VSP Vision and EyeMed are two of the most popular vision insurance providers. This comparison will help you determine which plan best suits your needs and budget.

Choosing the right vision insurance can make a significant difference in your eye care costs. While we do offer group health benefits, this guide references individual vision insurance.

The best vision insurance has allowances for frames and lenses and encourages regular checkups which is especially important to avoid eye problems down the road.

Read on to compare what each plan offers, including prices and coverage options.

We’ll help you get an instant quote and enrolled online in about 10 minutes or less!

VSP or EyeMed: What’s The Difference?

VSP stands for Vision Service Plan and is the largest vision insurance provider in the country.

EyeMed is one of the fastest-growing vision benefits companies. Both provide exceptional individual and group plans, but they are not the same.

We earn revenue from partners and advertisers. For more information >

The two carriers are known for providing employee benefits to businesses as well as individual vision insurance (plans you can purchase without an employer)

And while they both promote annual exams and preventative care for early detection of vision problems, their networks, pricing, and retail outlets are different.

Annual eye exams are included in both plans along with member-only savings on glasses, contacts, and LASIK.

VSP Vision vs EyeMed Vision: Network

VSP or EyeMed – each has a large network of providers and plans to choose from, offering savings and discounts on vision services and treatments.

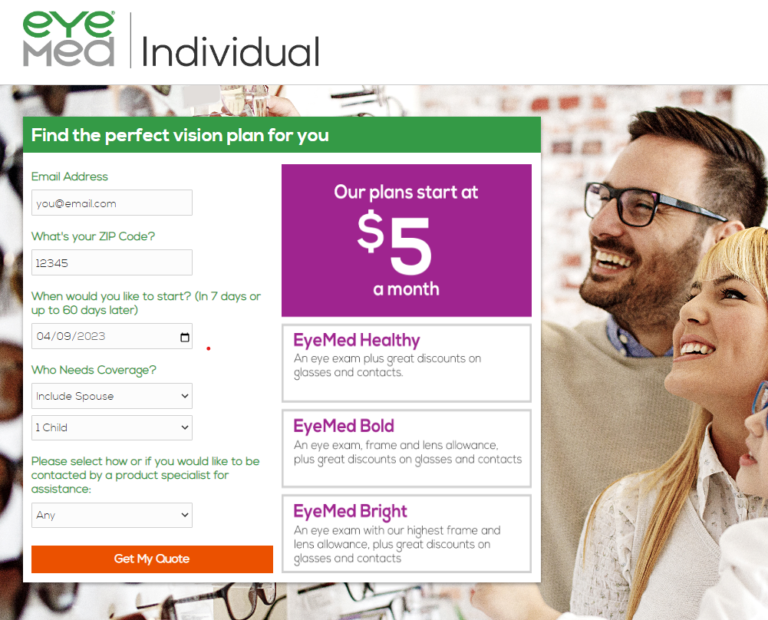

EyeMed has the lowest cost plan starting at just $5 a month.

To choose which is better though, look beyond price alone. Compare provider and retail networks and the cost savings on the products you need like frames and lenses.

In other words, where can you buy stuff? If you’re comparing EyeMed vs VSP on in-network retailers there is a big difference.

The first step when shopping for any type of plan is to search the network for a doctor near you. With VSP you can locate an eye doctor in private practice or go to VisionWorks.

The same rule applies with EyeMed, but your big box retail options are Target Optical or LensCrafters. Again you’ll be able to find independent doctors of optometry in the network.

I’ve worn glasses and contacts most of my life and have gone to the eye doctor with and without insurance. Having vision insurance is a much better deal.

SPONSORED

- 1-800 Contacts – Up To 30% Off First Order + Free Shipping

- For Eyes Promo – 2 Pairs Only $69 Book An Eye Exam

The savings on lenses is worth it especially as you get older (like me!) and you add progressive and photochromatic (self-tint) options.

I don’t think you can go wrong with either of these plans, but if you’re only going to get an eye exam once a year it might not be worth it.

Once you do the math on the cost of an eye exam, plus frames and lenses though, I think you’ll see the benefits.

If you haven’t seen the eye doctor in a while, the cost of an exam can range from $50-$250 and the cost of designer frames and lenses could take you up to $500.

Whichever one you choose, the right vision plan can save you money.

VSP Vision

- Exam Copay: $15

- Frame Allowance: $150-$230

- Plan Prices: $15-$35

EyeMed Vision

- Exam Copay: $0-$10

- Frame Allowance: $130-$200

- Plan Prices: $5-$30

^

VSP & EyeMed: What Is Individual Vision Insurance?

