Getting older means thinking more about our loved ones. Maybe you are shopping for financial protection and wondering how much senior final expense insurance costs and is it worth it.

Whether you’re in your 50’s, 60’s, or beyond, this type of insurance can provide peace of mind and financial security after you’re gone — but it may not be for everyone.

And guess what, senior final expense life insurance isn’t just for retirees. Some carriers offer this type of whole life insurance policy to adults aged 40 and up.

In this guide, we’ll explore some things you need to know about this type of coverage, from the benefits to the costs and beyond.

Don’t let financial burdens weigh heavy on your loved ones. Take advantage of our free consultation to ensure your final wishes are fulfilled.

In This Article:

How Do Senior Final Expense Insurance Plans Work?

According to this Harvard study, the average life expectancy in the U.S. is just over 76 years.

While that can be a good thing for many reasons, it can also mean more time to accumulate medical bills and expenses.

Final expense insurance is a whole life insurance policy designed for older adults typically ages 50-80 to help cover the costs associated with end-of-life expenses.

This can include medical, hospice, funeral, and burial costs, but is up to the beneficiary on how the money is spent.

This coverage works much like any other type of life insurance policy.

You pay premiums to your insurance provider, and they provide a death benefit to your beneficiaries when you pass away.

The death benefit is typically used to cover your funeral and burial costs and any related expenses.

One of the key differences between final expense life insurance and other types of life insurance policies is that final expense policies are typically smaller in size.

But because of the lower benefits, most plans are guaranteed issue and do not require a medical exam.

Final expense insurance has payouts ranging from $2,000-$50,000 depending on the carrier and is generally more affordable than term life insurance if you’re older.

With level premiums, your monthly payment won’t change making these plans a popular choice for seniors on a fixed income.

The death benefit is typically paid out in a lump sum, allowing the family to cover burial costs or any outstanding debts.

PROS of Final Expense Insurance

- No medical exams or blood work

- Premiums are fixed and won’t change

- Build cash value over time that you can borrow from

- Death benefit can be used by the beneficiary for any purpose

CONS of Final Expense Insurance

Death benefits are lower with options usually around $2,000-$50,000

- Premiums paid can exceed the amount of coverage

- Health can affect the premium, benefit amount and approval (see: simplified issue vs. guaranteed issue)

- 2-year waiting period for full death benefit

Simplified Issue vs Guaranteed Issue

Final expense insurance is a type of permanent (whole) life insurance meaning you’ll be covered as long as you pay your premiums. There are two main types of final expense insurance:

Simplified Issue (SI)

Best for applicants with minor health issues who may not qualify for traditional life insurance. There are typically no medical exams with simplified issue, but may have to answer a few health questions to assess your overall level of risk and therefore your premium.

Simplified issue plans are sometimes available as level or modified, based on the answers to your health questions, have higher death benefits and are usually more affordable than guaranteed issue.

Guaranteed Issue (GI)

A guaranteed issue plan is a good option for applicants with more serious health conditions and those who don’t qualify for any other reason.

You can’t get turned down for health reasons, however, because there is more risk guaranteed issue plans usually offer lower amounts at slightly higher rates compared to simplified issue.

Does Final Expense Insurance Have a Waiting Period?

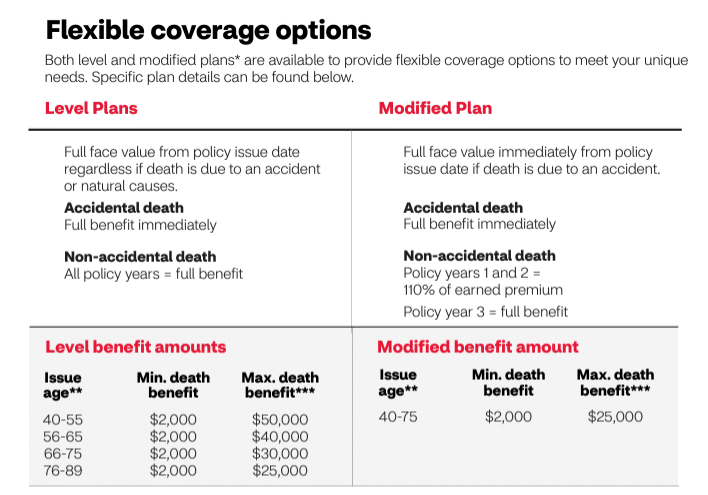

Some plans have rules on when the full death benefit can be paid out. Two years is typical.

