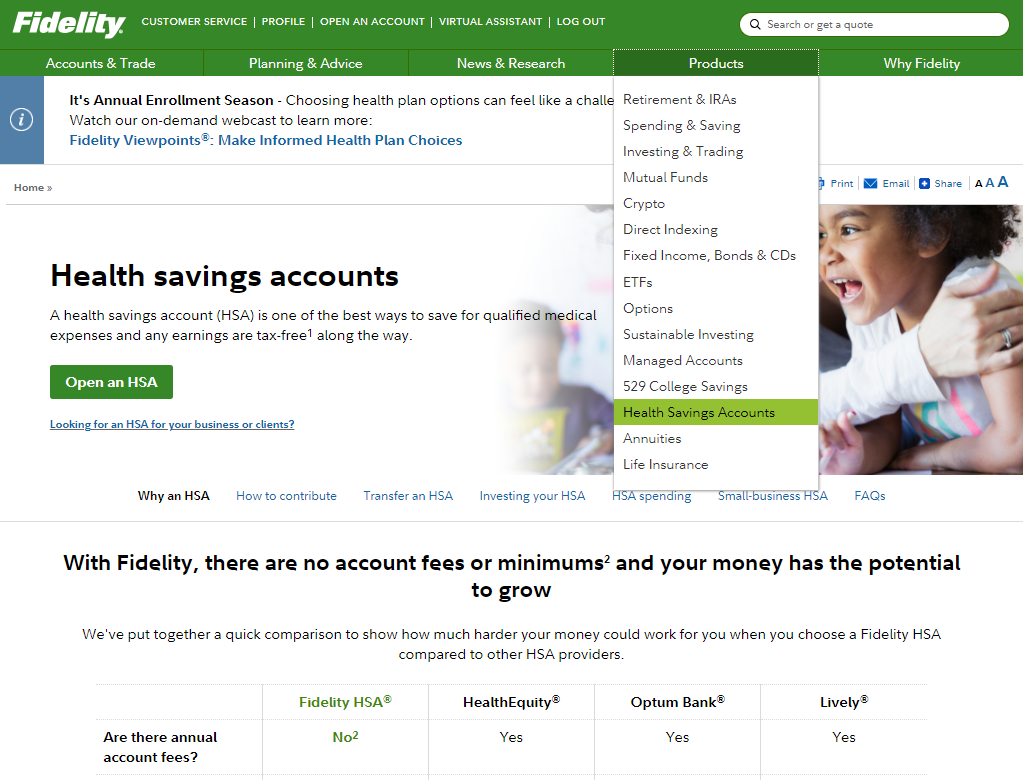

Fidelity HSA

Fidelity, often referred to as Fidelity Investments, is a well-established and globally recognized financial services company. Founded in 1946, Fidelity has grown to become one of the largest and most reputable investment management firms in the world.

It is renowned for its extensive range of financial products and services, catering to a diverse clientele, including individual investors, institutions, and businesses.