If you don’t have employee benefits or access to group health, individual vision insurance is available to purchase on your own.

Other plans exist, but VSP & EyeMed are the two most popular for our visitors.

VSP vs EyeMed – both offer coverage for free eye exams with discounts on eyeglasses, contact lenses, and other vision care needs with no waiting periods and enrollment anytime throughout the year.

However, there are some key differences between the two providers.

Vision insurance usually includes one eye exam a year for each covered person. You also get allowances and discounts on frames and contacts, plus savings on LASIK and other perks.

The allowance can range from $100-$200 or more with vision plans.

Regular eye exams are crucial to maintaining healthy vision since they often detect major medical problems in the early stages of development, such as diabetes, high blood pressure, and macular degeneration.

VSP gives you access to the largest network of eye doctors, a generous frame allowance, family discounts, and member-only deals at certain online retailers.

For example, when you shop online at Eyeconic, you’re shopping at the preferred online retailer for VSP members where you can connect your benefits at checkout.

EyeMed has a smaller network of independent doctors, but you can shop with instant savings at more retailers like Target Optical, Glasses.com, or LensCrafters.

Tip: Remember, you can visit any doctor or shop outside the network at a small discount but this will require paying the full amount and having to submit for reimbursement.

To get the most bang for your buck, use in-network doctors and retailers.

VSP vs EyeMed: Cost

When comparing VSP vs EyeMed look at their network of providers and the discounts offered before the cost of each plan.

While you can go to your favorite doctor or clinic, the most bang for your dollar is using an in-network doctor and retailer.

VSP has the largest national network, allowing customers to find a provider with ease no matter their location. If size matters get a quote from VSP.

They also provide services internationally. This is a huge deal if you travel overseas.

Additionally, VSP vision plans include members-only benefits like an additional 20% savings on eyecare and discounts on laser vision correction like LASIK.

You can apply those savings directly online at affiliated retailers like Eyeconic.

A quick search in Maryland shows a Standard Plan at around $13 a month. You’ll get an exam, low copays a $150 allowance on frames or contacts, plus additional savings on lens enhancements like anti-glare and UV protection.

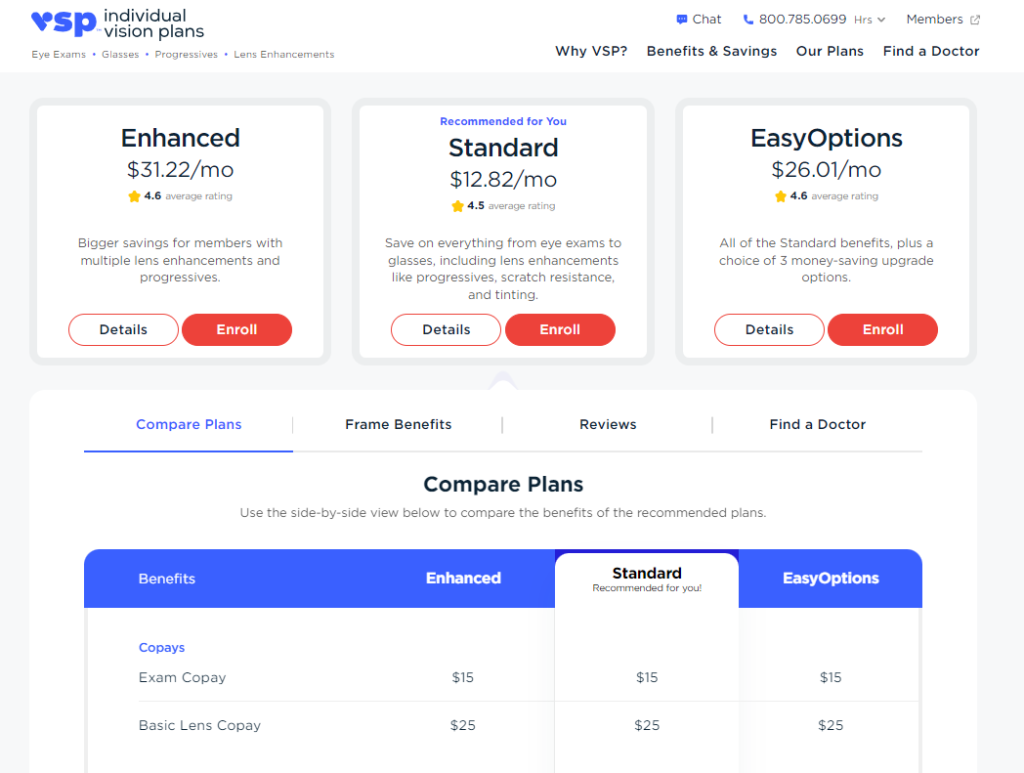

How Much Does VSP Vision Cost?