Payout of the death benefit can also depend on the cause of death. For example, accidental death usually pays full face value immediately.

But with some plans, death by natural causes will return the premiums paid plus 10% in the first two years of the policy and full benefits after that.

Senior Final Expense Insurance Policy Limits?

Data from The National Funeral Directors Association, shows the median cost of a funeral with viewing is over $8,000.

Along with the decisions your family will need to make after your passing, they will have financial obligations and a lump sum benefit can help alleviate a few burdens.

Final expense insurance has lower limits than other life insurance policies.

Most final expense policy amounts max out around $30,000 and the average policy is around $15,000.

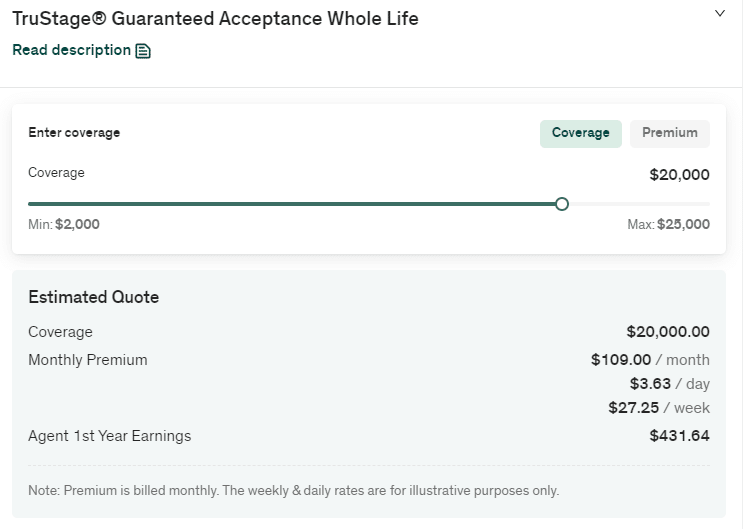

For example, Ethos offers a guaranteed whole life policy to seniors ages 66-80 up to $25,000.

Aetna (CVS Health) simplified issue final expense is for adults ages 40-89 with coverage amounts from $2,000-$50,000.

Benefits can help with living expenses if you become incapacitated or used to pay for the cost of burial and funeral services, hospice or medical bills after you pass away.

Your loved one can also use the money for other things like outstanding debt, starting a college fund for a child or whatever they need.

| Company | Issue Ages | Benefit |

|---|---|---|

| Aetna | 40-89 | $2,000-$50,000 |

| Ethos | 66-80 | $2,000-$25,000 |

| AIG | 50-80 | $5,000-$25,000 |

How Much Does Senior Final Expense Insurance Cost?

The cost of final expense insurance varies depending on several factors, including age, health and where you live.

We already know with age comes higher premiums and our options for life insurance become limited.

However, senior final expense insurance can still be an affordable alternative to term life insurance if you’re shopping for financial protection.

Is Senior Final Expense Insurance Worth It?

If your family has enough money set aside to cover obligations after you pass away, then you probably don’t need final expense insurance.

Plus, depending on your age the cost might not be worth it.

On the other hand, as funeral costs continue to rise you can’t underestimate the emotional and financial burden left on family members. In that case, final expense insurance may be worth a look.

Final expense insurance is affordable, predictable and easy to get.

Coverage amounts will range from $2,000 to $30,000 based on your age and the carrier you choose.

If you want an idea of what your rates would be check out my Ethos page for an easy online quote.

The amount of coverage available and the price you pay will vary on your age, state of residence and overall health.

Free No Obligation Quote

We hope this post has provided insight into what medical conditions can disqualify you from life insurance. During your search, there may be a time when consulting with an agent becomes necessary.

Life insurance depends on many risk factors like health, finances, credit score, lifestyle and even your driving record.

If you have questions contact us before you dive into an application.

We work with several life insurance companies to get the peace of mind you deserve.

With Ethos, you can start a quote and even enroll on your own.

Our plans from AIG, Mutual of Omaha and Aetna require agent assistance, but there are no broker fees or commissions!

Information is meant to be accurate and educational and not intended to be legal, medical or financial advice. Be sure to do your own research and contact a professional for help. Our site is free to use, but we may receive a commission from our partners & advertisers at no additional cost to you. Read our disclosure for more information.

Licensed insurance broker helping individuals, families and small business owners get affordable benefits.