Navigating the world of dental insurance can be a crucial step toward maintaining optimal oral health. In this review of Ameritas vs Delta Dental we’ll introduce two more well-known individual dental plans to help you choose the best dental insurance for your needs.

Each provider offers a range of plans, benefits and pricing options, but one offers no waiting period coverage which means you can receive benefits for basic and major work on day one. Let’s get started!

What’s Inside:

Ameritas vs Delta Dental

When it comes to choosing individual dental insurance, it’s essential to make an informed decision that aligns with your specific needs and budget.

There is no “one size fits all” and comparing Ameritas Dental vs Delta Dental is no exception.

One of the biggest differences between these plans is the waiting period. Keep scrolling as we try to shed light and help you find the best solution in less time.

- Price

- Network

- Benefits

- Waiting Period

- Reputation

Ameritas Dental

- Waiting Periods: No

- Vision & Hearing? Yes

- Increasing Benefits? Yes

- Preventative Covered: 100% (no waiting)

- Exams & Cleanings: 3 a year (included)

- Basic Services Covered: 65%; 80% (no waiting)

- Major Services Covered: 20%; 50% (no waiting)

- Implants: Yes (select plans)

- Orthodontia: Yes (child only)

- Teeth Whitening: Yes

- Annual Maximums: $1,500-$3,000

Delta Dental

- Waiting Periods: Yes

- Vision & Hearing? No

- Increasing Benefits? No

- Preventative Covered: 100% (no waiting)

- Exams & Cleanings: 2 a year (included)

- Basic Services Covered: 80% (6-months)

- Major Services Covered: 50% (12-months)

- Implants: Yes (select plans)

- Orthodontia: Yes

- Teeth Whitening: Yes

- Annual Maximums: $1,000-$2,000

What Is Individual Dental Insurance?

Individual or supplemental dental insurance is coverage you can purchase independently, separate from any employer-sponsored plans or healthcare marketplace.

These plans are designed to help cover the costs associated with various dental treatments and services, such as cleanings, fillings, x-rays, and more.

There are no enrollment periods and no income or employment verification like marketplace plans.

On the other hand, individual dental insurance costs a bit more than marketplace dental insurance plans, but they normally have higher benefits and no waiting periods with certain carriers. If you have an immediate need for dental work this is an important consideration. (see below)

With the average cost of a single dental implant at around $3,500-$5,000, having dental insurance makes financial sense.

Keep scrolling to see a comparison of two of our most popular dental plans: Ameritas Dental vs Delta Dental.

RELATED PRODUCTS

- Oral-B iO Series 5 Rechargeable Electric Toothbrush ($100-$125)

- Audien Atom Hearing Aids (No Insurance Required)

| We may receive compensation from partners at no additional cost to you. Read our disclosure for details. |

Ameritas Dental vs Delta Dental (Coverage)

Ameritas Dental and Delta Dental offer a range of dental plans to accommodate different needs and budgets. Side-by-side though, Ameritas Dental has more coverage options allowing you to bundle vision and hearing in many states.

Dental plans typically classify their coverage this way:

- Preventative – office visits, dental exams, routine cleanings, x-rays

- Basic – fillings, simple tooth extraction, emergency treatment

- Major – deep cleaning, crowns, oral surgery, bridges, dentures, implants

- Cosmetic – teeth whitening, aligners, mouthguards

- Orthodontia – braces, retainers, etc

The specific coverage, benefits, and costs can vary between the two providers, so take your time to understand each plan before you apply.

Ameritas Dental vs Delta Dental (Network)

With most dental insurance plans you can visit an out-of-network dentist and get reimbursed. However, to get the full benefit of membership and you should find a network provider.

Member-only rates have already been negotiated and the dentist will bill the insurance company leaving you with just the deductible and any balance.

Delta Dental is widely recognized for its extensive dentist network, which is one of the largest in the country. Delta Dental members are usually more likely to find a dentist or specialist conveniently located who accepts their insurance.

This extensive network coverage can be particularly beneficial for individuals who frequently travel or relocate. It can also be a bit confusing since Delta Dental is comprised of several different companies:

“Today, Delta Dental Plans Association is comprised of a network of 39 independent Delta Dental companies operating in all 50 states, Puerto Rico and other U.S. territories, and together we provide coverage to more Americans than any other dental insurance company.”

So to find your network or get a quote, you’ll have to visit Delta Dental and locate your state.