- Standard Plan: $12.82

- EasyOptions: $26.01 (see comparison)

- Enhanced: $31.22

If you’re shopping for premium eyewear their EasyOptions plans might be worth a look.

Available in all states: Check Your ZIP Code

Why Are VSP & EyeMed So Popular?

If you’re shopping for individual vision insurance VSP Vision & EyeMed Vision are two of the best options available.

Both offer instant online quotes and enrollment with no waiting period to start using coverage.

VSP has one of the largest provider networks in the country. Members can also access their benefits internationally.

RELATED

- Does Vision Insurance Cover Diabetic Retinopathy?

- Which Is Best? Marketplace Dental vs. Private Dental

On the other hand, although the EyeMed provider network isn’t as big, its retail network is and their prices are comparable.

Their Healthy plan starting at $5 a month will get you an exam with no copay and 35% off the retail price of frames.

These prices are for single-member coverage. You have the option to add family members.

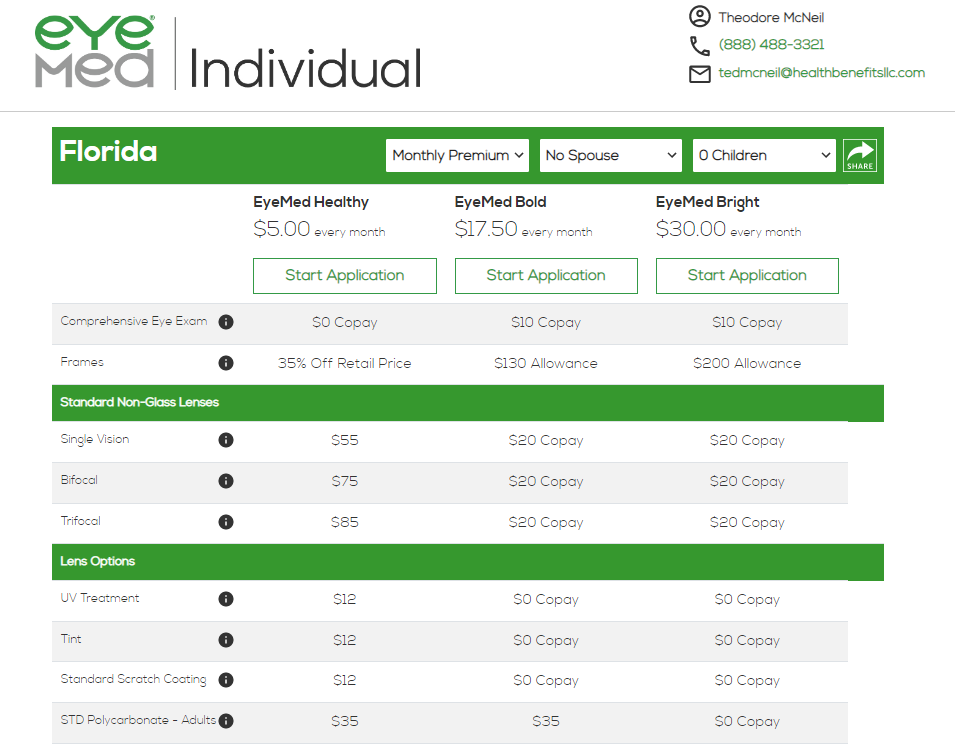

How Much Does EyeMed Vision Cost?

- Healthy: $5.00

- Bold: $17.50

- Bright: $30.00 (see comparison)

Plus, with EyeMed you’ll have more options to use your benefits through in-network retail partners like Ray-Ban, Glasses.com and LensCrafters.

