Are you confused about the difference between Marketplace dental insurance and private dental plans? Let’s break it down.

Marketplace dental insurance is often a more affordable option, perfect for preventive care like regular checkups and cleanings.

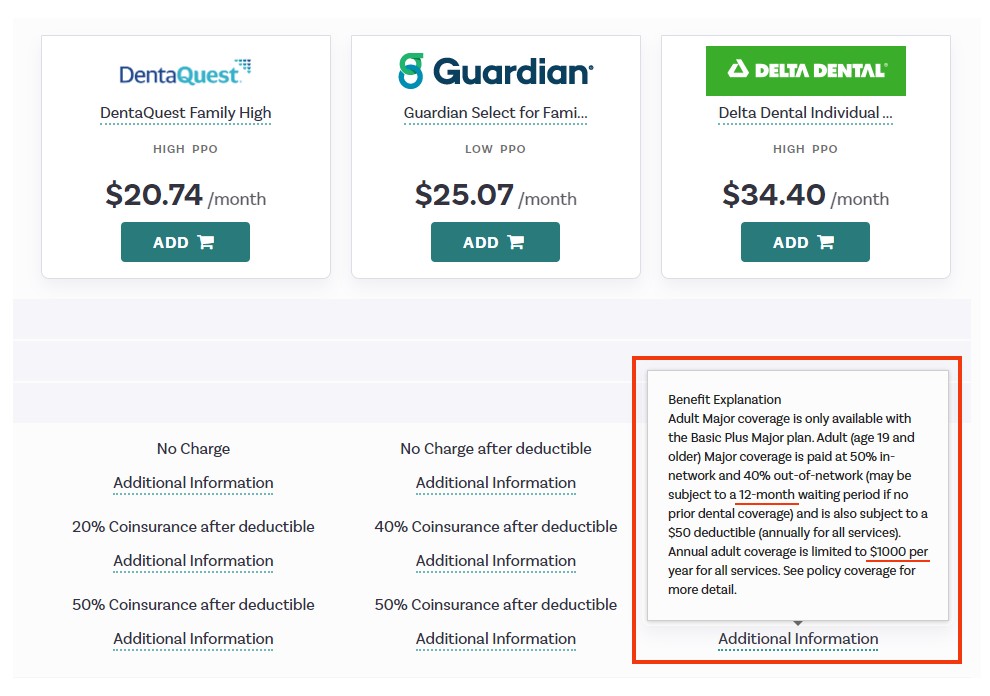

However, they typically have waiting periods and lower annual coverage limits — usually around $1,000.

This means you will need to plan ahead for major dental work.

Private dental insurance or “off-exchange” plans, offer higher benefits, wider networks, and often no waiting periods.

They might be a better choice if you need immediate dental work.

So which is better, Marketplace dental insurance or private dental insurance?

In this guide, we’ll help you weigh the pros and cons of both options so you can make an informed decision.

Note: Insurance plans may have limitations. Please carefully review the policy before enrolling. If you have any questions, please contact us for a free consultation!

Questions?

Speak to a licensed expert by phone, email or chat absolutely free. Agents are available in:

FL, GA, MD, MS, NC, PA, SC, TN, TX, VA

Your privacy is our priority! We don’t share personal information or collect payments, ensuring a safe and secure experience.

How Does Marketplace Dental Insurance Work?

As you may know, the ACA Health Insurance Marketplace offers options for both health insurance and dental coverage.

In most states, you have to enroll in a health plan before signing up for dental insurance.

You can do this during Open Enrollment or if you have a qualifying life event.

While a few health plans on the Marketplace are bundled with dental benefits, you will typically have the to purchase a separate plan for an additional cost.

Here’s how most dental insurance plans work:

Waiting Periods

Most dental insurance plans have waiting periods. These can be frustrating, but they have a purpose.

To prevent adverse selection, waiting periods help discourage people in poor health from buying dental insurance to get work done and immediately cancelling their policy.

Waiting periods help keep prices low for everyone else.

Depending on the type of procedure you need the waiting period is calculated from your plan start date and generally looks like this:

- Preventative (exams, checkup): no waiting period

- Basic (filling, simple extraction, etc): 6-month waiting period

- Major (dentures, crown, implants): 12-month waiting period

As the saying goes, an ounce of prevention is worth a pound of cure.

