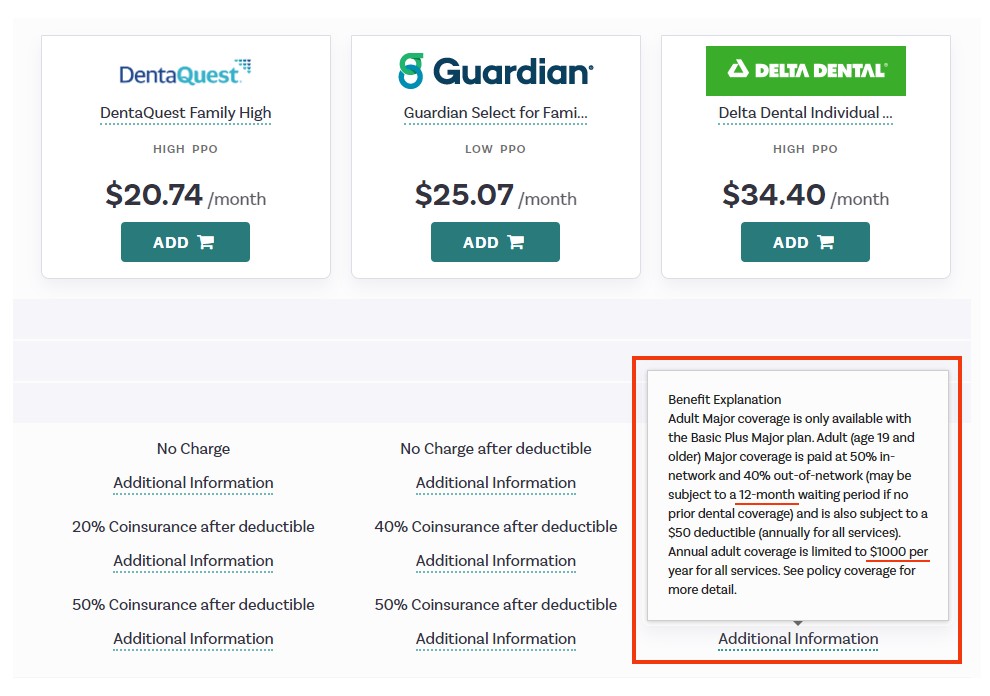

Looking at Marketplace dental insurance and confused by your options? Maybe you’ve heard about private dental insurance which can be purchased off the exchange and wonder if those are better?

In most cases, Marketplace dental plans are affordable and suitable for preventative care like annual checkups and cleanings.

However, most dental plans on the Marketplace have waiting periods of 6-12 months depending on your procedure and work well when it comes to prevention.

But what if you can’t wait a year to see a dentist? What if you need a filling, root canal or implant ASAP?

In that case, these plans may not be the best solution.

In this review, we’ll review Marketplace dental insurance (plans you buy on the health insurance exchange) vs. private dental (plans you can purchase off the exchange).

These are sometimes referred to as individual dental or even supplemental plans and you can find one with high benefits, large networks and no waiting periods for those costly procedures.

We help individuals & families shop for health, dental & vision plans every day. On average, 1 out of 3 needs to see a dentist ASAP.

If that sounds like you and you can’t wait, keep reading or contact us for free assistance!

Ted McNeil

Owner, Broker

HealthBenefits, LLC

BenZen Insurance

Licensed in: DC, FL, GA, MD, MS, NC, PA, TN, TX, VA

How Marketplace Dental Insurance Works

As you may know, the ACA Health Insurance Marketplace offers options for both health insurance and dental coverage.

Marketplace dental insurance, also referred to as on-exchange dental, is a way to get affordable coverage online.

In most states, you must enroll in a health plan before signing up for dental insurance. You can do this during Open Enrollment or if you have a qualifying life event.

While a few health plans on the Marketplace include dental coverage, you will most likely have the to purchase a separate plan at an additional cost.