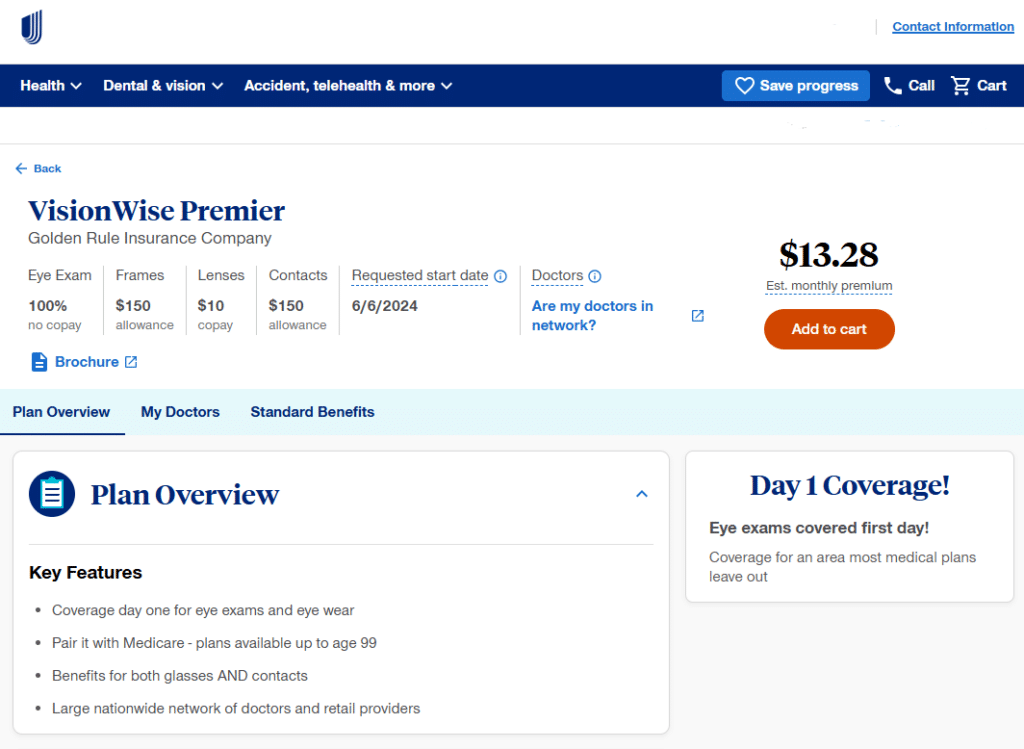

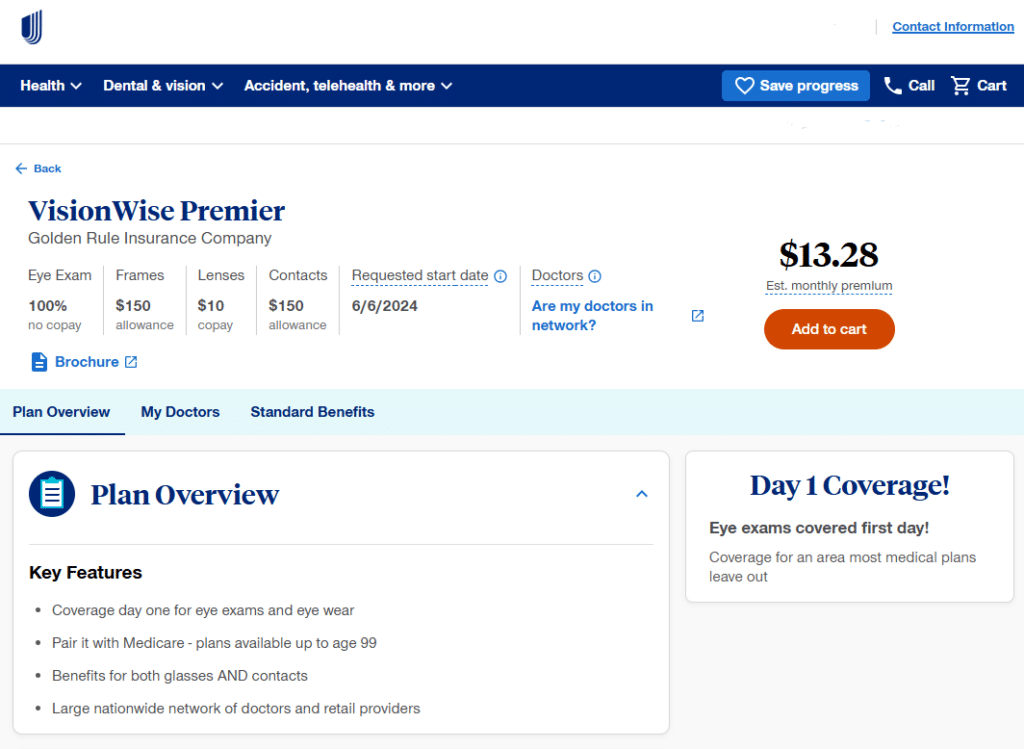

Best Alternative: VisionWise

VisionWise is our newest vision plan from UnitedHealthcare.