By taking advantage of free annual checkups your dentist can spot issues early before they become more expensive problems down the road.

Deductibles

Think of this as the deposit you’re required to make before your insurance starts covering costs.

Most dental plans have a $50-$100 annual deductible.

Similar to your health insurance, once you pay the deductible, your plan will start sharing costs according to the policy.

Coinsurance

This is how you split the bill. Coinsurance or “cost-sharing” is usually a percentage and works like your health insurance.

You might see a dental plan described as 100/80/50 which means:

| Category | Plan Pays | Waiting Period |

|---|---|---|

| Preventative | 100% | No |

| Basic | 80% | 6-months |

| Major | 50% | 12-months |

Annual Maximum

This is the total amount your insurance company will pay towards covered dental services in a year.

Unlike health insurance though, there is a “cap” or a maximum on what your carrier will pay.

Once you reach this limit, you’re responsible for the remaining costs for the rest of the year.

Marketplace dental plans usually have annual maximums of $750-$1,000.

Off-Exchange Dental Insurance

Unlike Marketplace plans with limited benefits and enrollment periods, private dental insurance purchased off-exchange offers many advantages.

Our most popular off-exchange dental plans UnitedHealthcare DentalWise and Ameritas Primestar have high annual maximums, increasing benefits and day one coverage.

Available: FL, GA, MD, MS, NC, PA, SC, TN, TX, VA

Unlike, traditional dental insurance there is no waiting for basic or major work. You receive benefits on day one and the amount increases after 12 months:

| Category | Day 1 | 12-months | Waiting Period |

|---|---|---|---|

| Preventative | 100% | 100% | no waiting period |

| Basic | 60% | 80% | no waiting period |

| Major | 15%-20% | 50% | no waiting period |

| Implants | No | 50% | 12-months |

Annual Maximum

Off-exchange plans offer more flexibility and higher benefits.

For instance, our plans have annual maximums up to $3,000.

Remember, this is the amount the insurance company will pay toward your dental bill each year.

With higher benefit amounts, you’ll save on the most costly procedures like dentures, implants and orthodontia.

DentalWise Max vs. Ameritas PrimeStar

Our two most popular plans offer high benefits, no waiting periods and easy online enrollment.

UnitedHealthcare DentalWise Max: This plan goes beyond just teeth, offering a convenient all-in-one package that includes dental, vision, and even optional hearing coverage in many states.

It boasts high benefits for a wide range of dental procedures, from routine checkups to major restorative work, making it a great choice for those seeking comprehensive care.

Ameritas PrimeStar: This plan focuses primarily on dental needs.

They offer two options: PrimeStar Complete, a robust dental plan with extensive coverage, and PrimeStar Boost, a more basic plan suitable for those who prioritize preventive care.

Here are some key factors to consider when choosing between these plans:

- Do you need vision or hearing coverage? DentalWise Max is automatically bundled with vision and hearing. Ameritas gives you the option to purchase additional coverage.

- How important is a large network of dentists? Research each plan’s network to see if your preferred providers are included or conveniently located

- What’s your budget? Compare the monthly premiums and coverage details of each plan to find the best value for your needs.

