For individuals living with this disease, it’s important to know if diabetic eye exams are covered by your insurance to detect and prevent serious eye conditions like diabetic retinopathy, glaucoma, and cataracts.

However, when it comes to covering eye exams, many people are unsure whether their vision insurance or health insurance will foot the bill.

While vision insurance typically covers routine eye care, diabetic eye exams often fall under medically necessary care, meaning they should be covered by your health insurance instead.

Diabetes can lead to several eye complications, with diabetic retinopathy being one of the most serious.

Regular eye exams are vital to catch these problems early, so let’s find out if they’re covered.

Questions? Speak to a licensed agent and get free personalized help!

Your privacy is our priority. We don’t store personal information or process payments, ensuring a safe and secure experience.

Shop Marketplace Health Insurance!

We’ll help you find an affordable Marketplace health plan. Contact us and speak to a licensed expert absolutely free!

Licensed: FL, GA, MD, MS, NC, PA, SC, TN, TX, VA

- HealthCare.gov

- Georgia Access (GA Marketplace)

- Maryland Health Connection

- Pennie (PA Marketplace)

- Virginia’s Insurance Marketplace

What Is Vision Insurance?

Vision insurance is a type of coverage specifically designed to help with routine eye care, such as annual eye exams, glasses, and contact lenses. It typically focuses on preventative care and providing discounts on corrective eyewear.

Vision insurance is ideal for covering basic vision needs but usually does not extend to medically necessary treatments related to health conditions like diabetes or eye diseases.

On the other hand, health insurance may cover vision-related services when they are considered medically necessary.

It’s important to know the distinction between vision and health insurance.

For example, if you have diabetes and require a comprehensive diabetic eye exam, your health insurance will likely cover this, as it falls under medical care.

Health insurance may also cover treatments for eye conditions like cataracts, glaucoma, or diabetic retinopathy, which are tied to underlying health issues.

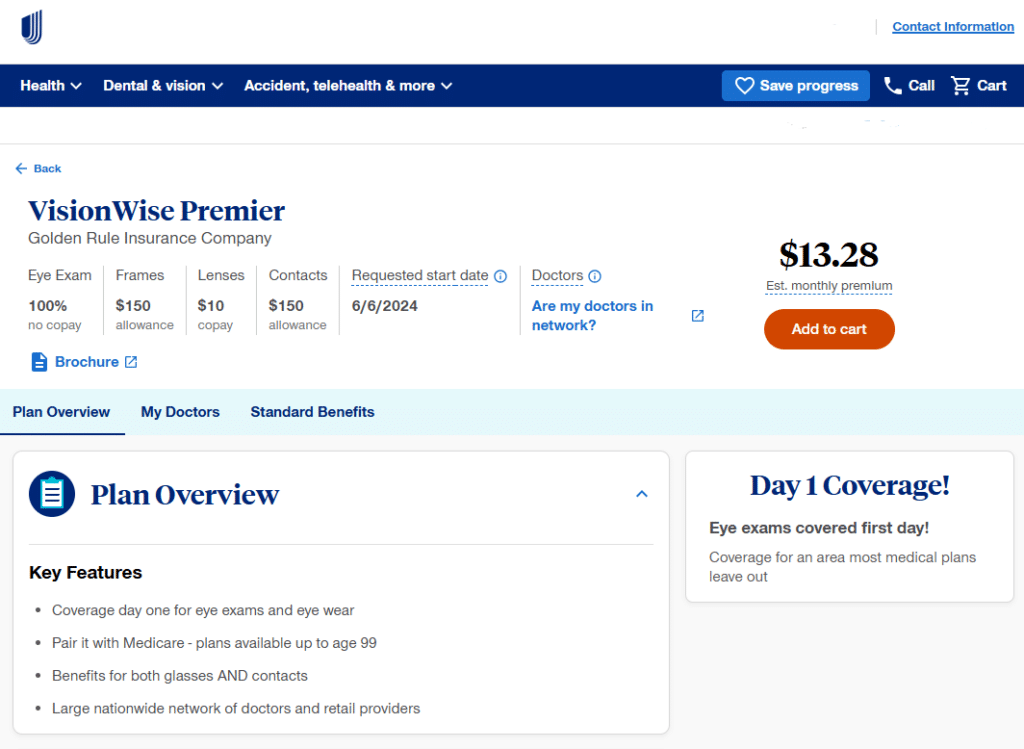

UnitedHealthcare VisionWise >>

How Is a Diabetic Eye Exam Different from a Regular Eye Exam?

A standard eye exam focuses on general vision health, checking for issues like refractive errors and providing prescriptions for glasses or contact lenses.

However, a diabetic eye exam is more comprehensive.

It specifically screens for complications related to diabetes, such as diabetic retinopathy, glaucoma, and cataracts.

These exams often include additional tests, such as retinal imaging or dilated eye exams, to assess damage caused by high blood sugar levels.

Understanding Diabetic Retinopathy

Diabetic retinopathy is one of the most common eye complications associated with diabetes.

It occurs when high blood sugar damages the blood vessels in the retina, leading to leakage, swelling, or blockage.

If left untreated, this can cause symptoms such as blurry vision, floaters, and even severe vision loss. Regular diabetic eye exams are crucial for early detection, which can significantly reduce the risk of permanent vision impairment.

The Role of Regular Eye Exams in Preventing Complications

For people with diabetes, regular eye exams are more than just routine check-ups—they are a critical tool in preventing severe complications.

Eye doctors can detect early signs of conditions like diabetic retinopathy, allowing for prompt treatment.

This early intervention is essential to preventing the need for costly treatments or surgeries down the line.

RELATED

Are Diabetic Eye Exams Covered By Insurance?

