| We may receive compensation from partners & advertiser links at no cost to you. Read our disclosure for details. |

Vision insurance is a popular benefit in the workplace and as supplemental coverage you can purchase on your own, but knowing the ins and outs of your plan can be confusing. For instance, if you have EyeMed does it cover cataracts? Or LASIK? Keep reading to find out.

EyeMed is one of our most popular vision plans for individuals, families and small businesses.

With low rates, an easy online application, and a large doctor & retail network, EyeMed Vision is considered to be one of the top-rated plans on the market. While vision insurance plays a crucial role in covering routine eye care services, it’s important to recognize the limitations.

In this EyeMed review, we’ll look at their individual vision plans, along with some pros and cons, the benefits, cost, and how to save money on frames, lenses, contacts, and even LASIK.

We’ll explore the benefits of vision insurance, if EyeMed covers LASIK or cataracts, and how it helps you save on essential eye care services.

With rising healthcare costs and the importance of regular eye care, having affordable vision insurance can provide peace of mind and big savings.

In This Article:

What is EyeMed Vision Insurance?

EyeMed is owned by Luxottica, the retail giant that also owns, LensCrafters, Sunglass Hut, Pearle Vision, Target Optical, and Glasses.com.

EyeMed individual vision insurance is considered an above-average vision plan covering the cost of eye exams, glasses, and contact lenses. The company has one of the largest private networks of doctors in 48 states.

Many of our clients consider EyeMed more than adequate coverage and a great value based on price and benefits.

With most vision insurance plans you can visit any eye doctor you like and still save, you’ll get maximum bang for your buck by visiting in-network providers.

EyeMed has more retail partners than some other plans and you can apply your benefits and allowances at places like Target Optical, Lenscrafters, Pearle Vision and Glasses.com

Rates provided by EyeMed

Starting as low as $5 a month, EyeMed has one of the most affordable vision plans on the market. Individual vision insurance is a smart choice for anyone who may not have access to employee benefits or looking to supplement an existing plan.

Benefits and price can vary based on where you live, but like other health plans, you will save more by visiting in-network doctors and retailers.

What is LASIK? (PRK)

LASIK and PRK are both types of laser eye surgery used to correct vision problems like nearsightedness, farsightedness, and astigmatism. However, they differ in how the cornea is reshaped to improve vision.

LASIK (Laser-Assisted In Situ Keratomileusis) involves creating a thin flap on the cornea using a laser or a blade. The flap is then lifted, and another laser is used to reshape the underlying corneal tissue. Finally, the flap is repositioned. LASIK typically offers a quicker recovery time and less discomfort compared to PRK.

PRK (Photorefractive Keratectomy), on the other hand, does not involve creating a flap. Instead, the outer layer of the cornea (epithelium) is removed entirely. The laser is then used to reshape the exposed corneal tissue. Since PRK involves removing the epithelium, the recovery process is longer and may be associated with more discomfort initially compared to LASIK.

Does EyeMed Cover LASIK?

Although LASIK is a popular surgical procedure used to correct vision problems such as nearsightedness, farsightedness, and astigmatism, vision insurance plans do not cover the full cost of LASIK surgery — but discounts apply.

Vision insurance is designed to offset the costs of preventive care, prescription eyewear, and other vision-related expenses. Surgeries and treatments deemed medically necessary generally fall under health insurance rather than vision insurance.

If you’re considering LASIK you should explore alternative payment options, such as financing plans offered by LASIK providers or utilizing health savings accounts (HSAs) or flexible spending accounts (FSAs).

You can also save on LASIK with vision insurance.

EyeMed Member Benefits

EyeMed members receive a consultation and either a 15% discount on standard LASIK rates or a 5% discount on promotional rates. The savings amounts to $500-$1,000 or more depending on the chosen provider.

When you consider the average cost for LASIK can range from $2,000-$3,000 per eye, the vision benefits are significant.

As a member and with eligible dependents, you gain access to substantial and exclusive discounts. Plus, LASIK providers must meet rigorous credentialing standards to ensure quality service to members.

The LASIK network gives you expanded access to approximately 600 provider locations nationwide including preferred providers like LasikPlus, TLC Laser Eye Centers and The LASIK Vision Institute.

Does EyeMed Cover Cataract Surgery?

Cataract surgery is a common procedure performed to remove clouded lenses from the eyes, restoring clear vision. Unlike LASIK, cataract surgery is typically covered by health (medical) insurance rather than vision insurance.