Here’s how most dental insurance plans work:

Waiting Periods

Most Marketplace dental insurance plans have waiting periods. These can be frustrating, but they have a purpose.

To prevent adverse selection, waiting periods help to discourage people in poor health from purchasing dental insurance, getting work done and immediately cancelling their policy.

Waiting periods ultimately keep prices low for everyone else.

So, depending on when your plan becomes effective you can typically schedule an exam the next day, or as soon as your dentist can see you.

Procedures are generally categorized this way:

- Preventative (exams, cleanings): no waiting period

- Basic (filling, simple extraction, etc): 6-month waiting period

- Major (dentures, crown, implants): 12-month waiting period

But if it turns out you need a filling which is a basic procedure, most dental insurance plans will make you wait 6 months. Ouch!

Dental insurance encourages preventative care. By taking advantage of free annual checkups your dentist can spot issues early before they become more expensive problems down the road.

Deductibles

This is like a down payment you make each year before your insurance starts covering costs.

Most dental plans have a $50 annual deductible for adults. A family plan might have a $100 deductible.

Just like your health insurance, once you pay the deductible, your plan will start sharing the bill.

Coinsurance

Once the deductible is paid, you’ll share the remaining cost with your insurance company based on the procedure.

This cost-sharing is usually a percentage and works sort of like your health insurance, but most dental plans have an annual maximum.

You might see a dental plan described as 100/80/50 which means:

Typical Marketplace Dental Plan

| Category | Plan Pays | Waiting Period |

|---|---|---|

| Preventative | 100% | No |

| Basic | up to 80% | 6-months |

| Major | up to 50% | 12-months |

Annual Maximum

This is the total amount your insurance company will pay towards covered dental services in a year.

Unlike health insurance, there is a “cap” on what your carrier will pay.

Once you reach this limit, you’re responsible for the remaining costs for the rest of the year.

Marketplace dental plans usually have annual maximums of $700-$1,000.

