Benefits for Your Business

Whether you’re a start-up or looking to supplement existing benefits, we’ll help you find the right solution to protect your most important assets.

The right benefits can help employees pay for healthcare and household bills, take time off to take care of a newborn or family member and save for retirement.

We launched BenZen to help small business owners with 2-25 employees.

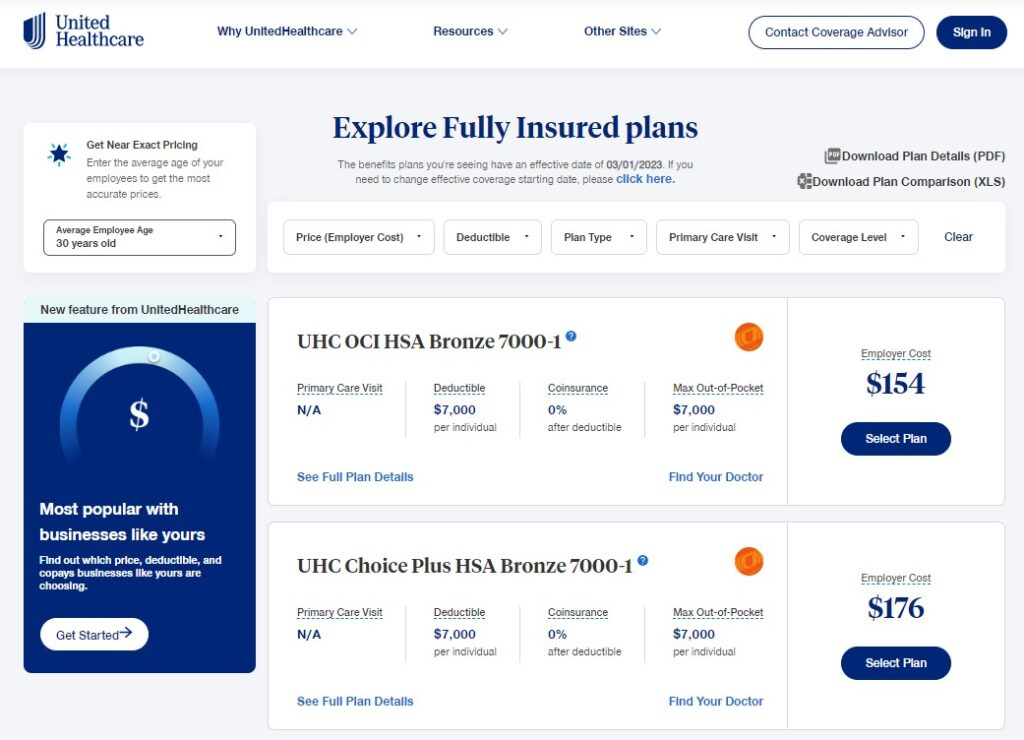

Health, Dental & Vision

Group Life & Disability

Aflac Supplemental

Online Therapy

LegalShield & IDShield

401(k) Retirement Plans (Q4 2023)

Browse our top-rated plans and providers to help your small business succeed with employee benefits and not break the bank.

BenZen Marketplace

If you’re self-employed or a business owner, be sure to check out our B2B Marketplace for solutions that can take you to the next level.

BenZen. We Make it Easy.

| We may receive compensation from partners & advertiser links at no cost to you. Read our disclosure for details. |

