Insurance companies calculate risk and as a result, you can be disqualified for life insurance due to various medical reasons, in some cases immediately during the application.

Being disqualified for life insurance because of diabetes, weight or mental health may seem harsh, but in the eyes of an underwriter, these conditions can lead to other problems which can be too risky for some insurers.

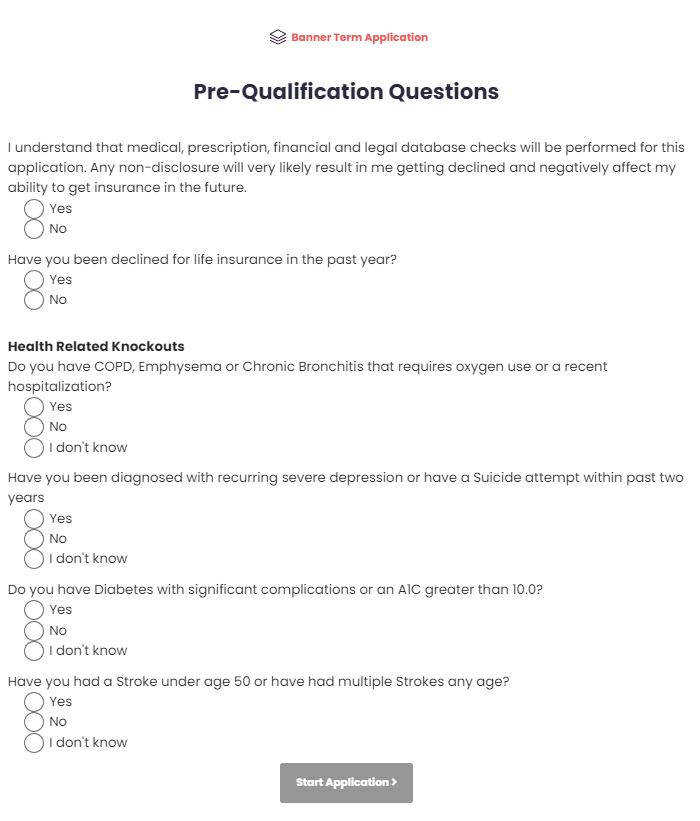

When you apply for life insurance there are usually a list of prequalification questions.

Answering yes to any of these will usually result in an instant denial or a “knockout” of the application process.

In this post, we’ll look at some of the top medical conditions that will disqualify you for life insurance along with several non-medical situations considered high risk for many insurance companies.

Before you apply, it’s a good idea to know what some of these conditions are, how underwriting works and what your best options might be if you have a pre-existing condition.

Maybe you’ve put off life insurance because you’re worried about being denied or disqualified.

Take a minute to read this article to the insight to confidently navigate the life insurance process, address any issues in advance and avoid unnecessary frustration.

Note: Life insurance depends on many risk factors like health, finances, credit score, lifestyle and even your driving record.

If you have questions contact us before you dive in. There is no cost or obligation and it could save you money and being denied coverage!

We work with several life insurance companies such as AIG, Ethos, Banner Life and Mutual of Omaha. Each has different criteria for underwriting and may be more flexible to your situation.

In This Article:

How Can You Be Disqualified for Life Insurance

During the application process, you’ll go through a comprehensive assessment of your health status through a process known as underwriting.

It involves grouping applications based on risk and other factors and classification that places you in a risk pool of similar applicants. For example, women with other women or tobacco users with other tobacco users.

Pre-existing medical conditions play a major role in the underwriting process for life insurance. These are health issues that individuals have before applying for life insurance that could potentially affect their lifespan.

Each insurance company has its own criteria for evaluating what’s considered an acceptable health condition. Depending on the company you choose, you can be denied life insurance for diabetes, depression, weight & BMI or prescription history.

Due to the additional risk these conditions pose for insurers, some health conditions may result in higher premiums or the insurance company can disqualify you for life insurance altogether.

Life insurance denials often occur when individuals fall into a high-risk category. These risks can stem from both health-related factors and non-health-related disqualifiers.

Examples of non-health-related disqualifiers include engaging in dangerous jobs or hobbies, and having a history of speeding tickets or criminal activity.

These factors contribute to insurers perceiving individuals as high-risk applicants and may result in denial of life insurance or adjustments to policy terms.

Insurance companies have different criteria, but in general, underwriters will look at your MIB consumer file as part of their process.

READ: “The MIB For Life Insurance: What You Should Know”

What Is “Instant” Term Life Insurance?