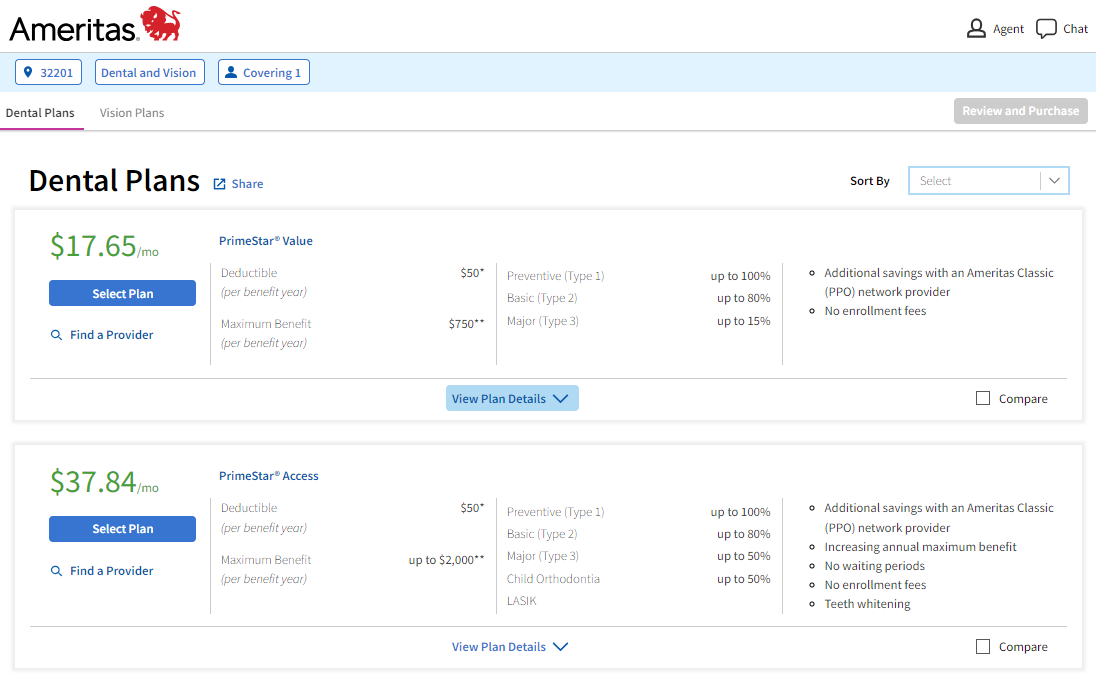

Off-Exchange Dental Insurance

Unlike Marketplace plans with limited enrollment periods, private dental purchased off-exchange offers the freedom to enroll any time of the year.

Plus, the most popular off-exchange dental plans have high annual maximums, increasing benefits and no waiting period for preventative, basic and major procedures.

Available in: DC, FL, GA, MD, MS, NC, PA, TN, TX, VA

Unlike, traditional dental insurance you receive Basic & Major benefits on day one and the amount of coinsurance increases after a year:

| Category | Day 1 | 12-months | Waiting Period |

|---|---|---|---|

| Preventative | 100% | 100% | no waiting period |

| Basic | 60% | 80% | no waiting period |

| Major | 15%-20% | 50% | no waiting period |

| Implants | No | 50% | 12-months |

Annual Maximum

Off-exchange plans offer more flexibility and higher benefits based on your budget.

Our most popular Ameritas and UnitedHealthcare plans have annual maximums that range from $1,000-$3,000.

Note: The one exception to most private dental insurance is you’ll have to wait 12-months for implants.

With higher benefit limits, your plan will cover a larger portion of the expenses associated with costly procedures like dentures, implants and orthodontia.