EyeMed vision insurance does not cover cataract surgery.

Insurance providers consider cataract surgery medically necessary when a cataract significantly impairs vision and affects daily activities. In such cases, health insurance plans often cover the costs associated with cataract surgery, including pre-operative evaluations, surgical procedures, and post-operative care.

Is EyeMed Good Insurance?

EyeMed provides comprehensive coverage for various eye care services. One of the primary benefits is a routine eye exam.

Regular eye exams are essential for maintaining good eye health, detecting any potential issues, and ensuring that your prescription is up-to-date.

With EyeMed individual coverage, you can schedule these exams with participating providers without worrying about the cost.

EyeMed plans offer a range of coverage options and benefits to fit different needs and budgets. Their plans typically cover the cost of annual eye exams and a portion of the cost of glasses or contact lenses.

It also has a large network of providers, making it easy to find an eye doctor near you. Additionally, their online tools and resources make it easy to manage your benefits and find answers to any questions you may have.

EyeMed covers routine eye exams, savings on prescription glasses and contact lenses, and discounts on LASIK surgery and hearing aids:

- Comprehensive eye exams included

- Discounts on frames and lenses and contacts

- Save on prescription sunglasses at participating retailers.

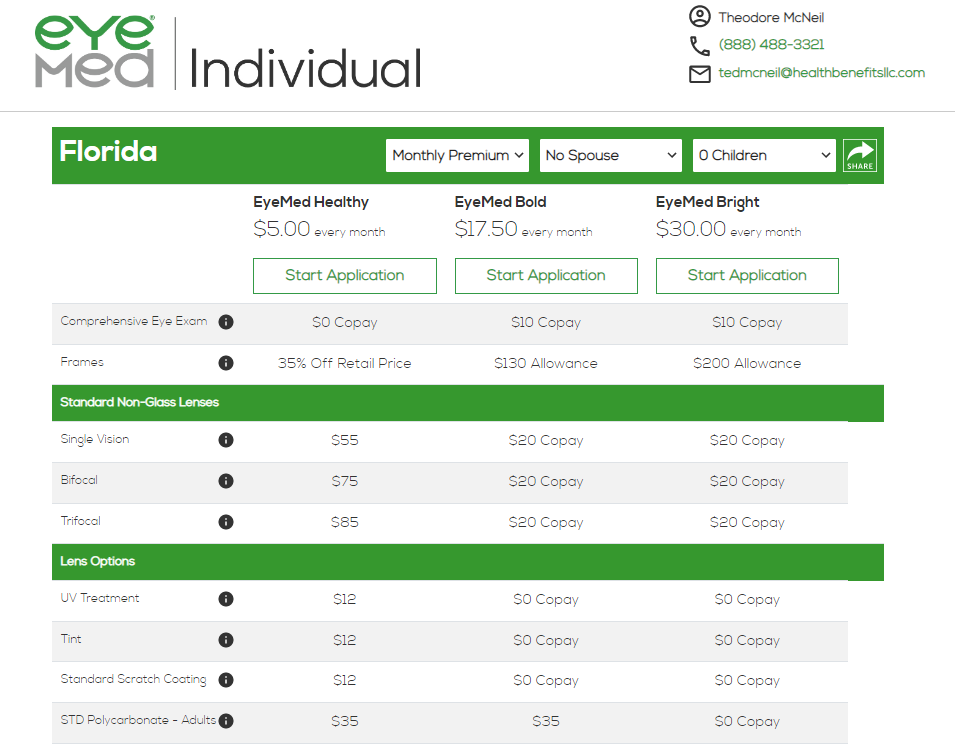

- Member discounts on LASIK laser vision surgery

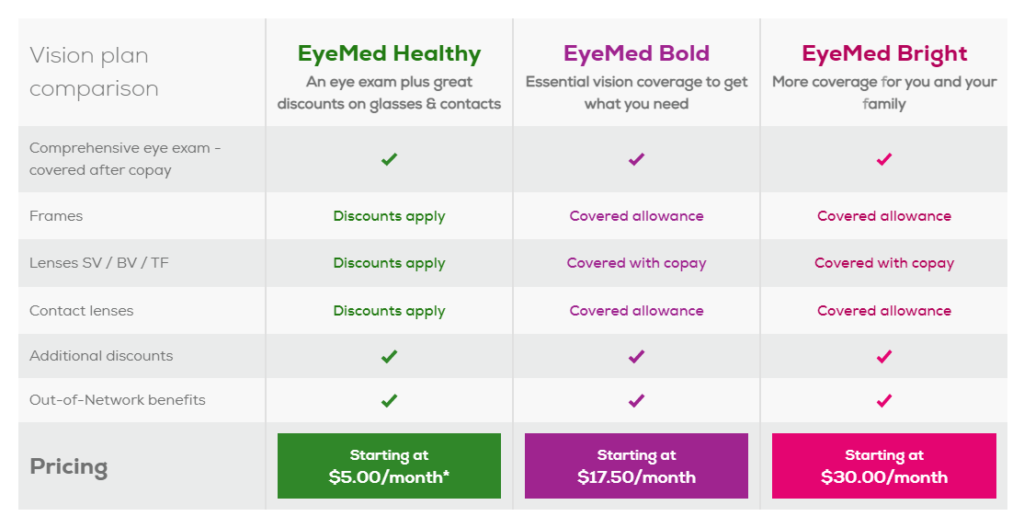

Depending on the plan you choose: EyeMed Healthy, EyeMed Bold or EyeMed Bright, you might have a $0 to $10 copay, with instant savings or a generous allowance of up to $200 on frames and contacts.

Lastly, EyeMed has a slight advantage over some other vision plans mainly because of its network of online retailers.

You can schedule an eye exam and shop for glasses at Lenscrafters and other in-network partners like Glasses.com, Ray-Ban, and Target Optical. This saves having to submit a claim for reimbursement if you shop elsewhere.

MORE ARTICLES

- A Review Of Careington 500 Dental Plan: Is It The Best Dental Savings Plan?

- Compare Sonicare 4100 ProtectiveClean 5100 vs 6100 (Price & Features)

EyeMed Vision Review (Cost)

Individual & family plans can cost a bit more than employee benefits through work simply because you’re paying the full premium on your own without an employer contribution.

However, the cost of a vision plan is still less than paying out-of-pocket for an exam, frames and lenses on your own.

With the average cost of an eye exam (without insurance) at around $50-$250 and a new pair of eyeglasses anywhere from $100-$500 or more, an individual vision plan makes a lot of sense when you add it all up.