To find out if your insurance covers diabetic eye exams, it’s important to first determine what type of insurance you have:

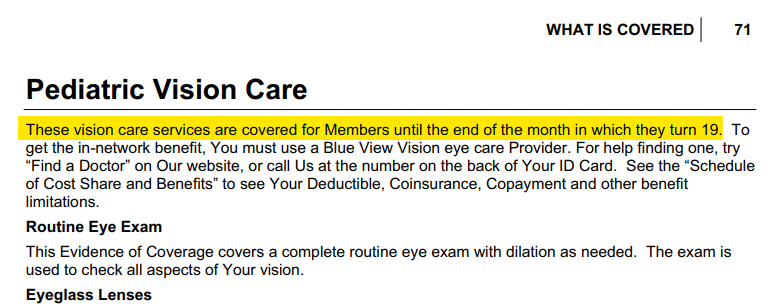

- Health Insurance: If you have a health insurance, diabetic eye exams are generally considered medically necessary and are often covered under your medical plan when directed by your physician.

Most health insurance plans do not include routine vision benefits for adults, but will typically cover your children up to age 19.

Source: BlueCross BlueShield

- Medicaid: Most Medicaid plans offer coverage for diabetic eye exams, as they are considered essential for managing diabetes.

Government health programs like Medicaid ensure that individuals with diabetes have access to preventive eye care, reducing the long-term healthcare costs associated with untreated complications. - Medicare: Medicare Part B covers an annual diabetic retinopathy exam for individuals with diabetes.

This exam must be conducted by an eye doctor licensed in your state. Medicare’s coverage helps ensure seniors with diabetes receive timely and necessary care to prevent vision loss.

What If I Don’t Have Insurance to Cover a Diabetic Eye Exam?

If you have diabetes but no employer health plan, start by visiting Healthcare.gov or your state’s marketplace can help you find affordable plans.

Our licensed agents can help you find insurance that fits your needs.

If you are unemployed or have a low income, you may qualify for Medicaid.

Medicaid often covers diabetic eye exams and can help reduce your out-of-pocket costs.

While vision insurance is useful for routine exams and discounts on eyewear, it is not a replacement for comprehensive medical insurance if you have diabetes.

Managing diabetes means prioritizing comprehensive health coverage that supports every aspect of your care. While vision insurance is beneficial, it has its limitations.

We hope this guide has clarified how vision insurance works as part of a complete healthcare plan, especially for those living with diabetes.

For more information and expert guidance in choosing the right coverage, visit our health insurance page today.

Questions?

Speak to a licensed expert by phone, email or chat absolutely free. Agents are available in:

FL, GA, MD, MS, NC, PA, SC, TN, TX, VA

Your privacy is our priority! We don’t share personal information or collect payments, ensuring a safe and secure experience.

UnitedHealthcare VisionWise offers comprehensive vision benefits with no waiting period, so you can start saving on eye care right away.

- Large Provider & Retail Network

- Eye Exams Included

- $150 Allowance (frames & contacts)

- $10 Lens Copay

Available: FL, GA, MD, MI, MS, NC, PA, SC, TN, TX, VA

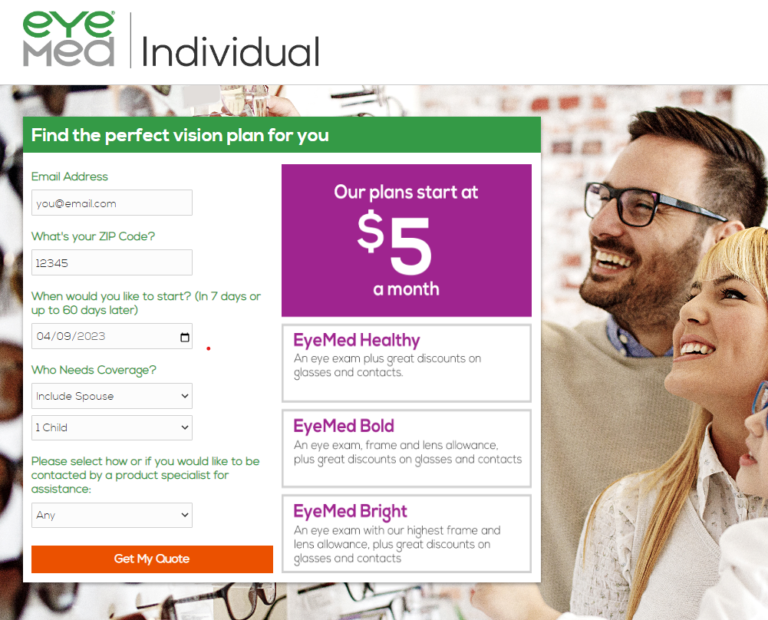

EyeMed believes excellent eye care should be accessible to everyone.

With promotional pricing, and partnerships with Target Optical, Lenscrafters, Glasses.com and more, you can receive top-notch vision care without breaking the bank.

With three plans available for individuals or families starting at just $5 a month, EyeMed makes vision health affordable for just about everyone.

- EyeMed Healthy

- EyeMed Bold

- EyeMed Bright

Available: FL, GA, MD, MI, MS, NC, PA, SC, TN, TX, VA

Information is meant to be accurate and educational and not intended to be legal, medical or financial advice. Do your own research and contact a professional for help. We earn revenue from partners & advertisers. Read our disclosure for more.

Owner, HealthBenefits! & BenZen Insurance. Licensed insurance broker helping individuals, families and business owners get affordable health benefits.

Inspired by personal experiences with diabetes, Ted’s mission is to offer compassionate support and practical solutions that empower the diabetes community to lead healthier lives.

His background in marketing research, insurance, and financial services gives him a unique perspective to help others plan for a secure future and improve their physical, mental, and overall well-being.