Backed by a trusted industry leader, VisionWise provides the comprehensive coverage and reliability you expect.

For even greater convenience, consider bundling your vision and dental coverage with UnitedHealthcare’s DentalWise Max plans.

This combined approach ensures comprehensive care for both your eyes and teeth.

Available in: FL, GA, MD, MI, MS, NC, PA, SC, TN, TX, VA

^

VSP Vision or EyeMed Vision: Which Is Best?

As a broker, it’s safe to say these are the most popular vision-only plans we offer, so comparing VSP vs EyeMed is a tough one.

But, things are changing. UnitedHealthcare VisionMax has become one of our most popular vision plans next to their DentalWise Max which bundles vision & hearing coverage.

That being said, if you’re only in it for the annual exam a vision plan might not be worth it.

As I mentioned earlier, you can shop around and get an eye exam for around $50-$250. In the VSP or EyeMed comparison, you’ll pay around $20 a month.

Is vision insurance worth it?

On the other hand, when you need glasses (or contacts) is when you’ll feel the true benefit of vision insurance.

If I were comparing VSP vs EyeMed I’d look at the allowance and discounts on frames, lenses, and contacts as well as the retail network — in other words, where can you actually spend money and save?

If you haven’t started looking at eyeglasses yet, just take a look at Glasses.com and you’ll see the costs add up quickly.

Going back to which is better. I’ve had both! VSP was great when I had company benefits. I remember having a good experience with customer service anytime I needed to speak with someone.

Since being self-employed though, our family has been with EyeMed, mainly because we moved and my son fell in love with our eye doctor.

I wear contact lenses and I like buying eyeglasses. A pair on every floor, in the car, upstairs, in the office, in the kitchen.

I prefer shopping online and like being able to apply any savings instantly at checkout compared to getting reimbursed.

You can do that with VSP too, but our doctor isn’t in their network.

Both EyeMed and VSP include annual eye exams along with discounts on glasses and contact lenses.

So deciding which is better may come down to actually searching your ZIP Code to find an eye doctor near you and doing some window shopping online.

VSP or EyeMed: Final Verdict

The winner in the VSP vs EyeMed comparison? Both provide access to a large network of doctors. So scheduling an eye exam shouldn’t be a problem even if you’re in a rural area.

EyeMed is available in 48 states, but VSP is available in North America and internationally. That could be the deciding factor if you travel.

As mentioned, EyeMed has more options for in-network retailers.

In my opinion, this is an advantage since you can apply your vision benefits and savings at checkout instead of trying to get reimbursed.

Visit EyeMed to check for plans and doctors near you.

VSP has been around longer, has more members, and offers exclusive discounts on laser surgery, such as LASIK procedures making it an ideal plan for anyone who is interested in pursuing those treatments.

VSP also offers slightly higher coverage for frames and contact lenses.

Check VSP plans to compare prices in your area.

Ultimately, you’ll have to do a side-by-side when comparing VSP or EyeMed to understand all of the benefits available under each plan.

Choosing either to protect yourself or your family is a smart investment in your health.

On its own, EyeMed is a great plan, but next to VSP and now VisionWise it’s a toss up.

Start a free quote, search the provider network and contact us if you need assistance.

Questions?

Speak to a licensed expert by phone, email or chat absolutely free. Agents are available in:

FL, GA, MD, MS, NC, PA, SC, TN, TX, VA

Your privacy is our priority! We don’t share personal information or collect payments, ensuring a safe and secure experience.

UnitedHealthcare VisionWise offers comprehensive vision benefits with no waiting period, so you can start saving on eye care right away.

- Large Provider & Retail Network

- Eye Exams Included

- $150 Allowance (frames & contacts)

- $10 Lens Copay

Available: FL, GA, MD, MI, MS, NC, PA, SC, TN, TX, VA

EyeMed believes excellent eye care should be accessible to everyone.

With promotional pricing, and partnerships with Target Optical, Lenscrafters, Glasses.com and more, you can receive top-notch vision care without breaking the bank.

With three plans available for individuals or families starting at just $5 a month, EyeMed makes vision health affordable for just about everyone.

- EyeMed Healthy

- EyeMed Bold

- EyeMed Bright

Available: FL, GA, MD, MI, MS, NC, PA, SC, TN, TX, VA