Available: FL, GA, MD, MS, NC, PA, SC, TN, TX, VA

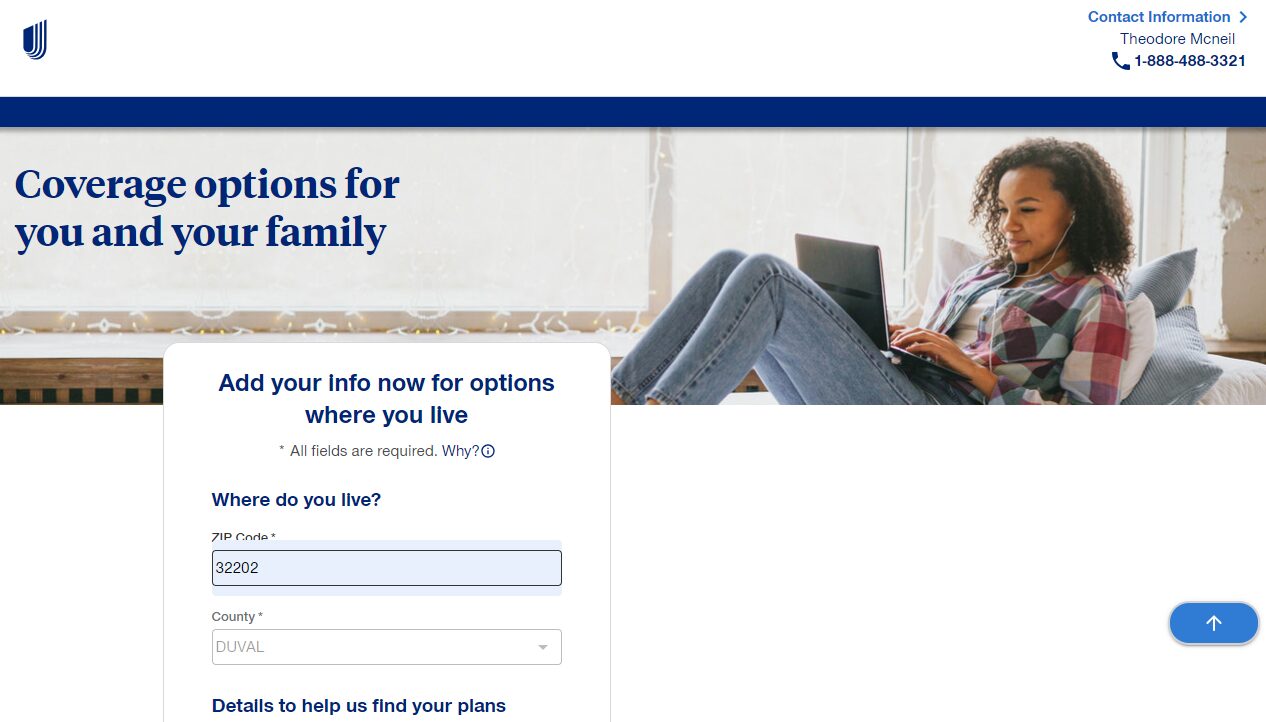

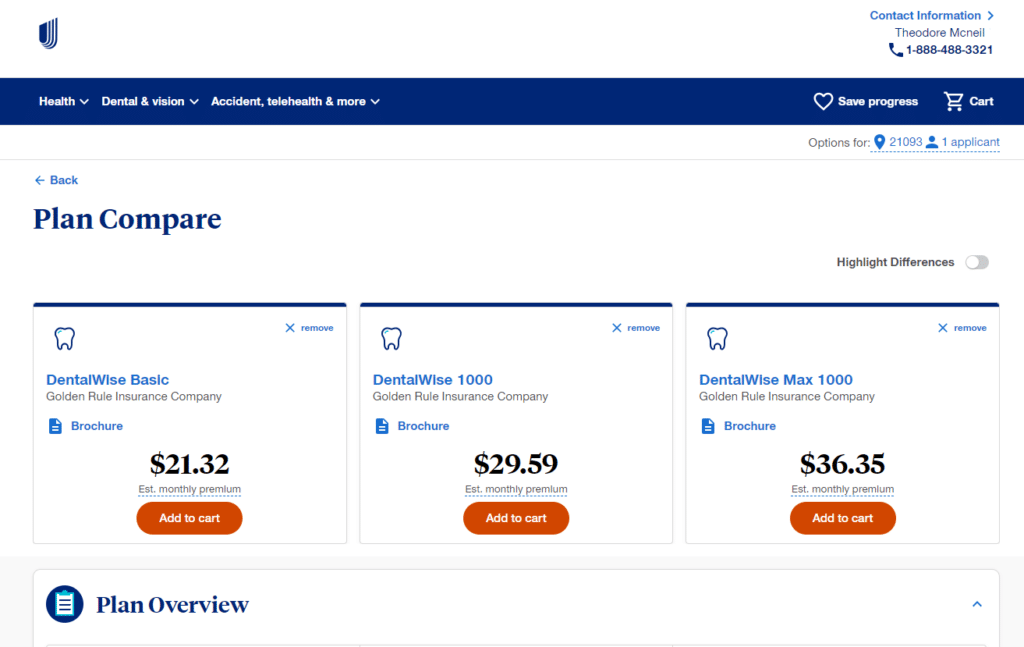

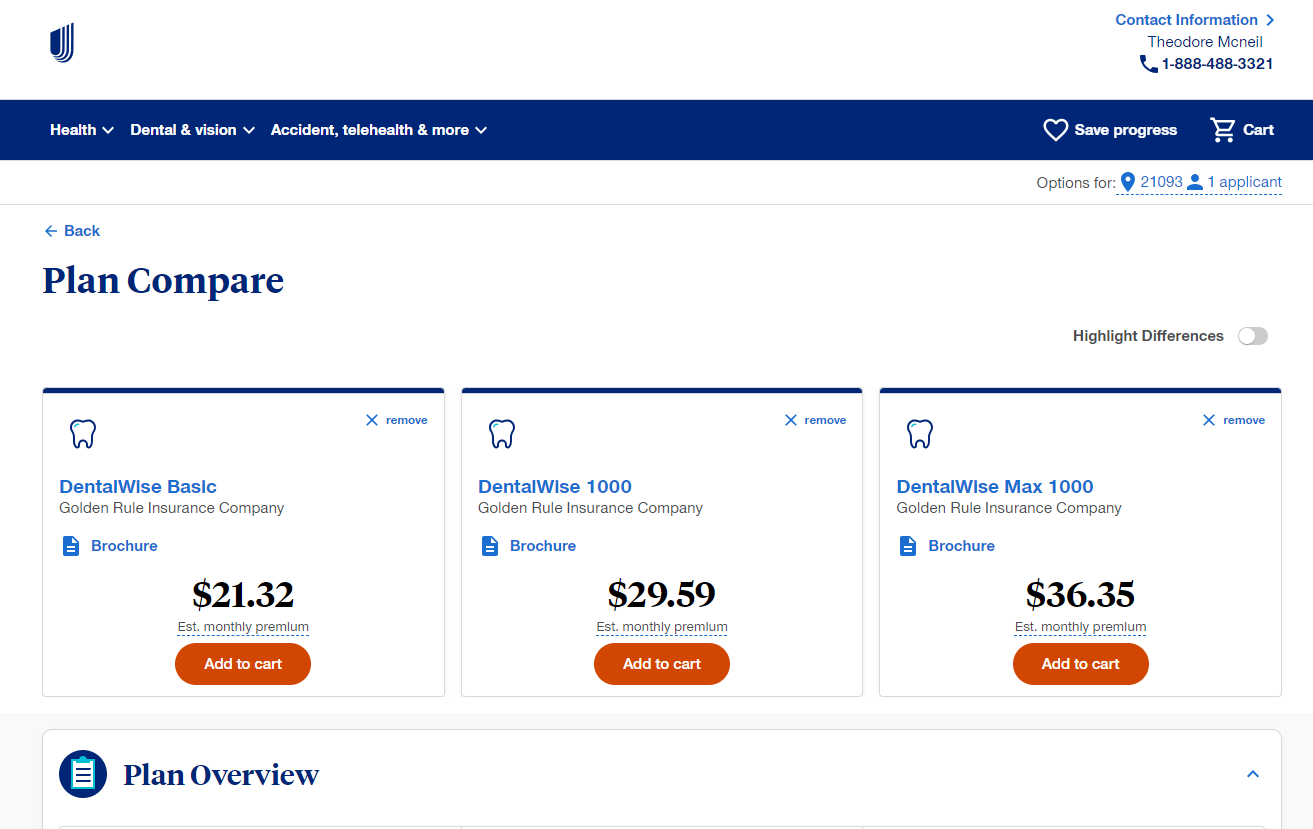

UnitedHealthcare DentalWise Max

When it comes to maintaining your overall health, DentalWise and DentalWise Max from UnitedHealthcare is a smart choice.

DentalWise offers dental only at two benefit levels: DentalWise Basic and DentalWise 1000.

DentalWise Max plans are bundled and offer comprehensive dental, vision, and hearing (DVH) with no waiting periods so you can start using your benefits right away.

DentalWise 1000

This budget-friendly dental only plan provides a $1,000 annual maximum. Benefits increase after 12 months. It’s a great starter if you prioritize preventive care and anticipate low to moderate dental needs.

- Waiting Period: No

- Exams: 2 per year

- Preventative: Insurance pays 100%

- Basic: Insurance pays 60% year 1; 80% year 2

- Major: Insurance pays 15% year 1; 50% year 2

- Vision: No

- Hearing: No

DentalWise Max 1000

This plan provides a $1,000 annual benefit for dental procedures. Includes vision with $150 allowance for frames/contacts. Hearing is available in select states.