Ameritas is a top-rated provider of health plans with one of the largest combined networks of dental, vision & hearing providers. This ensures members have access to a diverse range of services under one umbrella.

This holistic approach underscores their dedication to addressing the changing needs of their members. Through their network and products Ameritas is an affordable, convenient one-stop solution.

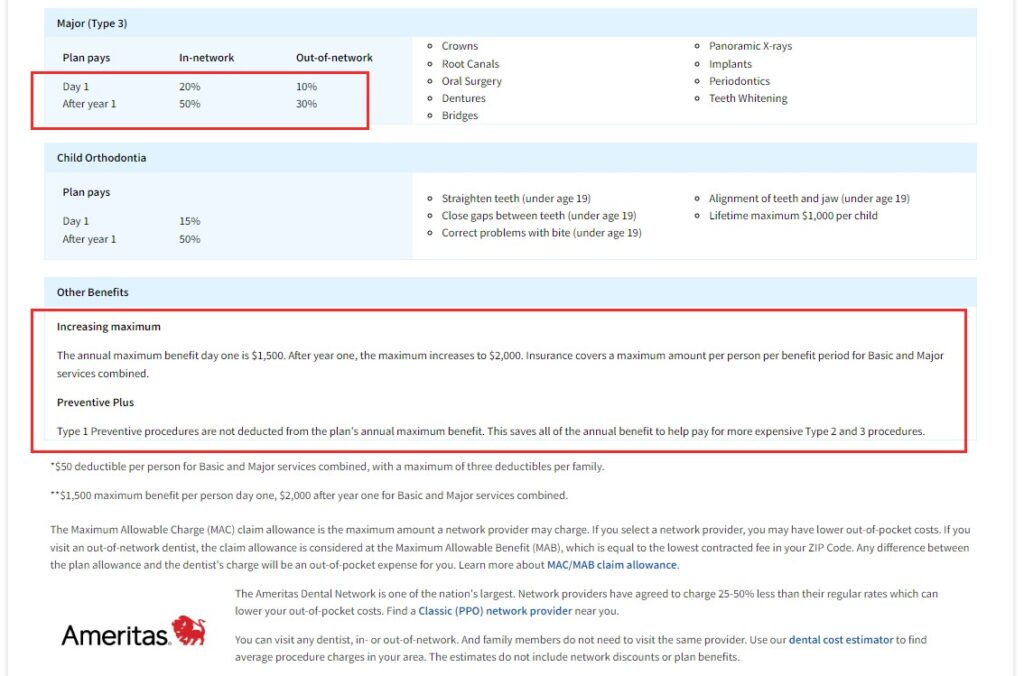

Ameritas vs Delta Dental (Waiting Period?)

Dental plans often include waiting periods as a way to prevent individuals from signing up for insurance solely to receive expensive treatments immediately and then canceling their coverage.

Waiting periods vary depending on the plan and the specific services. During this period, you may be required to maintain the insurance before you can access coverage for certain procedures, typically more complex treatments like crowns or orthodontics.

Waiting periods help insurance companies manage costs and ensure affordability for all policyholders. Maximize your benefits by visiting network providers.