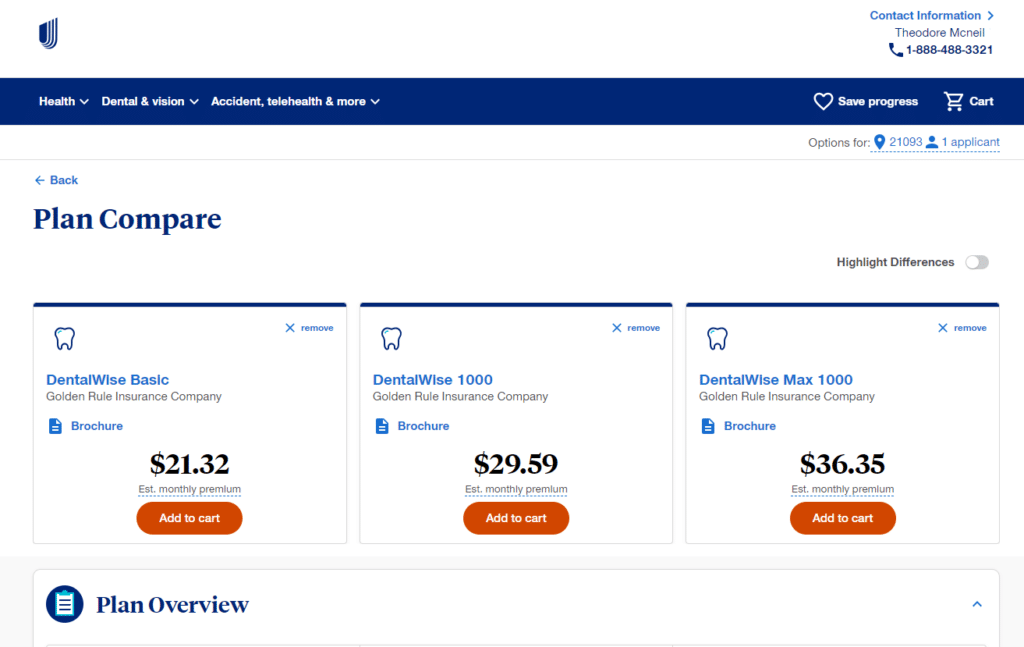

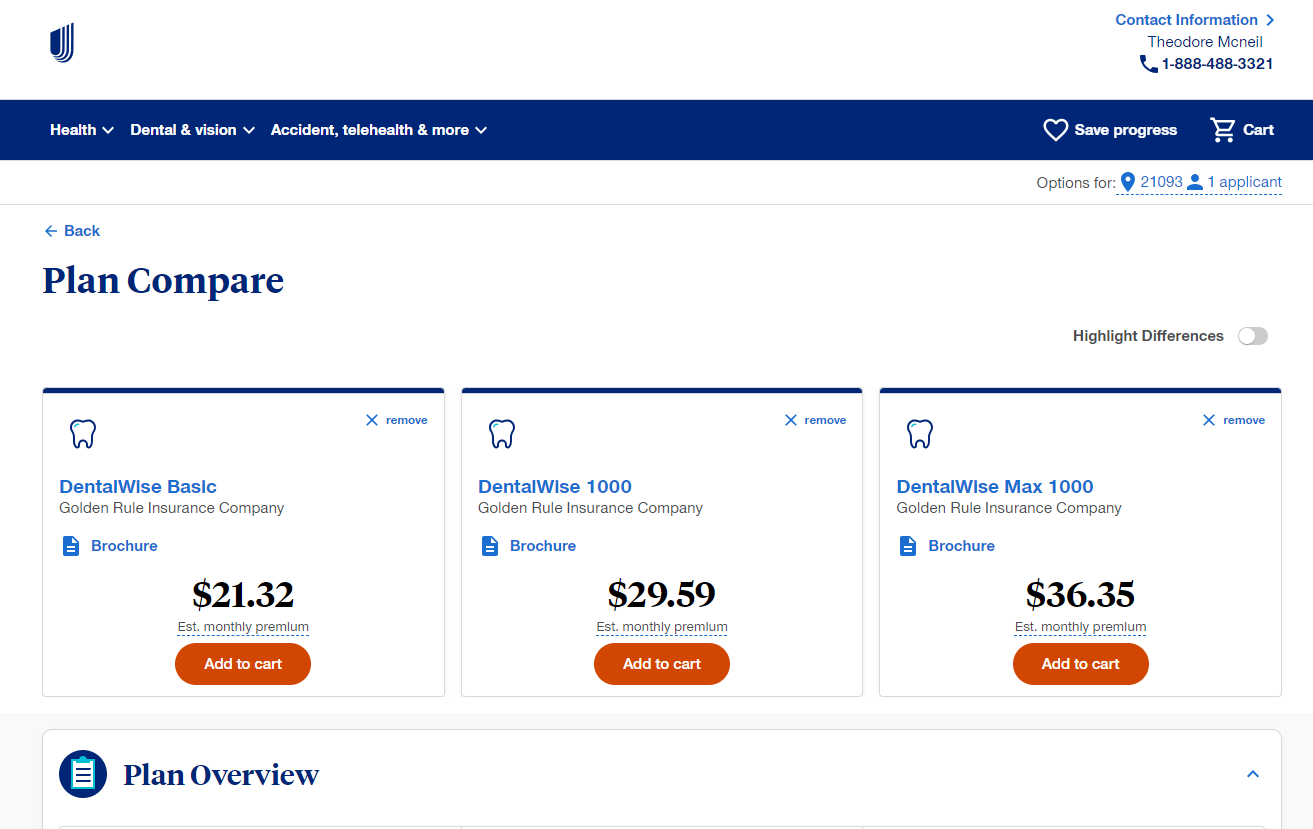

DentalWise Max vs. Ameritas PrimeStar

Our two most popular plans offer high benefits, no waiting periods and easy online enrollment.

UnitedHealthcare DentalWise Max: This plan goes beyond just teeth, offering a convenient all-in-one package that includes dental, vision, and even optional hearing coverage (depending on your state).

It boasts high benefits for a wide range of dental procedures, from routine checkups to major restorative work, making it a great choice for those seeking comprehensive care.