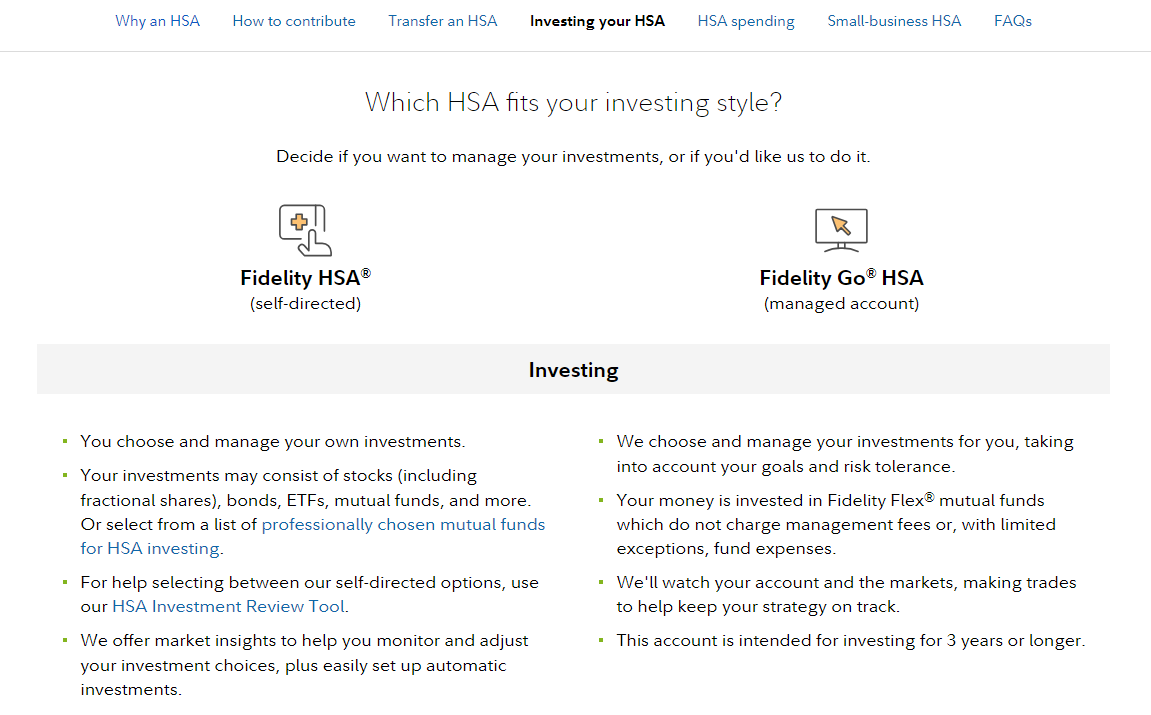

With Fidelity, you can choose to manage your own investments in stocks, bonds, ETF’s, mutual funds and more.

Small print on fees

“There are zero account fees and zero account minimums for Fidelity HSAs® offered through Fidelity.com to individuals and employers. There may be commissions, interest charges, and other expenses associated with transacting or holding specific investments (e.g., mutual funds), or selecting certain account features or types (e.g., managed accounts). When a Fidelity HSA® is offered as part of an employer’s benefits package (which occurs through NetBenefits®), Fidelity charges the employer a recordkeeping fee. This is a common fee charged by HSA providers. This fee may be up to $48/year, but it could be reduced or waived depending on the HSA balance. Employers may pass this fee on to their employees. Contact the employer for more information. Accounts that have been opened through, or are serviced by, an intermediary, or in connection with your workplace benefits, may incur additional fees or restrictions.”

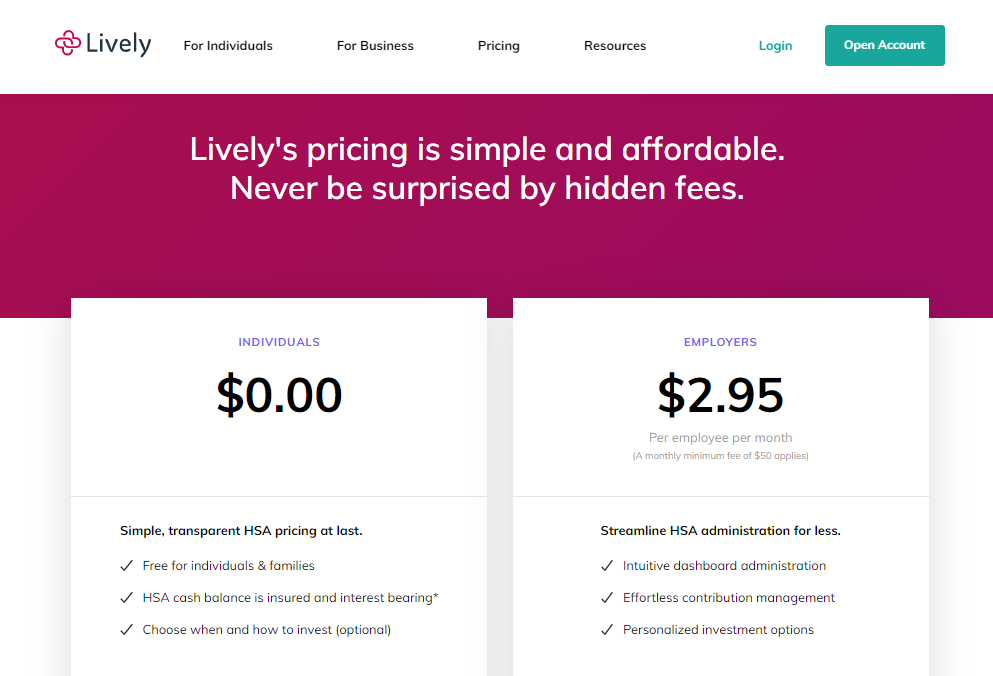

Lively HSA

Lively HSA Investing Options

Lively is a FinTech. In other words they are a technology company in the financial space. So their model is to partner with existing financial companies to offer their savings accounts:

Small print on fees

“Lively is integrated with two industry-leading HSA investment solutions: Charles Schwab’s Schwab Health Savings Brokerage Account and Devenir’s HSA Guided Portfolio. Both solutions include the option for first-dollar investing.

- Schwab Health Savings Brokerage Account (by Charles Schwab): We offer two ways to set up your Schwab HSBA account. You can either invest with no minimum restrictions after a $24 annual fee from Lively or invest anything above $3,000 above your cash account for no additional fee from Lively. (Additional investment fees from Charles Schwab may apply.)

- HSA Guided Portfolio (by Devenir): Lively charges a 0.50% annual management fee for access to investment capabilities through the HSA Guided Portfolio by Devenir, including automated features such as rebalancing. The fee is based on invested assets and debited quarterly.”

HSA Bank

HSA Bank

HSA Bank, short for Health Savings Account Bank, is a financial institution that specializes in providing Health Savings Accounts (HSAs) and related financial services.

HSA Bank serves as a custodian for these accounts, allowing individuals to contribute pre-tax dollars, earn interest on their balances, and use the funds for eligible healthcare expenses.