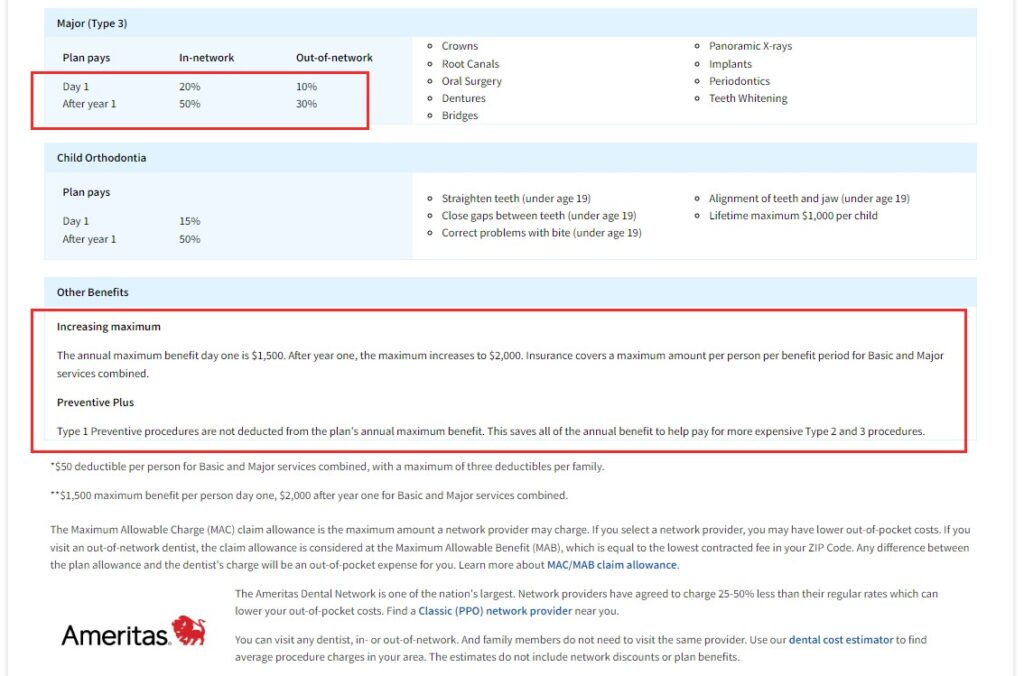

Ameritas

- No waiting period for preventative, basic or major work

- Basic services: pays 65% on day 1, pays 80% after 12-months

- Major services: pays 20% day 1, pays 50% after 12-months

- Implants: see Major services

Delta Dental

- No waiting period for preventative services

- Basic services: pays 80% after 6-months

- Major services: pays 50% after 12-months

- Implants: see Major services

Can I Get Ameritas Dental Insurance Without A Job?

Yes, you can obtain dental insurance without being employed by a company offering group benefits. In theory, you can get individual dental insurance without a job. There is no income verification — you just need pay your monthly premium.

If you’re shopping for dental coverage independently, you have the option to purchase individual dental plans directly from the insurance company.

These private plans are tailored for individuals, families & self-employed professionals to help fill gaps in coverage outside the ACA Marketplace any time of the year.

How Much Does Individual Dental Insurance Cost?

The cost of individual dental insurance can vary widely depending on several factors, including the specific plan you choose, the coverage it offers, your location, and your age.

Generally, dental insurance plans can range from the most affordable plans that cover basic preventive services to more comprehensive plans that include a broader range of treatments.

Typically, all dental insurance plans include annual checkups which can cost a few hundred dollars or more without insurance.

It’s recommended to thoroughly compare different plans, read the policy along with any exclusions or limitation and their costs to find the one that aligns with your budget and dental care needs.

RELATED ARTICLES:

- Compare Sonicare 4100 ProtectiveClean 5100 vs 6100 (Price & Features)

- How Much Do White Cavity Fillings Cost Without Insurance?

What About Annual Maximums?

The annual maximum, also known as the annual benefit maximum or “cap”, refers to the maximum amount of money that a dental insurance plan will pay out for covered dental services within a specific period, usually a year.

Once your dental expenses reach this maximum limit, you will be responsible for covering any additional costs for the remainder of the year.

Annual maximums vary among different dental insurance plans and can depend on the level of coverage you select. It’s important to understand your plan’s annual maximum to budget and plan for potential out-of-pocket expenses.

Ameritas vs Delta Dental

| Ameritas PrimeStar | Delta Dental PPO | UnitedHealthcare | |

|---|---|---|---|

| Individual Plan | $25-$50/mo | $20-$40/mo | $25-$50/mo |

| Waiting Period | None | 6 & 12 months | None |

| Deductible | $50/$150 | $50/$150 | $100 |

| Annual Max | $1,500-$3,000 | $1,000-$2,000 | $1,000-$3,000 |

| Preventative | 100% | 100% | 100% |

| Basic Services | 65%-80%* | 80% | 60%-80%* |

| Major Services | 20%-50%* | 50% | 15%-50%* |

| Orthodontia | Yes (child only) | Yes | No |

| Implants | Yes** | Yes** | Yes** |

| Vision option | Yes | No | Yes |

| Hearing option | Yes | No | Yes |

| Plans & Prices | Start A Quote | Start A Quote | Start A Quote |

Note: Prices are per month based on single coverage and will vary. Not all plans are available in all states. $50 deductible for individual, $150 deductible for family or $100 deductible each for UnitedHealthcare DentalWise plans. All plans cover preventative 100%

- Ameritas PrimeStar – no waiting period; day 1 coverage and increasing benefits after the first year.