Ameritas PrimeStar: This plan focuses primarily on dental needs. They offer two options: PrimeStar Complete, a robust dental plan with extensive coverage, and PrimeStar Boost, a more basic plan suitable for those who prioritize preventive care. Depending on your location, Ameritas PrimeStar might boast a wider network of dentists compared to DentalWise Max.

Here are some key factors to consider when choosing between these plans:

- Do you need vision and/or hearing coverage? DentalWise Max is a bundled product while Ameritas gives you the option to purchase additional coverage based on your ZIP Code.

- How important is a large network of dentists? Research each plan’s network to see if your preferred providers are included or conveniently located

- What’s your budget? Compare the monthly premiums and coverage details of each plan to find the best value for your needs.

Available in: DC, FL, GA, MD, MS, NC, PA, TN, TX, VA

UnitedHealthcare DentalWise Max

When it comes to maintaining your overall health, DentalWise and DentalWise Max from UnitedHealthcare is a smart choice.

DentalWise offers dental only at two benefit levels: DentalWise Basic and DentalWise 1000.

DentalWise Max plans are bundled and offer comprehensive dental, vision, and hearing with no waiting periods so you can start using your benefits right away.

Our UnitedHealthcare plans provide various coverage levels to suit different needs:

DentalWise 1000

This budget-friendly dental only plan provides a $1,000 annual maximum. Benefits increase after 12 months. Great starter if you prioritize preventive care and anticipate low to moderate dental needs.

- Waiting Period: No

- Exams: 2 per year

- Preventative: Insurance pays 100%

- Basic: Insurance pays 60% year 1; 80% year 2

- Major: Insurance pays 15% year 1; 50% year 2

- Vision: No

- Hearing: No

DentalWise Max 1000

This plan provides a $1,000 annual benefit for dental procedures. Includes vision with $150 allowance for frames/contacts. Hearing is available in select states.

- Annual Max: $1,000

- Waiting Period: No

- Exams: 2 per year

- Preventative: Insurance pays 100%

- Basic: Insurance pays 60% year 1; 80% year 2

- Major: Insurance pays 15% year 1; 50% year 2

- Vision: Yes

- Hearing: Varies by state

- Impants: No

DentalWise Max 2000

Doubling the annual benefit to $2,000, this plan offers comprehensive coverage with a higher limit.

Additionally, it includes coverage for dental implants after a 12-month waiting period with a separate $1,500 benefit!

Includes vision with $150 allowance for frames/contacts. Hearing is available in select states.

- Annual Max: $2,000

- Waiting Period: No

- Exams: 2 per year

- Preventative: Insurance pays 100%

- Basic: Insurance pays 60% year 1; 80% year 2

- Major: Insurance pays 15% year 1; 50% year 2

- Vision: Yes

- Hearing: Varies by state

- Implants: Yes ($1,500 benefit after 12-months)

DentalWise Max 3000

This top-tier plan boasts a $3,000 annual benefit maximum, providing the most extensive coverage within the DentalWise Max series.

Also includes coverage for dental implants after a 12-month waiting period with a separate $1,500 benefit.

Includes vision with $150 allowance for frames/contacts. Hearing is available in select states.

- Annual Max: $3,000

- Waiting Period: No

- Exams: 2 per year

- Preventative: Insurance pays 100%

- Basic: Insurance pays 60% year 1; 80% year 2

- Major: Insurance pays 15% year 1; 50% year 2

- Vision: Yes

- Hearing: Varies by state

- Implants: Yes ($1,500 benefit after 12-months)