For many years, obtaining life insurance involved a lengthy process that could take weeks or even months.

It usually involved scheduling a physical examination, blood work, paperwork and waiting.

However, technology has changed all of that and the insurance industry has automated the application process to offer instant term life insurance with “no medical exam.”

Look online and you’ll see options for instant term life with no medical exam.

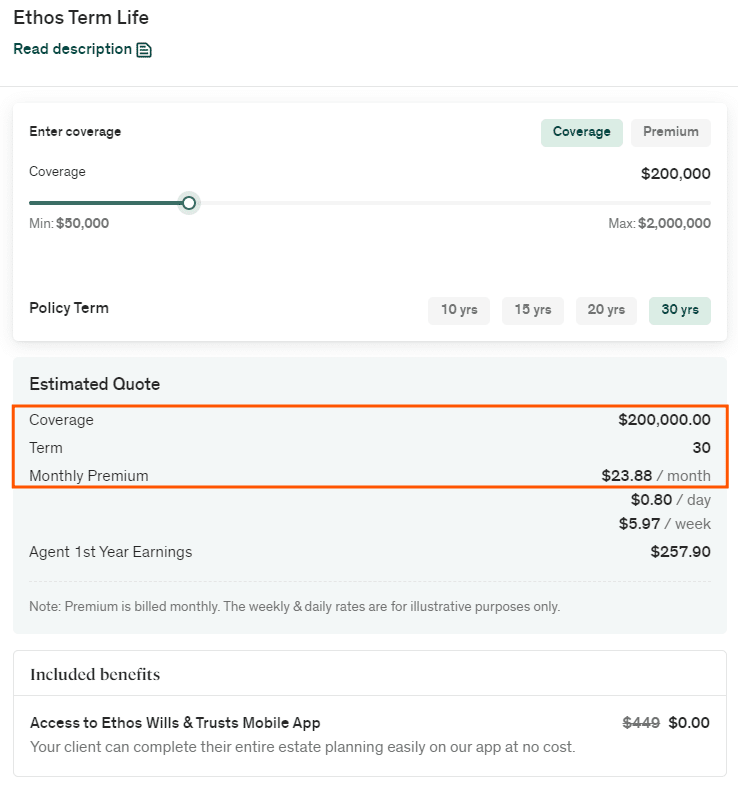

Ethos is a good example and is a popular choice if you’re looking for a fast & convenient solution.

Because instant term life relies so heavily on data and technology it can be a more stringent option.

It is not the cheapest life insurance, but it is fast and convenient for qualified applicants.

If you have a pre-existing medical condition instant term life may not be the best solution, but accelerated underwriting might be. (see below)

Medical Reasons You Can Be Disqualified For Life Insurance

Certain health conditions and situations may lead to you being denied life insurance instantly during the application process. You should know these “knockout” questions before you apply.

This list is intended to be informational, is not all-inclusive and will vary depending on the insurance carrier you choose:

- AIDS/HIV+ status

- ALS (Amyotrophic Lateral Sclerosis)

- Alzheimer’s Disease, Dementia or significant Cognitive Impairments related to functionality

- Cancer diagnosis within the last 2 years

- Cirrhosis of the Liver

- Congestive Heart Failure

- COPD/Emphysema or Chronic Bronchitis, severe or with current nicotine use

- Cystic Fibrosis

- Diabetes uncontrolled with high A1C

- Muscular Dystrophy

- Heart/Cardiac Disease, multiple vessels diagnosed within the last 2 years, or any past history of current nicotine use

RELATED ARTICLES:

Accelerated Underwriting Will Help You From Being Disqualified For Life Insurance

Accelerated underwriting (or AU) adds that human component. An underwriter will still use data and digital tools to fast-track your life insurance application, but with a personal touch making it more flexible and potentially less costly.

One of the main advantages of AU is eliminating the need for the medical exam that comes with traditional underwriting. In most cases.

This makes it ideal for individuals looking for a quicker, more convenient application process particularly if you have a medical condition.

During AU, the insurance company underwriter gathers data from various sources to assess risk including information provided by the applicant on the application form, such as their medical history, lifestyle habits, and family medical history.

Accelerated underwriting is generally a better option than instant term if you have an acceptable medical condition.

More Reasons You Can Be Denied Life Insurance

Again, this is not an all-inclusive list as each insurance carrier has its own criteria. It’s meant to give you some idea of what situations or preexisting conditions might lead to a denial of your application.