A division of Webster Bank, N.A.

Small print on fees

“There is no minimum account balance required to open a Health Savings Account (HSA) or to obtain the annual percentage yield disclosed. We use the daily balance method to calculate the interest on your account. The daily balance method applies a daily periodic rate to the principal in the account each day. Interest is compounded monthly and credited monthly. Interest begins to accrue no later than the business day that we receive credit for the deposit of non-cash items (for example, checks). The interest rate and annual percentage yield (APY) is based on the balance in your account. If you close your account, interest that has accrued but has not yet posted will not be paid. The interest rate and annual percentage yield available on your account is as follows, effective as of October 1, 2022.

Daily Balance Interest Rate APY

$50,000 or more 0.50% 0.50%

$25,000 – $49,999 0.30% 0.30%

$5,000.00 – $24,999.99 0.15% 0.15%

Less Than $5,000 0.05% 0.05%

This interest rate is subject to change at our discretion at any time. Fees may reduce your earnings.”

Invest The Money In Your HSA

Have some extra money to invest? Putting it in a mutual fund or ETF within your HSA can yield big benefits. Not only will this form of investment grow with potential gains over time, but you can also use these accumulations to cover medical expenses without any penalty at any point in the future.

This flexibility is a great way to gain control over your healthcare costs down the road and make the most of your savings for the future!

While HSAs generally limit investing options to mutual funds and ETFs, these two forms of investments can give you a significant return if you plan ahead and make sound choices.

Both have the potential to grow fairly rapidly, although it’s important to realize that they also carry risks.

Mutual funds usually encompass a range of investments in stocks, bonds and other securities while ETFs are typically focused on just one sector such as energy or technology.

Consider your personal risk tolerance when making investment decisions within your HSA account so that you can maximize returns when it comes time to pay for medical expenses in 2023 or beyond.

Managing Your Money

While HSAs are excellent for saving on taxes and medical expenses, it’s crucial to manage your money wisely. Don’t invest with money you can’t afford to lose.

If you have the means an HSA can be very useful to help manage high deductibles and medical expenses. It can also be a smart investment tool for retirement.

Conversely, if you don’t have the extra money to set aside each month or take advantage of the investing features of an HSA you might want to stick with a traditional savings account.

That way, if a non-medical emergency comes up you’ll have access to your funds without penalty.

Note: Be sure to consult with a financial planner or tax professional as needed to fully understand your options.

Choosing An HSA Provider

Selecting the right Health Savings Account (HSA) provider is a crucial decision that can significantly impact your ability to manage healthcare expenses efficiently.

Here’s a comprehensive summary of key considerations when choosing an HSA provider:

1. Financial Stability: Ensure the financial stability and reputation of the HSA provider. Opt for well-established financial institutions with a track record of reliability and sound financial management.

2. Fees and Costs: Understand the fee structure associated with the HSA. Evaluate factors such as monthly maintenance fees, transaction fees, and investment-related charges. Look for providers with transparent fee schedules and consider how these fees align with your financial goals.

3. Interest Rates: Check the interest rates offered on HSA balances. While interest rates may be modest, selecting a provider that offers competitive rates can contribute to the growth of your HSA funds over time.

4. Investment Options: If you plan to invest your HSA funds, assess the investment options provided by the HSA provider. Consider the range of investment choices, fees associated with investments, and the ease of managing your investment portfolio.

5. Account Access and Technology: Evaluate the accessibility of your HSA account. Choose a provider that offers user-friendly online platforms, mobile apps, and other technological features that make it easy to manage your account, monitor transactions, and access statements.

6. Customer Service: Assess the quality of customer service offered by the HSA provider. Look for providers with responsive customer support, clear communication channels, and helpful resources for addressing any queries or concerns.

7. Compatibility with High-Deductible Health Plan (HDHP): Ensure that the HSA provider is compatible with the high-deductible health plan (HDHP) you have or plan to enroll in. Confirm that the provider allows contributions and aligns with the specific requirements of your chosen HDHP.

8. Additional Features and Benefits: Consider additional features and benefits offered by the HSA provider. This may include tools for budgeting, educational resources on healthcare savings, or discounts on health and wellness services.

9. Integration with Employer Plans: If your employer offers an HSA as part of a benefits package, check whether there are preferred HSA providers. Integration with employer plans can simplify contributions and may come with additional perks.

10. Reputation and Reviews: Research the reputation of the HSA provider by reading reviews from other account holders. Pay attention to feedback on customer service, account management, and overall satisfaction.

By carefully considering these factors, you can make an informed decision when choosing an HSA provider that aligns with your financial goals and healthcare needs.

Remember that the right provider can enhance your ability to save for medical expenses while enjoying tax advantages and investment opportunities.

Information is meant to be accurate and educational and not intended to be legal, medical or financial advice. Be sure to do your own research and contact a professional for help. Our site is free to use, but we may receive a commission from our partners & advertisers at no additional cost to you. Read our disclosure for more information.