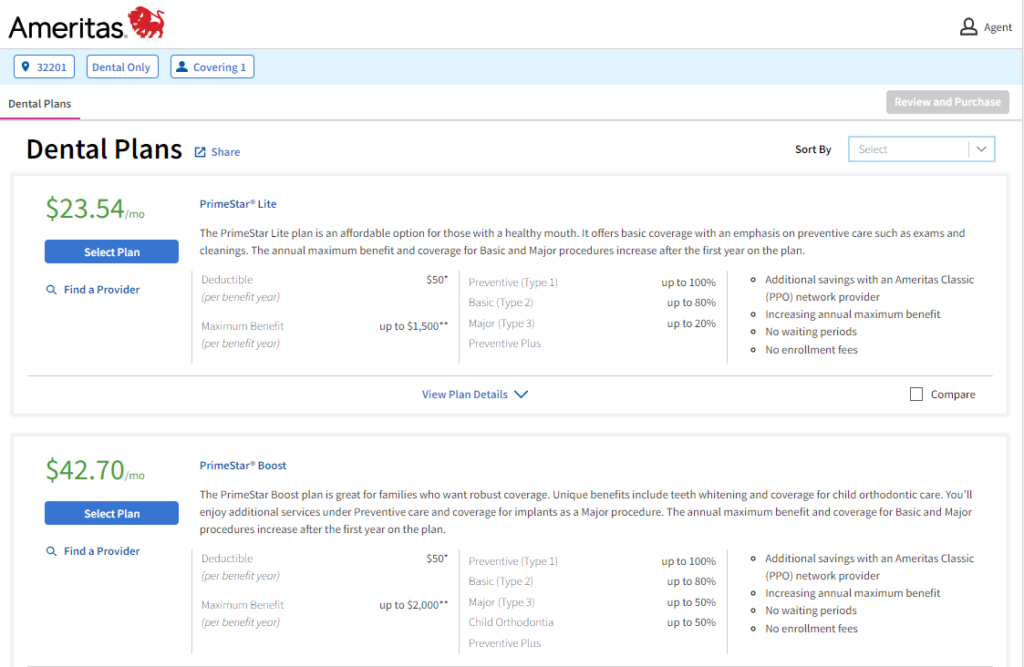

Ameritas PrimeStar

Ameritas PrimeStar offers a suite of dental insurance plans that provide coverage from day one, with no waiting periods and increasing benefits.

Both plans emphasize the importance of preventive care by covering cleanings and exams at 100% with generous limits.

Unlike DentalMax Wise, vision is not bundled, but available during shopping.