- Annual Max: $1,000

- Waiting Period: No

- Exams: 2 per year

- Preventative: Insurance pays 100%

- Basic: Insurance pays 60% year 1; 80% year 2

- Major: Insurance pays 15% year 1; 50% year 2

- Vision: Yes

- Hearing: Varies by state

- Impants: No

DentalWise Max 2000

Doubling the annual benefit to $2,000, this plan offers comprehensive coverage with a higher limit.

Additionally, it includes coverage for dental implants after a 12-month waiting period with a separate $1,500 benefit!

Includes vision with $150 allowance for frames/contacts. Hearing is available in select states.

- Annual Max: $2,000

- Waiting Period: No

- Exams: 2 per year

- Preventative: Insurance pays 100%

- Basic: Insurance pays 60% year 1; 80% year 2

- Major: Insurance pays 15% year 1; 50% year 2

- Vision: Yes

- Hearing: Varies by state

- Implants: Yes ($1,500 benefit after 12-months)

DentalWise Max 3000

This top-tier plan boasts a $3,000 annual benefit maximum, providing the most extensive coverage within the DentalWise Max series.

Also includes coverage for dental implants after a 12-month waiting period with a separate $1,500 benefit.

Includes vision with $150 allowance for frames/contacts. Hearing is available in select states.

- Annual Max: $3,000

- Waiting Period: No

- Exams: 2 per year

- Preventative: Insurance pays 100%

- Basic: Insurance pays 60% year 1; 80% year 2

- Major: Insurance pays 15% year 1; 50% year 2

- Vision: Yes

- Hearing: Varies by state

- Implants: Yes ($1,500 benefit after 12-months)