When shopping for vision insurance be sure to consider the cost of the plan on an annual basis about the benefits you will receive, your health, and your budget.

The total costs associated with EyeMed Insurance depend on several factors, including the specific plan you choose, the level of coverage, and any add-ons or optional benefits.

Here are some key considerations when it comes to calculating costs and benefits:

Premiums: EyeMed Insurance plans come with monthly premiums that vary based on the level of coverage and the number of individuals covered under the plan. Individual plans generally have lower premiums compared to family plans.

Copayments: Some EyeMed Insurance plans may require copayments for certain services or products. Copayments are fixed amounts that you pay out-of-pocket at the time of service.

For example, you may be required to pay a copayment for each eye exam or when purchasing prescription glasses. These copayments can vary depending on the plan and the specific service or product.

- EyeMed Healthy – $0

- EyeMed Bold – $10

- EyeMed Bright – $10

Deductibles: Deductibles are the amount you must pay out-of-pocket before the insurance coverage kicks in. EyeMed Insurance plans may have deductibles for certain services or products.

Out-of-network costs: If you choose to visit an eye care provider who is not part of the EyeMed Insurance network, you may incur additional out-of-pocket costs. EyeMed Insurance typically covers a higher percentage of the expenses when you visit an in-network provider.

It’s important to check the network options in your area and consider the potential out-of-network costs if you have a preferred provider outside of the network.

Additional benefits and add-ons: EyeMed Insurance offers additional benefits and add-ons that can enhance your coverage but may come at an additional cost. For example, you may have the option to add coverage for progressive lenses or lens enhancements.

These add-ons can increase the overall cost of your insurance plan, so it’s essential to carefully evaluate the value they provide.

When considering EyeMed Insurance pricing and costs, it’s important to compare the benefits and coverage against the associated expenses. Evaluate your vision care needs and budget to determine if the pricing and costs align with your expectations.

EyeMed Vision Review (Pros)

EyeMed comes with several advantages that make it an attractive option for individuals and families seeking vision coverage.

One of the key benefits is the comprehensive coverage it offers for eye exams. Regular eye exams are included and crucial for detecting potential issues early on.

Coverage is available to both adults and children, ensuring that everyone in your family can access the necessary eye care services.

Other advantages of EyeMed vision insurance are discounts and allowances for prescription glasses and contact lenses. If you’ve never had to buy eyeglasses, you should know they can be pricey!