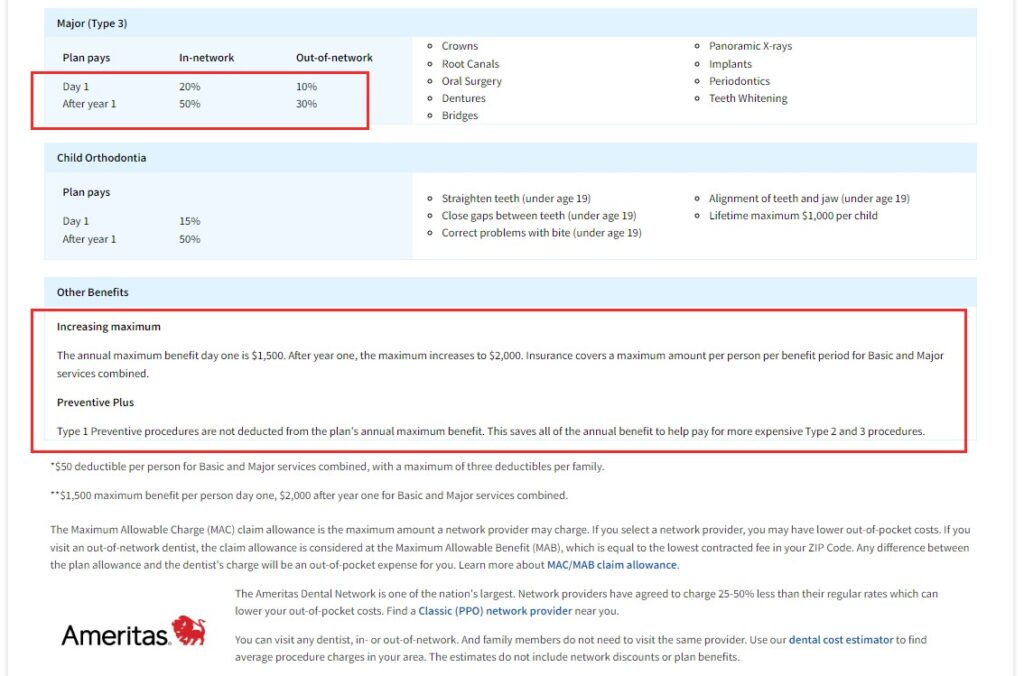

PrimeStar Boost

Boost starts with an annual maximum of $1,500 and increases to $2,000 after 12 months to help cover the costs of preventive, restorative, and major dental procedures.

- Annual Max: $1,500 year 1; $2,000 year 2

- Waiting Period: No

- Exams: 3 per year

- Preventative: Insurance pays 100%

- Basic: Insurance pays 65% year 1; 80% year 2

- Major: Insurance pays 20% year 1; 50% year 2

- Vision: Yes

- Hearing: Varies by state

- Implants: Yes (falls under Major)

- Orthodontia: Child only ($1,000 max)

PrimeStar Complete

For more comprehensive coverage, PrimeStar Complete starts at $2,500 annual benefit and increases to $3,000 after 12 months.

- Annual Max: $2,500 year 1; $3,000 year 2

- Waiting Period: No

- Exams: 3 per year

- Preventative: Insurance pays 100%

- Basic: Insurance pays 65% year 1; 80% year 2

- Major: Insurance pays 20% year 1; 50% year 2

- Vision: Yes

- Hearing: Varies by state

- Implants: Yes (falls under Major)

- Orthodontia: Child only ($1,000 max)

Ameritas PrimeStar

- Waiting Period: No

- Vision: Yes (optional)

- Hearing Available: Yes (varies by state)

- Exams & Cleanings: 3 a year

- Increasing Benefits? Yes

- Preventative Covered: 100%

- Basic Services: 65% year 1; 80% year 2

- Major Services: 20% year 1; 50% year 2

- Implants: Yes

- Orthodontia: Yes (child only)

- Annual Maximums: $1,500-$3,000

DentalWise Max

- Waiting Period: No

- Vision: Yes (bundled)

- Hearing Available: Yes (varies by state)

- Exams & Cleanings: 2 a year

- Increasing Benefits? Yes

- Preventative Covered: 100%

- Basic Services: 60% year 1; 80% year 2

- Major Services: 15% year 1; 50% year 2

- Implants: Yes

- Orthodontia: No

- Annual Maximums: $1,000-$3,000

Available in: DC, FL, GA, MD, MS, NC, PA, TN, TX, VA

What Is DVH? (Dental, Vision & Hearing Insurance)

Our plans include dental, vision & hearing options as a convenient way to bundle coverage for three essential aspects of your health, especially as we age.

Many of our valued clients appreciate the ease of having all their important needs covered in one plan. DVH insurance simplifies your life by:

Streamlining Coverage: No need to juggle multiple insurance plans and bills.

Peace of Mind: Knowing you have comprehensive coverage for dental care, eye exams, and hearing aids can be a huge relief.

Let’s start with the most requested supplemental benefit:

Dental Insurance

Maintaining good oral health is a cornerstone of overall well-being. Dental insurance helps you manage the associated costs, offering:

- Coverage for preventive care: Routine cleanings, exams, and x-rays are typically covered at 100%.

- Help with unexpected needs: Unexpected dental events like a chipped tooth or a cavity can be financially stressful. Dental insurance helps offset the costs of these procedures.

- Reduced costs for major services: If you require more complex dental work, such as crowns or bridges, dental insurance significantly reduces your out-of-pocket expenses.