- Delta Dental – Premier PPO is a 6-month waiting period for basic services at 80% coverage; 12-month waiting period for major services at 50% coverage

Additionally, we’re including our next most popular plan from UnitedHealthcare for comparison:

- UnitedHealthcare DentalWise – no waiting period, increasing benefits after the first year, hearing available in many states. DentalWise Max 2000 & 3000 plans cover implants.

Ameritas vs Delta Dental (Winner?)

I’ve seen more clients in the 40+ age range choosing Ameritas for dental and vision — in some cases hearing too.

The fact that there’s no waiting period means you can use the benefits as soon as coverage starts. Having the option to bundle vision makes billing easy and in one place.

Most consumers find their network of providers to be sufficient and dentist offices I’ve spoken to don’t have many complaints over billing or getting claims paid.

Winner: Ameritas

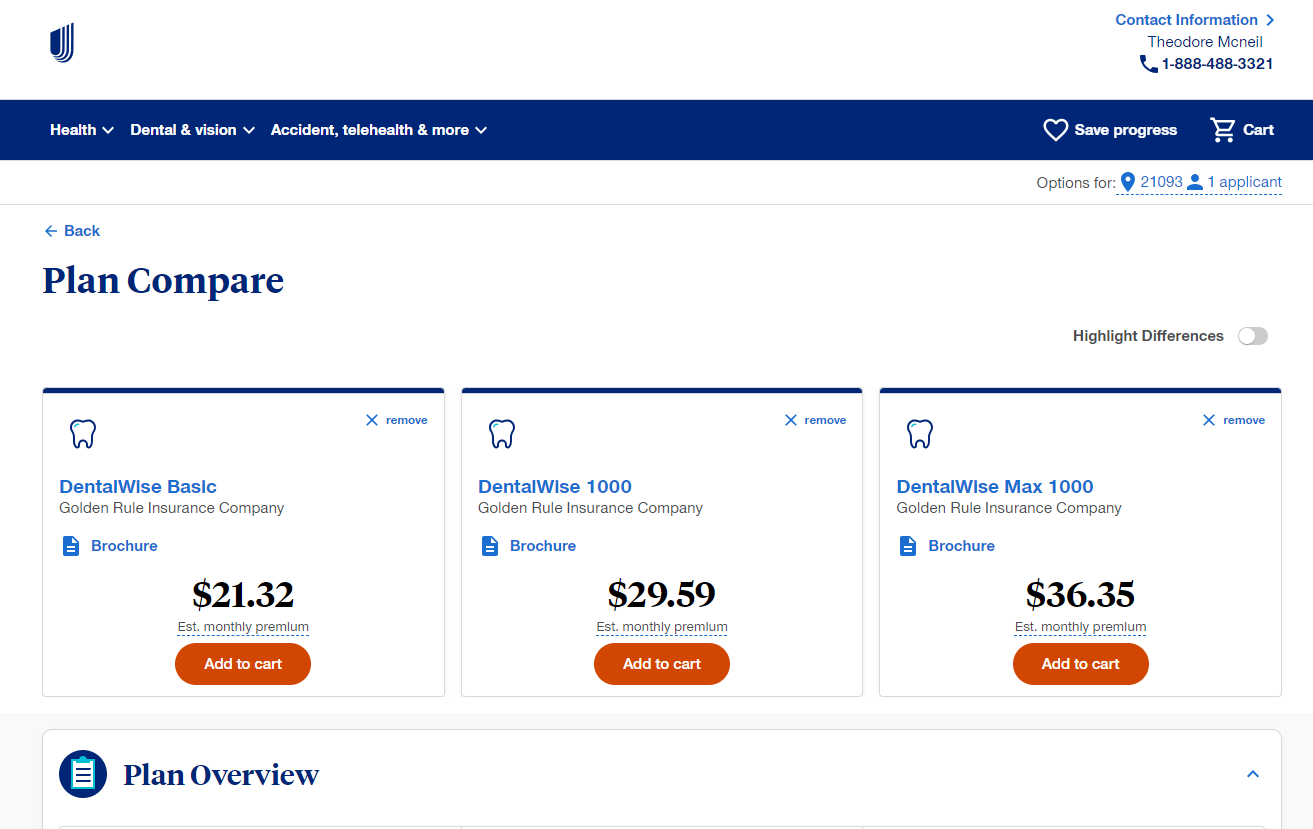

UnitedHealthcare

From one of the best known names in healthcare, affordable solutions to protect your important assets. Their large network is widely accepted throughout the country.