Health Insurance

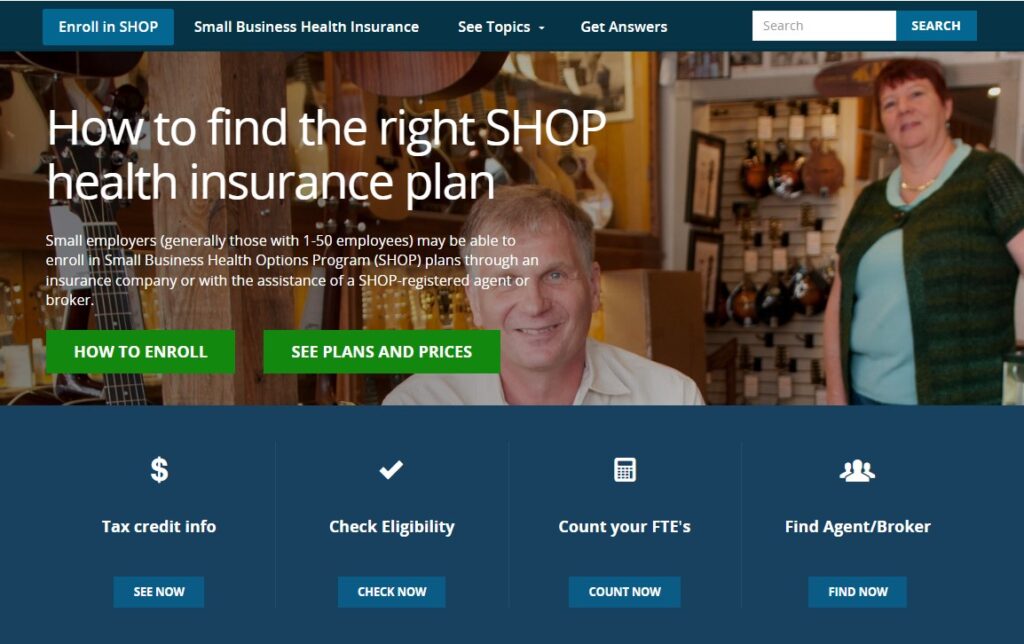

The Affordable Care Act introduced a new way for small business owners to offer group health insurance.

The Small Business Health Options Program (SHOP) gives financial incentives to business owners with a smaller workforce.

SHOP is an online marketplace where eligible employers can choose coverage options for their employees and where their employees can purchase coverage.

Benefits of SHOP Plans

If you have fewer than 25 employees, you may qualify for a Small Business Health Care Tax Credit worth up to 50% of your premium costs. You can still deduct from your taxes the remaining premium costs not covered by the tax credit.

New accounts can generally start coverage any time of the year and choose to offer health only, dental only, or both.

Check your eligibility, calculate FTE, and even start a quote. When you’re ready to move forward we’re happy to assist.

VSP Vision Care

Welcome to VSP® Vision Care—where you get a vision plan designed for health, and tailored to meet the coverage, network, and budget needs of your diverse workforce.

VSP has more members than any health carrier in the nation, and they know the features your employees want and need.

Why partner with VSP for vision benefits?

Building your ideal plan begins with a look at your team—their ages, working environment, and regional factors are all considerations when we create your personalized plan design.

- #1 in Access to Quality Care

- #1 in Member Satisfaction

- Convenient Plan Management

Your employees deserve the top choice in vision care. We’ll partner with you to design a plan for your unique employees, at a price that fits your budget.

Aflac for Small Business

Employee benefits rank high with workers. Aflac supplemental insurance makes sense for small business owners looking to enhance their offering with no additional costs to the bottom line.

Supplemental plans like accident insurance, cancer, hospital indemnity and critical illness fill gaps in coverage and help recover the costs of high deductibles and other out-of-pocket expenses.

Aflac’s popular short-term disability insurance is guaranteed issue with no medical exams at most income levels and gives employees an income stream if they get hurt or sick and can’t work.

Short-term disability will also cover maternity leave and may help reduce workers comp claims. for your business.

The minimum requirement is 3 employees for group rates, but they can be W-2 or 1099.

Plans are employee paid and most benefits can be set up and ready for enrollment in just a few days. Employer contributions are permitted but not required.

As a voluntary benefit, your employees get discounted rates and more options than they would on their own.

For instance, Aflac’s short-term disability and hospital indemnity plans are only available through the workplace.

Rates are based on your industry. If you’d like to get a preliminary quote contact us and we’ll send you a kit within 48 hours.

Employee education & enrollment

We’ll schedule time with your employees, consult with them individually and handle their enrollment. Setting up your plan is easy and it won’t cost you a dime.

Learn more about Aflac for your business with no obligation.

Cigna Dental for Small Business

Dental insurance can help make employees happier and healthier. Because this affordable benefit can have a surprisingly strong return on investment, it’s also a huge advantage for small businesses.

If you’re wondering if you can afford to provide this valuable benefit, consider that there are dental plans that cost less than $1 per day per employee.

We partnered with Delta Dental & Cigna to help your business succeed.

Now you have the option of dental-only or dental and vision as well as additional benefits to support your employees’ health and well-being.

Better health, dental and vision insurance are factors for 88% of workers when considering a job offer. Job satisfaction is also higher at businesses that provide dental insurance.

By offering dental insurance (or dental & vision) from Cigna Dental to your employees, you’ll stand out from the competition and promote a happy, healthy work environment.