Vision Insurance

Vision insurance offers valuable protection for your eye health, ensuring you have access to regular checkups and the necessary corrective lenses:

- Routine eye exams: Covers annual exams and screenings

- Eyeglasses or contacts: Most plans include an allowance of $100-$200.

Hearing Insurance

Hearing loss is a common concern, especially as we age. Hearing insurance provides essential resources for managing your hearing health:

- Hearing exams: Covers annual hearing exams, allowing you to proactively manage your health.

- Hearing aids: Offers substantial financial assistance towards hearing aids, making them a more accessible option.

By taking charge of your health today with the right insurance plan, you invest in a more proactive and fulfilling future.

Available in: DC, FL, GA, MD, MS, NC, PA, TN, TX, VA

RELATED PRODUCTS

- Oral-B iO Series 5 Rechargeable Electric Toothbrush ($100-$125)

- Audien Atom Hearing Aids – No Insurance Required ($99-$299)

| We may receive compensation from partners at no additional cost to you. Read our disclosure for details. |

Is Marketplace Dental Insurance Worth It?

Taking care of your health goes beyond regular medical checkups. Dental, vision, and hearing health are just as important to your overall well-being.

Having a supplemental plan like DentalWise Max can provide additional coverage to help protect your overall health and budget.

Regular checkups and preventive care in these areas can catch potential issues early, saving you from more serious health problems and higher costs down the line.

Quote & Enroll Online

Get an instant quote in seconds. Enroll online or contact us for assistance.

Online quotes and enrollment currently available in:

- Florida

- Georgia

- Maryland

- Mississippi

- North Carolina

- Pennsylvania

- Tennessee

- Texas

- Virginia

- Washington, DC

UnitedHealthcare

From one of the best known names in healthcare, affordable solutions to protect your important assets. Their large network is widely accepted throughout the country.

UnitedHealthcare dental plans provide flexible options for basic and major dental services with no age limit, no waiting period, Day 1 coverage and increasing benefits.

Preventive, basic and major services covered. Annual maximums from $1,000-$3,000.

Popular plans: DentalWise 1000, DentalWise Max 1000 (covers vision & hearing) and DentalWise Max 2000 & DentalWise Max 3000 cover implants.

Hearing is available in many states.

Online quoting and enrollment are available in licensed states. Contact us for assistance or if your state is not listed:

DC, FL, GA, MD, MS, NC, PA, TN, TX, VA.

- DentalWise 1000

- DentalWise Max 1000 (vision & hearing)

- DentalWise Max 2000 (covers implants with an additional $1,500 benefit!)

- DentalWise Max 3000 (covers implants with an additional $1,500 benefit!)

Always read the policy, exclusions & limitations or contact us for free assistance.

Ameritas

Ameritas dental insurance plans feature next-day coverage, no enrollment fees with increasing benefits.

You can add vision and hearing in many states.

There are no waiting periods for all dental services and no enrollment fees when you sign-up online.

Preventive visits, such as dental exams and cleanings, are covered up to 100%.

Fillings and extractions are covered in Basic services. Crowns, implants, dentures and even teeth whitening are covered in select plans.

Online quoting and enrollment.

Additional benefits and options are available such as vision, LASIK, orthodontia, or hearing. Check your ZIP Code for availability.

Always read the policy, exclusions & limitations or contact us for free assistance

- PrimeStar Lite

- PrimeStar Boost

- PrimeStar Complete

- Annual maximums from $1,500-$3,000

- Increasing benefits

- Child orthodontia

RELATED PRODUCTS:

- Philips Sonicare 4100 Electric Power Toothbrush ($40-$50)

- Oral-B iO Series 5 Rechargeable Electric Toothbrush ($100-$120)

Information is meant to be accurate and educational and not intended to be legal, medical or financial advice. Be sure to do your own research and contact a professional for help. Our site is free to use, but we may receive a commission from our partners & advertisers at no additional cost to you. Read our disclosure for more information.

Licensed insurance broker helping individuals, families and small business owners get affordable benefits.