UnitedHealthcare dental plans provide flexible options for basic and major dental services with no age limit, no waiting period, Day 1 coverage and increasing benefits.

Preventive, basic and major services covered. Annual maximums from $1,000-$3,000.

Popular plans: DentalWise 1000, DentalWise Max 1000 (covers vision & hearing) and DentalWise Max 2000 & DentalWise Max 3000 cover implants.

Hearing is available in many states.

Online quoting and enrollment are available in licensed states. Contact us for assistance or if your state is not listed:

DC, FL, GA, MD, MS, NC, PA, TN, TX, VA.

- DentalWise 1000

- DentalWise Max 1000 (vision & hearing)

- DentalWise Max 2000 (covers implants with an additional $1,500 benefit!)

- DentalWise Max 3000 (covers implants with an additional $1,500 benefit!)

Always read the policy, exclusions & limitations or contact us for free assistance.

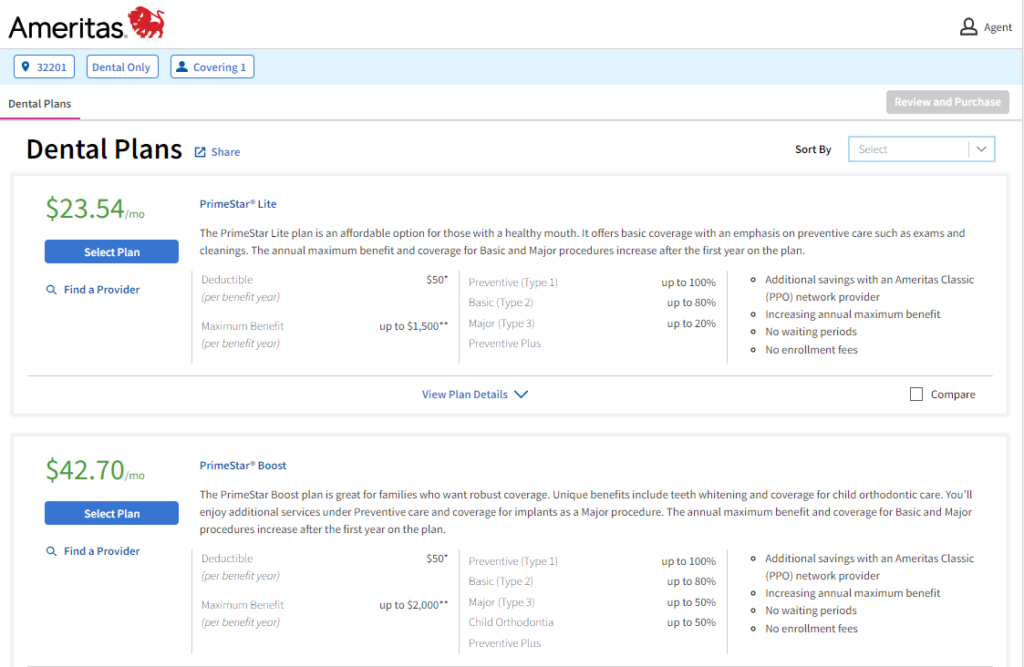

Ameritas

Ameritas dental insurance plans feature next-day coverage, no enrollment fees with increasing benefits.

You can add vision and hearing in many states.

There are no waiting periods for all dental services and no enrollment fees when you sign-up online.

Preventive visits, such as dental exams and cleanings, are covered up to 100%.

Fillings and extractions are covered in Basic services. Crowns, implants, dentures and even teeth whitening are covered in select plans.

Online quoting and enrollment.

Additional benefits and options are available such as vision, LASIK, orthodontia, or hearing. Check your ZIP Code for availability.

Always read the policy, exclusions & limitations or contact us for free assistance

- PrimeStar Lite

- PrimeStar Boost

- PrimeStar Complete

- Annual maximums from $1,500-$3,000

- Increasing benefits

- Child orthodontia

RELATED PRODUCTS:

- Philips Sonicare 4100 Electric Power Toothbrush ($40-$50)

- Oral-B iO Series 5 Rechargeable Electric Toothbrush ($100-$120)

Information is meant to be accurate and educational and not intended to be legal, medical or financial advice. Be sure to do your own research and contact a professional for help. Our site is free to use, but we may receive a commission from our partners & advertisers at no additional cost to you. Read our disclosure for more information.