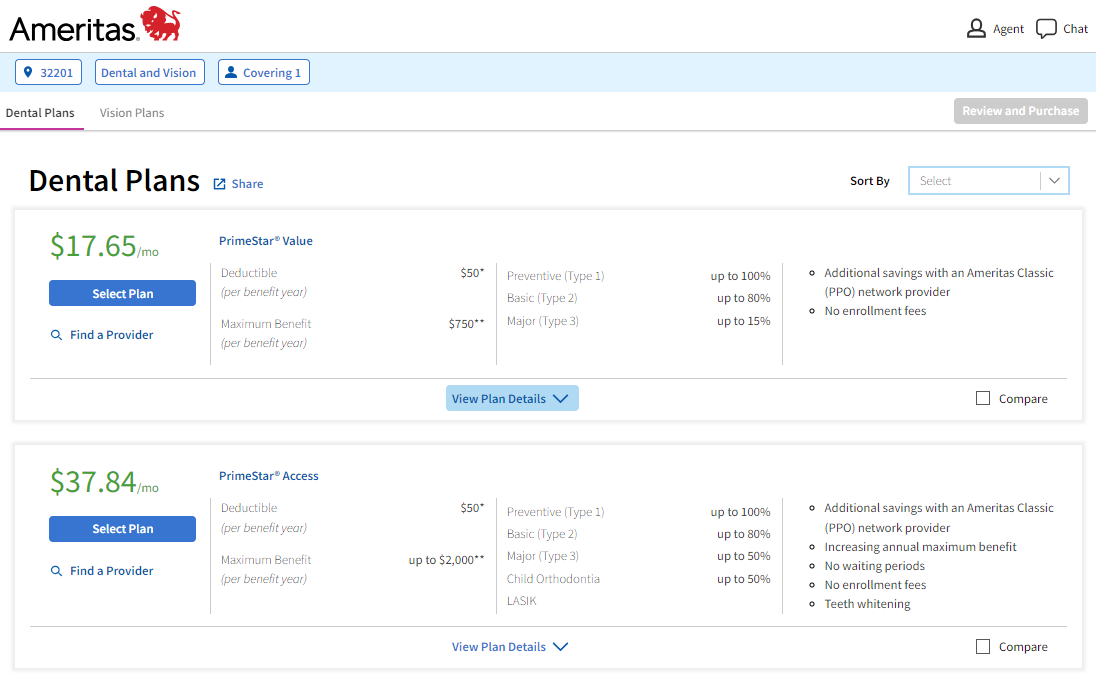

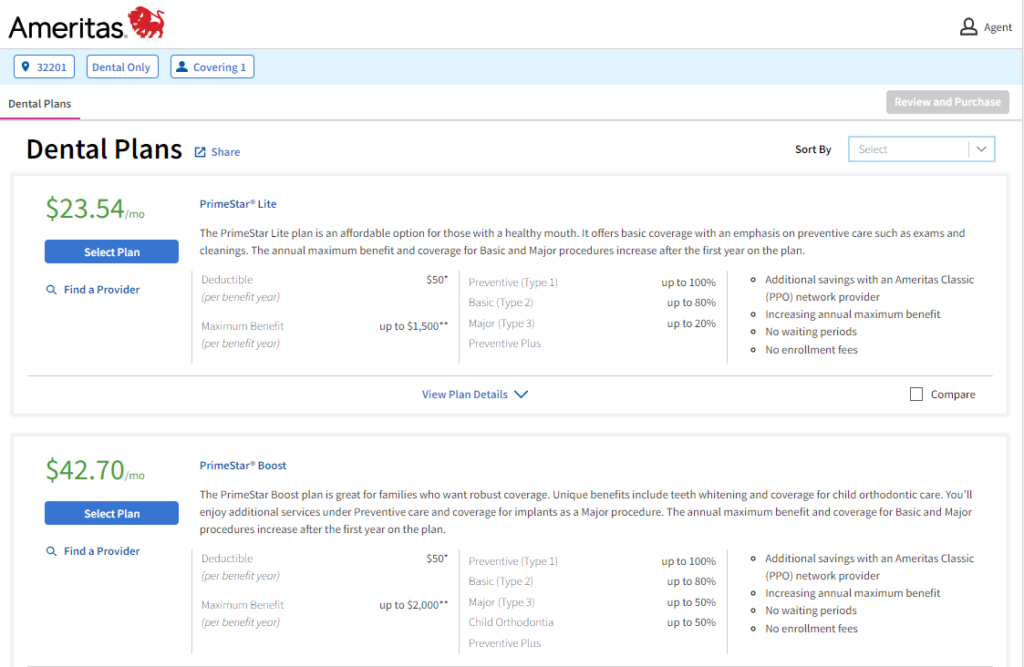

Ameritas PrimeStar

Ameritas PrimeStar offers a suite of dental insurance plans that provide coverage from day one, with no waiting periods and increasing benefits.

Both plans emphasize the importance of preventive care by covering cleanings and exams at 100% with generous limits.

Unlike DentalMax Wise, vision is not bundled, but available during shopping.

PrimeStar Boost

Boost starts with an annual maximum of $1,500 and increases to $2,000 after 12 months to help cover the costs of preventive, restorative, and major dental procedures.

- Annual Max: $1,500 year 1; $2,000 year 2

- Waiting Period: No

- Exams: 3 per year

- Preventative: Insurance pays 100%

- Basic: Insurance pays 65% year 1; 80% year 2

- Major: Insurance pays 20% year 1; 50% year 2

- Vision: Yes

- Hearing: Varies by state

- Implants: Yes (falls under Major)

- Orthodontia: Child only ($1,000 max)

PrimeStar Complete

For more comprehensive coverage, PrimeStar Complete starts at $2,500 annual benefit and increases to $3,000 after 12 months.

- Annual Max: $2,500 year 1; $3,000 year 2

- Waiting Period: No

- Exams: 3 per year

- Preventative: Insurance pays 100%

- Basic: Insurance pays 65% year 1; 80% year 2

- Major: Insurance pays 20% year 1; 50% year 2

- Vision: Yes

- Hearing: Varies by state

- Implants: Yes (falls under Major)

- Orthodontia: Child only ($1,000 max)

Ameritas PrimeStar

- Waiting Period: No

- Vision: Yes (optional)

- Hearing Available: Yes (varies by state)

- Exams & Cleanings: 3 a year

- Increasing Benefits? Yes

- Preventative Covered: 100%

- Basic Services: 65% year 1; 80% year 2

- Major Services: 20% year 1; 50% year 2

- Implants: Yes

- Orthodontia: Yes (child only)

- Annual Maximums: $1,500-$3,000

DentalWise Max

- Waiting Period: No

- Vision: Yes (bundled)

- Hearing Available: Yes (varies by state)

- Exams & Cleanings: 2 a year

- Increasing Benefits? Yes

- Preventative Covered: 100%

- Basic Services: 60% year 1; 80% year 2

- Major Services: 15% year 1; 50% year 2

- Implants: Yes

- Orthodontia: No

- Annual Maximums: $1,000-$3,000

Available: FL, GA, MD, MS, NC, PA, SC, TN, TX, VA

What Is DVH? (Dental, Vision & Hearing Insurance)

Our plans include dental, vision & hearing options as a convenient way to bundle coverage for three essential aspects of your health, especially as we age.