Even with accelerated underwriting, some applicants may have scenarios that are unsuitable and can be denied life insurance for:

- Clients age 50 and over who do not have routine wellness care

- Stroke within the last year

- Chronic Pain Treatment, severe, receiving disability, narcotic use

- Suicide attempt within the last 5 years

- Depression, severe, recurrent or with multiple in-patient hospitalization history

- Diabetes with co-morbidities, including significant Cardiac disease or impairment of Renal function or mobility

- Defibrillator use

- Alcohol/Substance abuse within the last 5 years

- Multiple Sclerosis, if symptoms progressing

- Organ Transplants, in most scenarios

- Quadriplegia

- Pulmonary Hypertension

- Renal Failure, Renal Insufficiency, severe

- Surgical repair of Heart Valves, aneurysms, intracranial tumors or major organs within the last 6 months, including gastric bypass

- Marijuana use, 4 or more times weekly

Non-Medical Reasons You Can Be Disqualified For Life Insurance

Life insurance eligibility is not solely determined by an individual’s health conditions. Non-medical factors can also be disqualifying conditions for life insurance and play a vital role in the assessment process conducted by insurance providers.

These factors are carefully evaluated to gauge risk and determine the feasibility of providing coverage:

Dangerous Occupations

Engaging in high-risk occupations, such as deep-sea diving, mining, or explosives handling, can increase the likelihood of accidents or fatalities. Insurers may disqualify individuals in these professions due to the elevated mortality risk associated with their work. If an occupation is deemed excessively hazardous, obtaining life insurance coverage may be challenging.

Dangerous Hobbies

Participating in dangerous hobbies or activities, such as skydiving, rock climbing, or racing, can raise concerns for life insurance providers. These activities carry inherent risks and increase the chances of accidental injuries or death. Individuals involved in such hobbies may face difficulties in securing life insurance coverage or may be subject to higher premiums due to elevated risk levels.

Criminal Background

A criminal history, especially convictions for serious offenses such as murder, fraud, or drug trafficking are disqualifying conditions for life insurance. Insurers assess an applicant’s risk profile, including factors related to personal conduct and law-abiding behavior. Individuals with significant criminal records may be considered too high risk for life insurance coverage.

Bankruptcy

A recent bankruptcy filing within the last 2 years can have implications for life insurance eligibility. Financial instability and poor credit history can be red flags for insurers. While a bankruptcy itself may not automatically disqualify an applicant, it can significantly impact the overall risk assessment and may result in denial or limited coverage options.

Substance Abuse

Persistent and severe substance abuse, including drug or alcohol addiction, can lead to disqualification for life insurance. Substance abuse poses a significant risk to an individual’s health and overall mortality. Insurers typically look at any substance abuse history, counseling, or medication-assisted treatments and may deny coverage or impose exclusions related to substance-related conditions.

Driving History

A history of reckless driving, multiple traffic violations, or DUI (Driving Under the Influence) convictions can negatively impact life insurance eligibility. Such driving behaviors indicate an increased likelihood of accidents and fatalities. Insurers may view individuals with a risky driving history as high-risk applicants and may disqualify them or charge higher premiums.

Sports & Recreation

Engaging in extreme sports or activities known for their high injury rates can be a disqualifying condition for life insurance. These activities involve significant physical risks and potential accidents. Life insurance providers may consider individuals involved in extreme sports as too high-risk for coverage.

What Are Some Acceptable Medical Conditions?

If you have an existing medical condition, you may initially feel discouraged or believe that obtaining life insurance is out of reach.

Fortunately, insurance companies know medical conditions are a fact of life so they do make accommodations based on risk classification.

These classifications help insurers assess risk and set appropriate premiums based on an individual’s health status and expected longevity.

Again, this list is not all-inclusive and is not meant to imply there are only five categories. Will vary depending on the insurance carrier:

Preferred Plus

Reserved for individuals with exceptional health and no significant health issues. They typically receive the best rates. Within this class, some insurers will consider:

- Cigarette Smokers Three Years Out

- Treated and Controlled Hypercholesterolemia

- Treated and Controlled Hypertension

- Combination of Treated Hypertension and Cholesterol

- Total Cholesterol Under 300, Treated or Untreated

- Recreational Scuba Diving up to 100 Feet

- Family History of Cancer (Non-Hereditary)

Preferred Plus (these conditions may be considered)

- Anxiety / Depression / Mood Disorder – One Episode, Duration Less Than One Year, Recovered, No Current Medication