As mentioned, EyeMed covers LASIK up to

Without a vision plan, you can expect to pay anywhere from $200-$500 or more for an exam, frames, and lenses.

Vision insurance gives you an allowance every year to cover a portion of these costs, reducing your out-of-pocket expenses.

Lastly, you can get EyeMed individual vision insurance easily online in just a few minutes without speaking to an agent or sales representative.

EyeMed Vision Review (Cons)

As you know by now, insurance isn’t perfect and EyeMed is no exception. While there are many advantages there are downsides. Their network is large, but it is not the largest.

Like other health plans, EyeMed is only as good as its provider network. It doesn’t make sense to purchase a plan if the closest doctor is an hour away. Unless you live in a remote area of course.

You can visit any eye doctor outside the network, but you won’t get the full benefit or discounts. Plus, you’ll pay the entire bill upfront and submit a claim for reimbursement — with less savings than if you were to visit an in-network provider.

The best way to avoid any issues is to search and review their provider network online before enrolling.

Another downside of EyeMed Insurance is the restriction on coverage. Vision plans may exclude certain procedures or pre-existing conditions. You may also discover limitations on specialized treatments or advanced procedures.

Again, EyeMed covers LASIK to an extent.

You’ll want to research the plan benefits and any exclusions before you sign-up.

Is EyeMed Good Insurance?

As mentioned before, EyeMed is the coverage my family has and we’ve been happy with it for years. It’s one of the reasons I partnered with them.

EyeMed is good vision insurance because we use every dime of it. We get our eye exams every year and apply our benefits toward contacts or a new pair of glasses. I happen to like frames and own six pair.

As much as we like EyeMed, you should get similar benefits across most major eye plans.

The big difference in my opinion is finding a doctor you like conveniently located near you and being able to use your benefits when shopping online or at the store. I prefer the EyeMed retail network including LensCrafters and Ray-Ban.

Network of providers and locations

EyeMed vision insurance offers a range of coverage options and benefits to fit different needs and budgets. Their plans typically cover the cost of annual eye exams, as well as a portion of the cost of glasses or contact lenses, known as the allowance.

The plans also offer discounts on prescription sunglasses and EyeMed covers LASIK surgery through discounts within their provider network.

They have a large network of providers, making it easy to find a provider near you. Additionally, their online tools and mobile app make it easy to manage your benefits and find answers to any questions you may have.

Customer service & support

The company offers customer service and support through its website, phone, and email. I’ve never had an issue getting a claim paid. I would suggest reading the plan summary thoroughly. That goes for any coverage you buy.

They have a dedicated service team to help answer any questions you may have about your plan, benefits, or claims. They also have an online portal where you can access your account information, view your benefits, and track your claims.

Additionally, EyeMed offers a mobile app that allows you to find providers, view your benefits, and access your digital ID card.

Overall, EyeMed provides above-average customer service to ensure its members are happy.

Bottom line

When you look at the cost of the average eye exam, plus frames and lenses and compare that to a $20 a month vision plan you can decide for yourself.

By purchasing an EyeMed individual plan, you can gain peace of mind knowing that your vision care expenses are covered.

Regular eye exams and proper eyewear are essential for maintaining good eye health, and having insurance coverage can significantly reduce the financial burden associated with these services.

Plus, having a plan encourages regular visits and that’s always a good thing for overall health.

Get An EyeMed Vision Quote

Enrolling in vision insurance online is easy! We are a licensed EyeMed partner and ready to assist with no additional fees or commissions.

Get an instant quote 24/7 in the following states: MD, DC, VA, FL, GA, NC, SC, TN, TX

Unlike employer plans or insurance from the ACA Marketplace, there is no enrollment period so you can sign up any time of the year.

FAQ

Is EyeMed the same as VSP?

No. VSP stands for Vision Service Plan and claims to be the largest vision insurance provider in the country. EyeMed is one of the fastest-growing vision health benefits companies, but they are not the same. One of the main differences is the network of eye doctors.

VSP in-network retailers include Walmart, Sam’s Club, Costco and Eyeconic.

EyeMed retailers include Target Optical, LensCrafters, ContactsDirect, Glasses.com and Ray-Ban

Does EyeMed cover Transitions?

Yes. the plan gives you discount pricing on photochromic (adaptive) lenses that change from clear to dark in color.

If you are considering adaptive lenses look at the Transitions Gen 8 which change from dark to clear in less time.