Many of our clients appreciate having all their important needs covered in one plan. DVH insurance simplifies your life by:

Streamlining Coverage: No need to juggle multiple insurance plans and bills.

Peace of Mind: Knowing you have comprehensive coverage for dental care, eye exams, and hearing aids can be a huge relief.

Let’s start with the most requested supplemental benefit:

Dental Insurance

Maintaining good oral health is a cornerstone of overall well-being. Dental insurance helps you manage the associated costs, offering:

- Coverage for preventive care: Routine cleanings, exams, and x-rays are typically covered at 100%.

- Help with unexpected needs: Unexpected dental events like a chipped tooth or a cavity can be financially stressful. Dental insurance helps offset the costs of these procedures.

- Reduced costs for major services: If you require more complex dental work, such as crowns or bridges, dental insurance significantly reduces your out-of-pocket expenses.

Vision Insurance

Vision insurance offers valuable protection for your eye health, ensuring you have access to regular checkups and the necessary corrective lenses:

- Routine eye exams: Covers annual exams and screenings

- Eyeglasses or contacts: Most plans include an allowance of $100-$200.

Hearing Insurance

Hearing loss is a common concern, especially as we age. Hearing insurance provides essential resources for managing your hearing health:

- Hearing exams: Covers annual hearing exams, allowing you to proactively manage your health.

- Hearing aids: Offers substantial financial assistance towards hearing aids, making them a more accessible option.

By taking charge of your health today with the right insurance plan, you invest in a more proactive and fulfilling future.

Questions?

Speak to a licensed expert by phone, email or chat absolutely free. Agents are available in:

FL, GA, MD, MS, NC, PA, SC, TN, TX, VA

Your privacy is our priority! We don’t share personal information or collect payments, ensuring a safe and secure experience.

UnitedHealthcare dental plans provide flexible options for basic and major dental services with no age limit, no waiting period, Day 1 coverage and increasing benefits.

Preventive, basic and major services covered. Annual maximums from $1,000-$3,000.

- DentalWise 1000

- DentalWise Max 1000 (vision & hearing)

- DentalWise Max 2000 (covers implants with an additional $1,500 benefit!)

- DentalWise Max 3000 (covers implants with an additional $1,500 benefit!)

Online quoting and enrollment are available in licensed states:

FL, GA, MD, MI, MS, NC, PA, SC, TN, TX, VA

Read the policy before purchasing or contact us for help.

Available: FL, GA, MD, MI, MS, NC, PA, SC, TN, TX, VA

Ameritas dental insurance plans feature next-day coverage, no enrollment fees with increasing benefits.

Online quoting and enrollment!

No waiting periods for preventative, basic & major work. Vision & hearing available in select states.

- PrimeStar Lite

- PrimeStar Boost

- PrimeStar Complete

- Annual maximums from $1,500-$3,000

- Increasing benefits

- Child orthodontia

Read the policy before purchasing or contact us for help.

Available: FL, GA, MD, MI, MS, NC, PA, SC, TN, TX, VA

We earn revenue from partners and advertisers. For more information >

RELATED PRODUCTS

- Removes up to 7x more plaque vs. a manual toothbrush

- 2 minute SmarTimer with QuadPacer ensure Dentist-recommended brushing time

- Pressure sensor and two intensity settings protect sensitive gums from overbrushing

- REMOVE UP TO 100% MORE PLAQUE* along the gumline whilst PROTECTING GUMS with our dentist-inspired round brush head technology *vs. a manual toothbrush

- PROTECT YOUR GUMS with sensi cleaning mode and GUM PRESSURE CONTROL that automatically stops brush pulsations when brushing too hard

- MAXIMIZE CLEANING performance with 3 EASY-TO-USE CLEANING MODES + handle-integrated quadrant timer that alerts you every 30sec to change brushing zone

Last update 2024-11-23. Amazon Associates earn from qualifying purchases.