- Asthma – Mild Exercise-Induced or Seasonal Asthma

- Carotid Imaging – Mildly Increased CIMT for Age/Gender, No Plaque or Stenosis

- Echocardiogram – Mild Diastolic Dysfunction, Otherwise Normal, Well-Controlled Blood Pressure

- Mitral Valve Prolapse – Normal Appearance, No Regurgitation

- Osteoporosis – No Known Complications

- Skin Cancers – Basal Cell Carcinoma, Superficial Squamous Cell Carcinoma, Single Atypical or Dysplastic Nevus, No Melanoma or Family History

Preferred

The next tier down is designated for applicants with excellent health but may have minor health concerns that are manageable with medication. Within this class, some insurers will consider:

- Asthma – Two Medications or Less, Well-Controlled

- Anxiety / Depression – One Prescription Medication, Well-Controlled

- Mild Sleep Apnea – AI < 20 or RDI < 30, Oxygen Saturation > 85%, Good Compliance, No Residual Symptoms

Preferred (these conditions may be considered)

- Alcohol or Single Drug Abuse Treatment – Last Used Over 10 Years Ago, Single Episode, Total Abstinence, No Relapse

- Anxiety / Depression / Mood Disorder – On One Drug, Well-Controlled

- Dysplastic Nevi – Up to Three, No History of Melanoma, Favorable Dermatology Follow-Up

- Valvular Disease – One Valve Mildly Thickened, No Mitral Valve Prolapse, Less Than Mild Regurgitation

Standard Plus

This category is for those with an average health profile and minor health issues that do not significantly impact life expectancy. Within this class, some insurers will consider:

- Controlled Type II Diabetes

- Severe Sleep Apnea with Good CPAP Compliance, No Residual Symptoms

- Personal History of Cancer (Type, Onset Date, Treatment Efficacy)

Standard

This category is designed for applicants with typical health and standard life expectancy.

Impaired Risk

Impaired risk life insurance is tailored for individuals who possess health conditions or lifestyle factors that heighten their risk, consequently leading to higher premiums.

- Asthma

- Atrial Fibrillation

- Bladder Cancer

- Breast Cancer

- Cerebrovascular Disease

- Coronary Artery Disease

- Diabetes Mellitus (Adult Onset)

- Elevated Liver Function Tests

- Hepatitis C

- Mood Disorders

- Prostate Cancer

- Thyroid Cancers

If You’ve Been Denied Life Insurance

Being denied life insurance for any reason can be disappointing, but knowing how the process works can save you time and frustration next time. If you can wait a year or two (more is better) to address any issues it can lead to a favorable outcome.

You may not be able to change family health and genetics, but if the reasons were related to lifestyle (in your control) there are things you can do to improve your chances and the price you pay in the future:

- Hobbies: Engaging in high-risk activities can lower your chance of getting approved

- Weight: Your BMI is a factor. Get familiar with the underwriting guidelines

- Cholesterol: Maintain healthy cholesterol levels

- Blood pressure: Keep your blood pressure under control

Steps You Can Take

- Get a copy of your MIB Consumer File – If you’ve applied for life or disability insurance within the last 7 years you should have a file at MIB. This report (similar to a credit report) contains much of the information insurance companies use to verify your information. It may contain your health history, medications and the results of your previous applications.

Important: Insurance companies are aware if you’ve applied elsewhere and the outcome. - Employers often offer group life insurance with discounted premiums. Check with your employer to determine if a group policy is available. For the most part, your health is not a factor.

- Guaranteed-issue whole life insurance is a type of life insurance that doesn’t require you to undergo a medical exam or complete a health questionnaire. It’s often the recommended life insurance for serious health conditions, patients and others when they don’t qualify for traditional life insurance.

Speak With A Licensed Agent

We hope this post has provided some insight as to what medical conditions can disqualify you from life insurance. During your search, there may be a time when consulting with an agent becomes necessary.

Life insurance depends on many risk factors like health, finances, credit score, lifestyle and even your driving record. If you have questions contact us before you dive into an application.

We work with several life insurance companies such as AIG, Ethos, Banner Life and Mutual of Omaha.

Each has different criteria for underwriting and may be more flexible to your particular situation.

There is no cost or obligation and it can save you time, money and the possibility of being denied coverage!

Information is meant to be accurate and educational and not intended to be legal, medical or financial advice. Be sure to do your own research and contact a professional for help. Our site is free to use, but we may receive a commission from our partners & advertisers at no additional cost to you. Read our disclosure for more information.

Licensed insurance broker helping individuals, families and small business owners get affordable benefits.